The AI Boom: Unleashing a Technological Goliath

The surge in artificial intelligence (AI) gained momentum last year and continues to charge ahead with unwavering vigor. OpenAI’s ChatGPT launch in late 2022 reignited passion for AI, challenging the existing boundaries of technological capabilities. This wave has propelled a substantial increase in demand for AI services across various sectors, leading to a meteoric rise in stock prices for companies embracing this transformative technology. The AI market’s growth spurt is poised to continue racing ahead, with predictions indicating a whopping compound annual growth rate of 37% through 2030.

Far from peaking, the AI industry offers ample opportunities for substantial long-term gains. Companies like Advanced Micro Devices (NASDAQ: AMD) and Microsoft (NASDAQ: MSFT) stand out as promising investment avenues, pouring significant resources into AI innovation.

Exploring the intricacies of AMD and Microsoft’s operations reveals insights into which might emerge as the superior AI stock in the current climate.

The Underdog: Advanced Micro Devices

AMD has witnessed a substantial 160% surge in its stock since March last year, captivating investors with its burgeoning AI prospects. While overshadowed by industry heavyweight Nvidia in recent times, AMD is gearing up to challenge its competitor head-on and carve out a substantial market share in AI chips, promising substantial returns for patient investors in the long haul.

AMD’s unveiling of the MI300X AI graphics processing unit last December sent shockwaves through the industry, positioning itself as a direct competitor to Nvidia’s offerings. Noteworthy tech giants including Microsoft and Meta Platforms have already enlisted AMD’s cutting-edge chip, underscoring its growing appeal and market presence.

Despite lagging reflections in earnings due to heavy AI investments, AMD’s recent performance reveals encouraging signs. The company’s fourth-quarter revenue for 2023 soared 10% year-over-year, surpassing analyst forecasts by a margin of approximately $60 million. Noteworthy spikes include a 38% revenue growth in its AI-focused data center segment and a remarkable 65% year-over-year uptick in its client segment fueled by a resurgent PC market.

Complementing its stride in AI chip development, AMD is venturing into AI-powered PCs, aiming to capitalize on a projected surge in PC shipments as AI integration emerges as a pivotal catalyst, as indicated by research firm IDC. A forecast by Canalys predicts that by 2027, 60% of all shipped PCs will feature AI integration, offering a promising growth trajectory for AMD.

As AMD ventures deeper into the AI domain, it presents an enticing investment opportunity.

The Tech Titan: Microsoft

Microsoft forged a path as an early AI adopter, funneling billions into OpenAI back in 2019. This strategic investment has allowed Microsoft to leverage some of the most advanced AI models available, propelling the company’s stock with a remarkable year-over-year surge of over 59%.

Harnessing OpenAI’s cutting-edge technology, Microsoft has infused AI functionalities across its product suite, gaining a competitive edge over rivals like Amazon and Alphabet. In 2023, the tech behemoth introduced new AI tools into its Azure cloud platform, integrated ChatGPT elements into its Bing search engine, and bolstered productivity across its Office software suite through AI features.

Empowered by OpenAI’s models and backed by a vast user base courtesy of services like Office and Azure, Microsoft is positioned to dominate the AI landscape. Boasting over $67 billion in free cash flow last year, Microsoft exhibits the financial muscle necessary to sustain investments in AI innovation and stay abreast of rivals in the relentless technological race.

Noteworthy in its Q2 2024 results ending December 2023, Microsoft showcased an impressive 18% year-over-year revenue growth, primarily fuelled by a notable 20% surge in revenue from its AI-focused intelligent cloud segment. With a robust AI trajectory, Microsoft emerges as an appealing stock to consider at present.

Navigating the Crossroads: AMD or Microsoft?

AMD and Microsoft traverse distinct stages in their AI odysseys, with one embarking on a nascent AI chip exploration while the other basks in the immense investments it sowed nearly half a decade ago.

Both stalwarts are poised for thriving AI journeys in the foreseeable future. However, AMD’s comparatively modest market cap of $342 billion, juxtaposed with Microsoft’s behemoth status at $3 trillion, hints at AMD potentially having more runway for exponential growth in the forthcoming years.

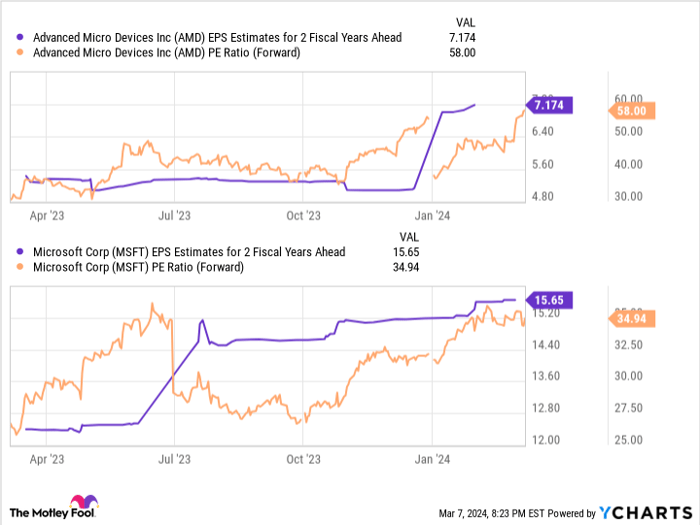

Data by YCharts

Delving deeper, projections indicate AMD’s earnings could soar to $7 per share in the next two fiscal years, whereas Microsoft’s earnings might approach $16. Crunching these figures through the companies’ forward price-to-earnings ratios depicted in the chart unveils a promising outlook: a potential stock price of $412 for AMD and $549 for Microsoft.

These foresights foretell a soaring trajectory for AMD’s stock, surging by 95%, while Microsoft is poised for a 34% uptick by 2026. In light of this, AMD’s stock shines brightly over Microsoft’s this month, positioning itself as a compelling investment option alongside its flourishing prospects within the AI domain.

Where to invest $1,000 right now

When our analyst team unearths a stock gem, lending an ear tends to pay off handsomely. The longstanding Motley Fool Stock Advisor newsletter, boasting over two decades of market-beating returns, speaks volumes about this maxim. *

Recently, they unveiled a list of the 10 best stocks to snatch up right now… and Advanced Micro Devices found a solid footing on this elite list. However, nine other stocks await your keen scrutiny.

*Stock Advisor returns as of March 11, 2024