When the Federal Reserve starts cutting interest rates, Bank of America advises investors to consider selling stocks due to the increasing likelihood of a significant slowdown in the U.S. economy. The recommendation, from strategist Michael Hartnett, follows a decline in U.S. stock indices such as the S&P 500 after a jobs report revealed a notable deceleration in hiring. Furthermore, the ISM Manufacturing PMI has declined for the fourth consecutive month.

Hartnett suggests that selling after the initial rate cut is prudent as the risk of a “hard landing” (indicative of a recession) is on the rise. This is in contrast to the expectations of many fund managers, who anticipate a soft landing for the economy, characterized by decreasing inflation without a recession.

He highlights the concerning correlation between job growth and manufacturing activity as a cautionary signal. Historically, manufacturing has only decreased without accompanying job losses during the period from September 1984 to April 1986. July’s job report unveiled a mere 114,000 new jobs added, significantly lower than the expected 178,000.

Interestingly, Bank of America recently released a report indicating that the “Magnificent Seven” stocks were teetering on the edge of a substantial decline pending a negative jobs report. Although today’s trading performance may not qualify as a significant drop, except in the case of Amazon, primarily impacted by its earnings outcome, the weak jobs report has the potential to initiate a bear market. Notably, the Nasdaq has now entered correction territory, having declined by over 10% from its peak.

Identifying the Strongest Contender among the Magnificent Seven Stocks

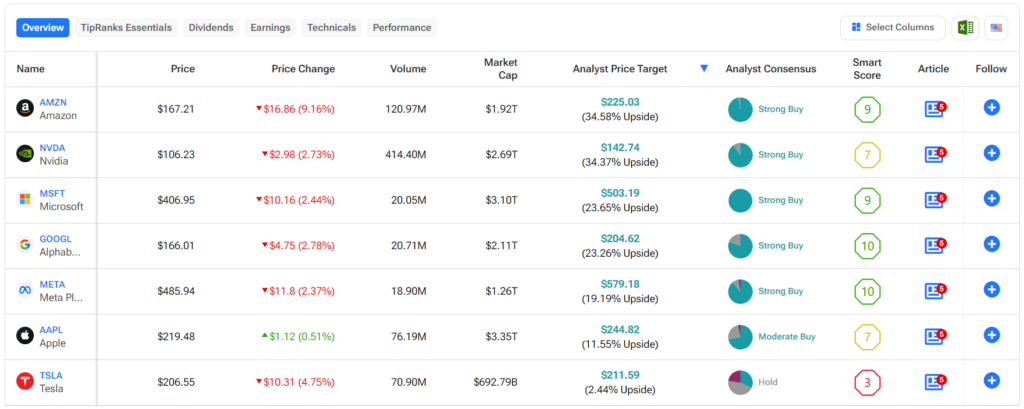

Among the “Magnificent Seven” stocks, which include Amazon, Alphabet, Apple, Meta, Microsoft, Nvidia, and Tesla, analysts project the highest upside potential for Amazon. The stock’s price target of $225.03 per share implies a remarkable 34.58% upside potential.