JPMorgan Chase & Co JPM and Goldman Sachs Group GS are shining stars in the financial sector, recovering solidly after a sharp correction in late July. The market turmoil triggered by the Bank of Japan’s (BOJ) interest rate increase, primarily affecting the yen carry trade, has since found some stability with the BOJ’s commitment to avoid rate hikes during market turbulence.

Confidence in the market was further bolstered by robust U.S. retail sales, surpassing expectations and indicating consumer resilience. Leaders like Visa V and Mastercard MA have stood firm amidst the economic volatility.

The spotlight now shifts to the Federal Reserve, considering compelling data supporting potential rate cuts. With inflation rising at a slower pace than anticipated, the Fed has solid grounds for a move towards a more accommodative monetary policy stance.

Despite positive economic indicators, a somber sentiment looms over the public, signaling a paradox. The predominant position of insurance giant Progressive Corp PGR among the top holdings in the Financial Select Sector Index hints at a flight to safety, hinting at underlying market apprehensions.

The ETF Opportunity: Amidst this uncertainty, Direxion’s leveraged exchange-traded funds offer a platform for speculative trading. The Direxion Daily Financial Bull 3x Shares FAS magnifies the Financial Select Sector Index’s performance by 300%, catering to bullish sentiment. On the flip side, the Direxion Daily Financial Bear 3x Shares FAZ provides a 300% inverse exposure to the same index for bearish traders.

Investors can capitalize on the agility of these ETFs, avoiding the complexity of options trading. It’s vital to note that leveraged funds like FAS and FAZ are designed for short-term plays, ideally not held beyond a single day to prevent value erosion from compounding effects.

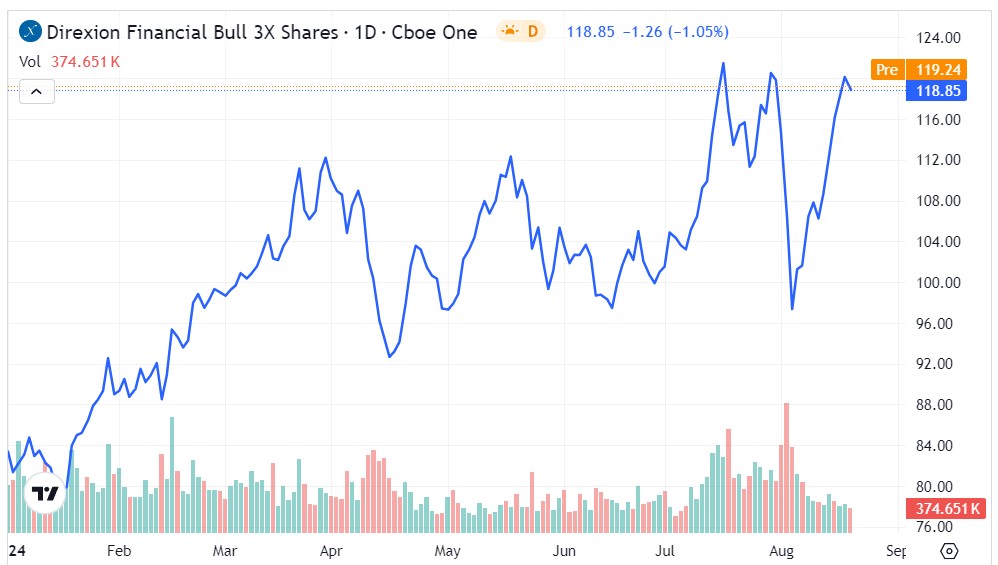

The FAS Performance: Bouncing back from the lows of late July, the FAS ETF has surged, showcasing a 40% gain since the year’s commencement.

- Notably, the FAS never breached its 200-day moving average during the downturn, swiftly surpassing its 50 DMA on the rebound.

- Watchful eyes should monitor the receding trading volume post-August 5th as rising volume typically corroborates price upticks.

The FAZ Outlook: While witnessing a notable surge during the July-August turmoil, the FAZ ETF has recently lost momentum, marking a 35% dip since January.

- Breaking above a significant support line near $10.40 during the correction, FAZ is now striving to stay above $9.

- The focus ahead lies on reclaiming the $9 threshold and aiming for the crucial $10 mark to stave off potential technical downturns.

Featured image by S K from Pixabay.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.