The clash of titans in the e-commerce realm, Amazon (NASDAQ: AMZN) and Shopify (NYSE: SHOP), has captivated investors with their contrasting business models. Amazon, a pioneer in online retail, branches out with Amazon Web Services, while Shopify thrives as a software platform empowering merchants.

Exploring the Distinctions

Amazon’s evolution from a humble online bookstore in 1994 to a retail powerhouse encompassing various high-margin sectors like cloud computing, adverts, and subscriptions illustrates its diversified revenue streams. In comparison, Shopify, established in 2006, focuses on offering merchants a versatile e-commerce platform.

Despite Amazon’s market cap dwarfing Shopify’s, the latter’s agility and targeted services have resonated with entrepreneurs seeking customizable solutions. Shopify continues to attract smaller businesses with its innovative approach.

Financial Landscape

Amazon’s revenue surge to $575 billion in 2023 signifies its enduring growth, fueled largely by ancillary segments rather than its core online sales. In contrast, Shopify’s revenue climb of $7.1 billion highlights its rapid expansion in the e-commerce marketplace.

While Amazon’s profit rebounded in 2023 after a sluggish 2022, Shopify’s strategic divestment decisions impacted its profitability. The e-commerce platforms diverge in valuation metrics, with Shopify’s forward P/E ratio trading at a premium compared to Amazon’s.

The Investment Dilemma: Amazon or Shopify?

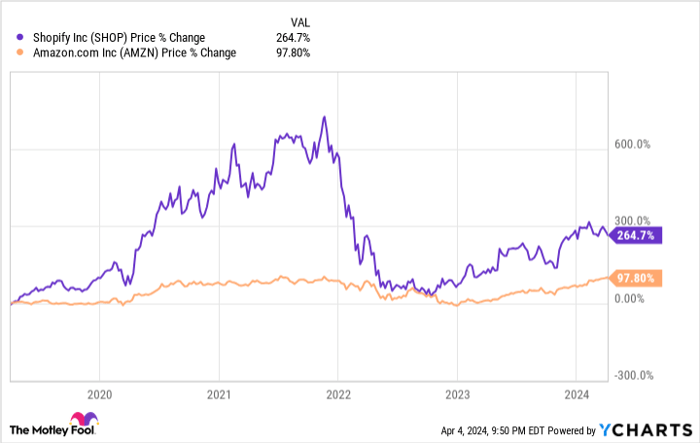

Both Amazon and Shopify remain attractive investments, leveraging technological advancements to drive growth. Risk-averse investors may find solace in Amazon’s stability, while Shopify’s momentum and revenue trajectory offer greater potential for returns.

Shopify’s recent profitability turnaround and its ecosystem nurturing merchant growth position it favorably for sustained earnings growth. The platform’s resilience and adaptability in the ever-evolving e-commerce landscape signal a bright future.

Final Words

As the stock market beckons with high stakes, Amazon and Shopify emerge as formidable contenders with distinct value propositions. While Amazon’s entrenched market presence provides stability, Shopify’s innovation and growth trajectory hint at a promising investment journey ahead.