The rumbling engine of the European auto market faced a bump in the road last month as the European Automobile Manufacturers Association reported a 5.2% year-over-year decline in new car registrations, marking the first dip of the year with 1 million units slipping off the speedometer. Notable decreases hit key markets like Germany, Spain, France, and Italy, with contractions ranging from 1.5% to 6.2%.

However, as the first quarter of 2024 drew to a close, the EU’s vehicle registrations managed to shift gears, accelerating up 4.4% year over year, totaling 2.8 million units. Italy and France revved up growth figures of 5.7% each, while Germany and Spain showed steady acceleration at 4.2% and 3.1%, respectively.

Quarterly Triumphs & Buyout Booms

The auto sector’s earnings season kicked into high gear last week, with Genuine Parts Company GPC as the first to roll out its quarterly results. Though the parts provider missed the mark on sales, it sped past earnings expectations. Meanwhile, Group 1 Automotive GPI shifted gears into high gear with a $439 million buyout agreement to acquire the U.K. dealerships of Inchcape.

Financial Maneuvers & Electric Advancements

Running on a different track, Tesla TSLA announced a 10% reduction in its workforce to streamline costs for its next phase of growth. Ford F, on the other hand, resumed online orders for its 2024 F-150 Lightning pickup after a brief pit stop earlier in the year. Nissan NSANY signaled future electrification plans by aiming to produce EVs fueled by next-generation batteries at scale by early 2029.

Last Week’s Significant Developments

Genuine Parts shifted into high gear with adjusted earnings hitting $2.22 per share in the first quarter of 2024, a 3.7% year-over-year increase. Despite missing the sales target, the company’s bottom line outpaced expectations, showcasing resilience. Genuine Parts also revealed its projections for 2024, with expectations of revenue growth in both automotive and industrial sales sectors, guided by adjusted earnings of $9.80-$9.95 per share.

In a dynamic buyout move, Group 1 surged ahead with an acquisition deal for Inchcape’s U.K. automotive retailing business and related real estate, signaling strategic expansion and enhancing its market presence in key regions of England and Wales. With $1 billion of annual revenue already under its belt this year, Group 1 expects the acquisition to rev up this figure to approximately $3.7 billion post closing.

Not to be outpaced, Tesla shifted gears with a global headcount reduction of 10% to fine-tune its operations for future growth, while Ford stepped on the gas by resuming orders for its 2024 F-150 Lightning pickup, complete with price adjustments and technology upgrades. Nissan, in a bid to stay competitive in the EV space, revealed plans to produce next-generation batteries and gear up for mass production by early 2029, signaling a strategic leap into a more sustainable future.

The Alloy Revolution: Nissan’s Bold Move In EV Production

Revolutionary Manufacturing

To produce the rear floor of electric vehicles, Nissan (NSANY) is set to employ heavy-force machines, a cutting-edge approach designed to slash both the cost and weight of components. Hideyuki Sakamoto, Executive Vice President for Manufacturing and Supply Chain Management at Nissan, noted the company’s decision to utilize a colossal 6,000-tonnes gigacasting machine for crafting the car’s rear body structure via aluminum casting, a move indicative of Nissan’s commitment to innovative practices.

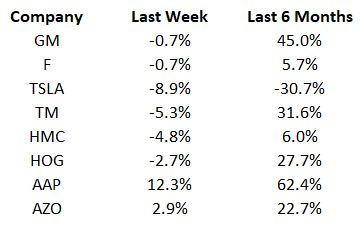

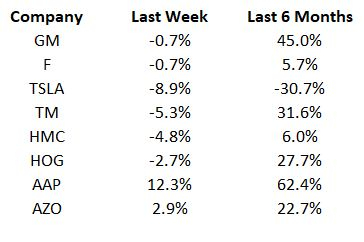

Price Performance Analysis

The recent movement of major players in the automotive sector over varying time frames projects a dynamic landscape for investors and industry enthusiasts to monitor.

Image Source: Zacks Investment Research

Future Prospects in the Auto Industry

The upcoming auto sector earnings season is poised to kick into high gear, offering investors a glimpse into the performance of key players like Tesla, Ford, and General Motors.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The historical data since 1950 indicates that, despite negative midterm years, the market has consistently witnessed positive trends in presidential election years. With a politically charged climate sparking investor engagement, the market has exhibited a bullish trajectory post-election, regardless of the winning party.

Now more than ever is the time to explore Zacks’ Special Report, unveiling 5 stocks with vast potential for both Democrats and Republicans:

1. A medical manufacturer boasting a remarkable +11,000% growth over the past 15 years.

2. A leading rental company showcasing dominance within its sector.

3. A robust energy powerhouse projecting a significant 25% dividend growth.

4. An aerospace and defense standout securing a substantial $80 billion contract.

5. A giant chipmaker making strides with massive U.S.-based plant expansions.