Wealthy investors, akin to whales of the financial ocean, have recently displayed a notably optimistic outlook on Robinhood Markets.

An examination of the options trading history for Robinhood Markets with the ticker symbol HOOD on the NASDAQ exchange reveals a total of 14 discernible trades.

Delving into the specifics of these trades, it emerges that 57% of the investors initiated trades with positive expectations, while 35% had a bearish sentiment.

Out of the identified transactions, 4 were puts, amounting to $171,711, and 10 were calls, totaling $799,861.

Foreseen Price Swing

Reviewing the Volume and Open Interest in these options contracts unveils that major market players have set their sights on a pricing range of $20.0 to $30.0 for Robinhood Markets over the recent quarter.

Exploring Volume & Open Interest Patterns

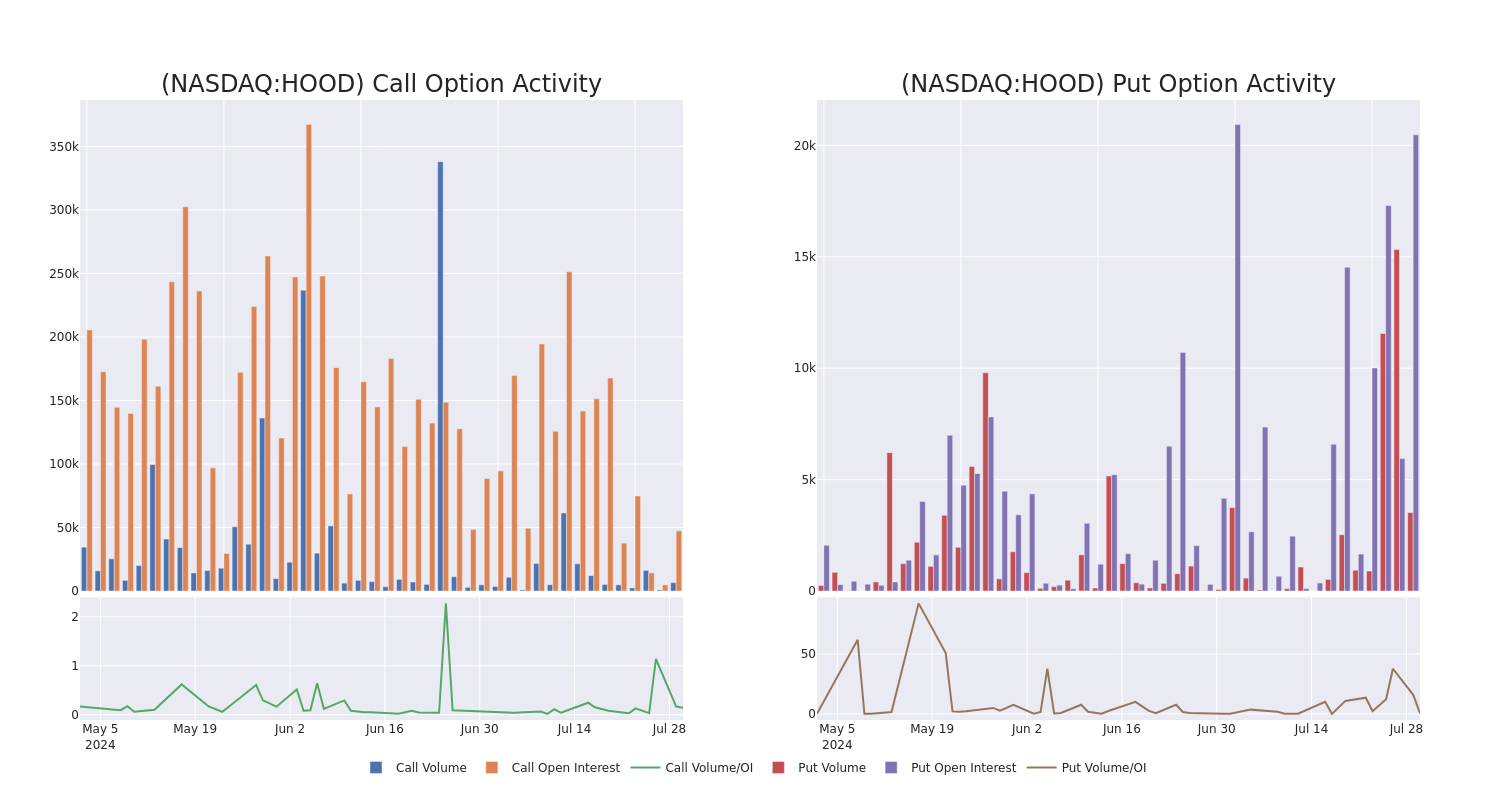

Scrutinizing the volume and open interest serves as a valuable method to conduct a thorough analysis of a stock.

This crucial data aids in tracking the liquidity and interest in Robinhood Markets’s options for a specific strike price.

Beneath, we witness the progression of volume and open interest for calls and puts concerning all of Robinhood Markets’s notable activity from $20.0 to $30.0 within the last 30 days.

Robinhood Markets Option Volume And Open Interest Changes Over Last 30 Days

Significant Options Movements:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | SWEEP | BULLISH | 01/16/26 | $4.5 | $4.4 | $4.5 | $30.00 | $225.0K | 9.9K | 272 |

| HOOD | CALL | SWEEP | BULLISH | 11/15/24 | $2.96 | $2.93 | $2.96 | $22.00 | $148.0K | 1.5K | 502 |

| HOOD | CALL | TRADE | BULLISH | 01/16/26 | $6.9 | $6.7 | $6.85 | $22.00 | $137.0K | 23.7K | 200 |

| HOOD | CALL | TRADE | NEUTRAL | 01/16/26 | $4.5 | $4.3 | $4.4 | $30.00 | $66.0K | 9.9K | 654 |

| HOOD | PUT | SWEEP | BULLISH | 08/02/24 | $0.49 | $0.48 | $0.48 | $20.50 | $58.3K | 8.3K | 2.7K |

A Glimpse at Robinhood Markets

Robinhood Markets Inc. is paving the way with its contemporary financial services platform. By crafting its own products and services and delivering them through a single, app-based cloud platform supported by cutting-edge technology, it is revolutionizing the industry. The vertically integrated platform has facilitated the introduction of innovative offerings such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. The company generates revenue from transaction-based fees by routing user orders for options, equities, and cryptocurrencies to market makers upon execution.

Current Position of Robinhood Markets in the Market

- With a trading volume of 5,290,986, HOOD is currently down -2.69% at $20.61.

- Relative Strength Index (RSI) signals suggest that the underlying stock might be approaching the oversold territory.

- Anticipated upcoming earnings release is scheduled in 8 days.

Expert Opinions on Robinhood Markets

Over the past month, 4 industry analysts have imparted their perspectives on Robinhood Markets, proposing an average target price of $21.5.

- Goldman Sachs’ analyst maintains a Neutral rating on Robinhood Markets, upholding a target price of $21.

- Piper Sandler’s analyst opts to retain a Neutral rating on Robinhood Markets with a target price of $20.

- Barclays’ analyst persistently advocates an Underweight rating on Robinhood Markets accompanied by a target price of $20.

- Keybanc’s analyst remains steadfast in their Overweight rating for Robinhood Markets, setting a price target of $25.

Options trading, akin to navigating choppy waters, entails both heightened risks and potential rewards. Astute traders adeptly mitigate these risks by constantly expanding their knowledge, tailoring their strategies, monitoring various indicators, and keenly observing market shifts. Stay abreast of the latest options activity in Robinhood Markets with real-time alerts.