As the financial world turns, shifts are afoot in the S&P 500 and the tech sector—a narrative unraveling, as outlined by Barclays and Stifel. Barclays keenly underscores the massive chasm in earnings growth separating tech titans like Nvidia, Apple, Google, Meta, Microsoft, and Amazon from the broader S&P 500 fold—an abyss that may well converge by the close of this year or early into the next.

This convergence, in Barclays’ vision, could signal the diminishing dominion of big tech within the market—ushering in the promise of a more equitable market ascension. Analyst Venu Krishna ventures that while the meteoric rise of tech’s earnings slows to a gentle trickle, a flurry of growth may cascade down to other companies enshrined in the S&P 500 pantheon, fostering a more robust marketplace milieu given an amicable economic backdrop.

However, from the bastion of Stifel emanates a bolder foretelling for the S&P 500 index. The oracle known as Barry Bannister envisions a zenith of 6,000 by the curtain call of 2024—only to be shadowed by a descent to around 4,800 come the midsummer of 2026. Presently, the index has soared over 14% since the dawn of this year, with an anticipated additional ascent of 10% before the sun sets on 2022.

Though his official year-end target paints a more modest picture at 4,750, hinting at a probable 13% recoil from present heights, Bannister cautions of a looming correction. This correction could be triggered by the demons of high inflation, a faltering Bitcoin, and the specter of Fed’s capricious interest rate policies.

Does Bitcoin Foretell the Stock Market’s Fate?

Unveiling the enigmatic tapestry of future markets, Bannister suggests that Bitcoin’s recent wane might hint at an impending stock market spiral. Deriving clues from historical rhythm, he unravels a pattern where the S&P 500 often treads water for roughly half a year subsequent to Bitcoin’s zenith, sometimes even plunging. In recent times, Bitcoin has swooned below the $64K mark from its grand zenith of $73,157 in March.

Is SPY a Wise Investment Now?

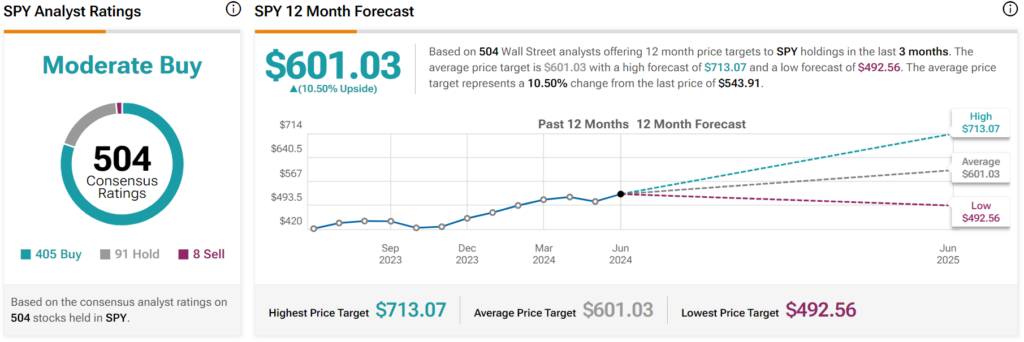

Verdict from market soothsayers reveals a Moderate Buy consensus for the SPDR S&P 500 ETF Trust, laden with 405 Buys, 91 Holds, and eight Sells cast over the last quarter, as depicted by the mystic chart. Moreover, the average SPY price target of $601.03 per share portends an auspicious 10.5% celestial ascendancy.