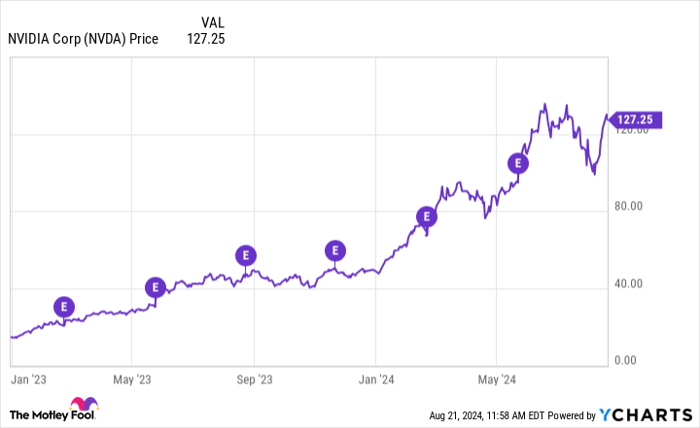

Nvidia (NASDAQ: NVDA) has been a standout player in the artificial intelligence (AI) market, consistently delivering remarkable growth figures quarter after quarter. Investors have eagerly awaited the company’s second-quarter FY 2025 results announcement scheduled for Aug. 28 after market close, presenting a potential buying opportunity for those considering investing in Nvidia stock.

The Shift in Growth Trajectory

Nvidia’s ascent is deeply intertwined with its core product: graphics processing units (GPUs). Originally designed for gaming graphics processing efficiency, GPUs have found diverse applications over the years. Their efficiency in processing multiple calculations simultaneously has made them invaluable in engineering simulations, drug discovery, and AI model training.

For the upcoming Q2, Nvidia anticipates revenue of $28 billion. While this signals a substantial 107% year-over-year growth from last year’s Q2 sales of $13.5 billion, it also marks a slowdown in growth compared to previous quarters due to the maturing AI demand cycle.

Nvidia has a history of surpassing its revenue projections, and analysts expect a revenue of $28.5 billion for Q2, underscoring the market’s confidence in the company’s performance.

Evaluating Profit Margins

Nvidia’s revenue growth is impressive, but its margin expansion is even more remarkable. Boasting a gross margin near 80% and a profit margin nearing 60%, Nvidia stands out as one of the most profitable companies in the public markets.

Investors keenly await the Q2 report to ascertain if Nvidia has sustained or expanded these elevated margins. Any signs of margin decline could hint at increased market competition, prompting adjustments in GPU pricing to stay competitive.

A potential drop in margins post-report could trigger immediate market volatility.

Is It Time to Buy?

While expectations are high for Nvidia’s upcoming quarterly performance, the decision to invest should not hinge on timing the market perfectly. At nearly 46 times forward earnings estimates, the stock’s premium valuation underscores the growth expectations priced in.

Some investors find the current valuation excessive, requiring Nvidia to deliver exceptional Q2 results and robust Q3 guidance to justify the optimism. With a track record of strong earnings performance, the stock remains enticing to those who believe in its potential.

If one is convinced Nvidia can sustain its growth trajectory, it might be prudent to consider a position prior to Aug. 28.

Considering Investment in Nvidia

Before diving into Nvidia stock, investors should note that the Motley Fool Stock Advisor team recently highlighted the 10 best stocks for potential investment opportunities – with Nvidia not making the list. Discovering the right investment fit can potentially yield substantial returns over time.

Reflecting on Nvidia’s journey since 2005, where an initial $1,000 investment could have grown to $779,735, underscores the transformative power of well-chosen investments. The Stock Advisor service offers a roadmap for success, with insights on portfolio building and regular stock recommendations.

It’s crucial for investors to weigh the risk factors and market dynamics before committing funds to Nvidia or any stock.