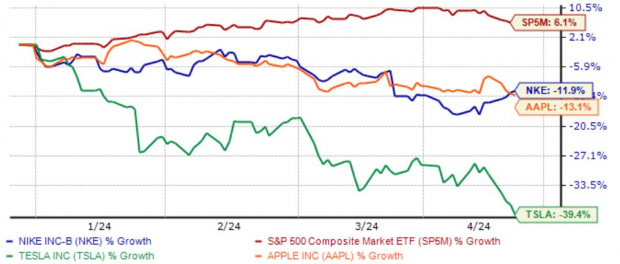

Apple: A Tale of Two Stories

Apple, a heavyweight known for its performance, has had a challenging year, hardly moving when compared to the S&P 500’s impressive 24% growth. Concerns about slowing growth and questions surrounding Chinese sales have hindered the stock. However, its Services division has been a saving grace, maintaining investor confidence.

Apple’s Revenue Composition

Despite a 13% dip in Chinese revenues to $20.8 billion, Apple’s Services segment shone, reaching a record $23.1 billion – an 11.3% increase from the previous year. Analysts, however, have adopted a cautious outlook, with a Zacks Rank #3 (Hold) and a 2% decrease in the $6.54 Zacks Consensus EPS estimate.

Assessing Tesla’s Volatile Journey

Tesla has had a turbulent time in 2024, plummeting by nearly 40%. Various factors such as declining margins, uncertain market sentiment, and layoffs have negatively impacted the stock. Analysts have reacted by downgrading their earnings forecasts across the spectrum, consequently pushing Tesla to a Zacks Rank #5 (Strong Sell).

The Tesla Equation

As Tesla gears up to announce its quarterly results on April 23rd, expectations indicate a considerable 45% slump in earnings alongside a 5% decrease in sales. Moreover, with a significant drop in revenue projections to $22.2 billion, the road ahead seems challenging for the automaker.

Nike: Running a Different Race

Nike’s shares have faced pressures lately, but April has been kind to the company, witnessing a 1.3% rise in contrast to the S&P 500’s 4% drop. While diminishing sales growth has cast shadows, Nike managed to beat both its sales and EPS targets in the latest quarter, sparking optimism.

Nike’s Positive Momentum

Encouragingly, analysts have revised their earnings forecasts for Nike this fiscal year. The current $3.73 Zacks Consensus EPS estimate, up from $3.57 in February, reflects an optimistic outlook. If this positive trajectory continues, Nike’s stock is poised for continued growth.

The Final Verdict

Several notable S&P 500 stocks, including Apple, Tesla, and Nike, have underperformed this year, stirring doubts among investors. While Apple battles Chinese sales slowdowns, it finds solace in its robust Services sector. In contrast, Tesla faces an uphill struggle with negative outlooks looming. On the other hand, Nike’s recent resilience coupled with positive earnings revisions suggests a brighter future.