Artificial intelligence (AI) stocks continue their quest for market domination in 2024. Industry giants like Nvidia (NVDA) and Advanced Micro Devices (AMD) have seen significant growth, with forecasts expecting a CAGR of 15.83% through 2030.

A Closer Look at Palantir Technologies

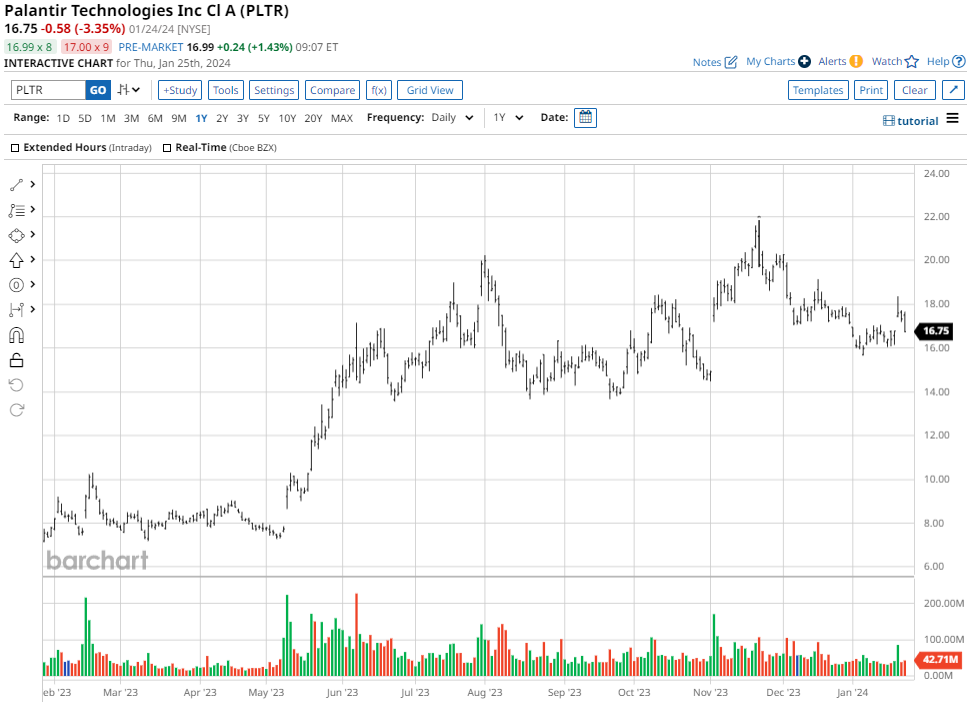

Established in 2003, Palantir Technologies is a software company specializing in big data analytics and fusion platforms for government, defense, and commercial clients. Its core platform Foundry assists in integrating, analyzing, and visualizing data for various security activities. With a current market capitalization of $36.4 billion, the company’s stock price has surged by 126% over the past year, leading to seemingly overvalued valuations.

Evaluating Palantir’s Performance

In the third quarter, Palantir reported revenues up 17% to $558 million, propelled by a 23% growth in commercial revenue to $251 million. Earnings per share (EPS) for the quarter also exhibited a substantial increase. However, the company’s earnings track record over the past five quarters has been mixed, raising concerns about its consistent performance.

Analysts’ Concerns and Forecasts

Despite a notable rise in customer count and commercial revenue, uncertainties surrounding government contracts and the lack of a clear monetization strategy have triggered apprehensions among analysts. Additionally, stiff competition from tech giants like Amazon, Microsoft, and Google in the AI market has intensified worries.

Deutsche Bank recently raised its price target on PLTR to $12, implying an expected downside of over 26% from current levels. The consensus among analysts remains bearish, with a mean target price of $14.35, suggesting an anticipated downside of about 12%.