The Rise of Alliance Resources

During the MLP boom of the late 1990s, Alliance Resources LP emerged as a stalwart player in the energy sector. By deftly eliminating incentive distribution rights through the acquisition of Alliance GP Holdings in 2018, the company showcased astute financial maneuvering.

Evolution in Cash Flows

Alliance, primarily a mining company, experienced fluctuations in cash flows tied to the volatile nature of commodity prices, particularly coal. However, the company’s strategic reliance on secure, fixed-price contracts with established US utilities provided a shield against drastic dividend fluctuations for the most part.

Challenges in the Modern Era

The landscape changed with the dawn of the North American shale revolution. As aging coal power plants faced obsolescence and stringent pollution control norms, US utilities transitioned to alternative energy sources. This shift led to a change in revenue streams for Alliance, with overseas markets now driving sales, introducing a new level of volatility.

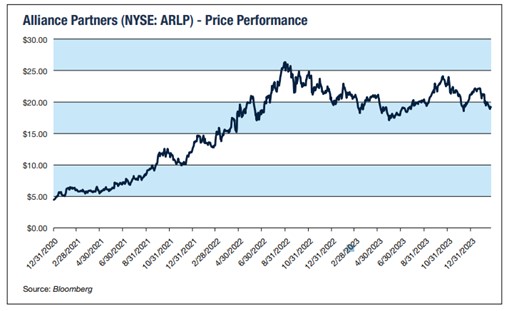

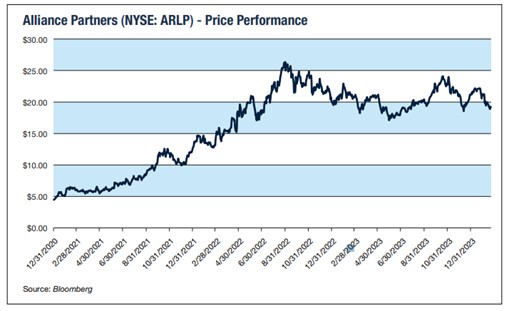

A graph depicting financial trends

Financial Performance & Dividend Dynamics

Alliance’s recent quarterly dividend of 70 cents per share marks a historic high, reflecting a nearly 30% increase from late 2019 levels. Despite some revenue decline in Q4, the company maintained strong dividend coverage at 1.31 times.

Path to Stability

Aggressive debt reduction measures have bolstered Alliance’s financial position, with debt to EBITDA ratio impressively standing at 0.3 times. The company’s coal output guidance for 2024 shows promising signs of stability, with most production already committed at favorable prices.

Market Speculation & Investment Outlook

The market’s current skepticism is reflected in Alliance’s exceptional dividend yield of 14%. While concerns of a potential dividend cut persist, some analysts argue that a snapback rally could propel the stock price significantly higher, especially with favorable commodity price trends anticipated.

Concluding Recommendation

Given the overall resilience and potential for growth in Alliance Resources LP, the prevailing sentiment leans towards a Buy recommendation for ARLP shares, highlighting the company’s capacity to weather market shifts and emerge stronger.