The rise of artificial intelligence (AI) services has sparked intense competition in the tech industry, particularly in the domain of chip manufacturing. As the demand for hardware, especially graphics processing units (GPUs), soars to facilitate AI model training, companies are seizing this lucrative opportunity to develop cutting-edge chips.

While Nvidia has surged ahead in AI GPUs, causing its stock price and earnings to soar, all eyes are now on industry stalwarts Intel (NASDAQ: INTC) and Advanced Micro Devices (NASDAQ: AMD) as they compete with their own line of chips, poised to capitalize on the expanding AI market.

Intel: Navigating the Path of Potential

Intel’s stock has seen a modest 3% uptick in the past month, indicating Wall Street’s growing confidence in its long-term prospects. This growth comes as a welcome relief after a year of setbacks that saw its share price plummet by 7% since the previous July, attributed to disappointing quarterly results amidst stiff competition and market dynamics.

Despite recent challenges, Intel is reshaping its business strategy, making substantial investments today to reap significant rewards over the next decade. Notably, the tech giant is ramping up its presence in the AI sphere by introducing competitive-priced accelerators like the Gaudi 2 and Gaudi 3, tailored for data-intensive AI workloads in cloud environments.

However, the most ambitious move by Intel involves aiming to become a dominant player in the foundry sector — a strategic gamble given that the semiconductor foundry market is projected to double in value from $107 billion in 2022 to $232 billion by 2032. Although Intel anticipates breaking even only by 2027, venturing into chip manufacturing could prove immensely rewarding as the demand for chips across various tech segments continues to rise.

Advanced Micro Devices: Navigating Challenges in AI Terrain

AMD has emerged as a pivotal player in the AI landscape, revamping its business structure to focus on AI-driven solutions. The company scored notable wins by launching its own AI GPUs and securing key clients like Microsoft and Meta Platforms.

Recent reports of AMD exploring a deal to build a colossal AI cluster housing 1.2 million GPUs highlight its commitment to AI innovation. Despite the promise in the segment, AMD faced setbacks in recent earnings, with mixed results in different market segments posing challenges to sustained financial growth.

Deciding Between Intel and AMD this July

Both Intel and AMD have distinct strategies in the AI arena: Intel seeks differentiation through a diverse chip portfolio and substantial manufacturing investments, while AMD pursues aspirations to rival Nvidia’s dominance.

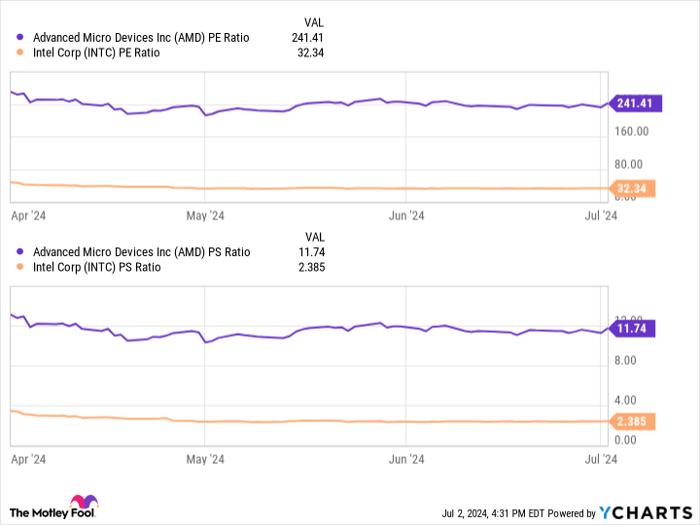

Nevertheless, Nvidia’s overwhelming 90% market share in AI GPUs poses a daunting challenge for both Intel and AMD, with Intel likely in a better position to scale up in the industry. A comparison of key financial metrics indicates Intel’s potential undervaluation compared to AMD, signaling a compelling investment opportunity.

Amid Intel’s promising foray into the foundry market, it emerges as a clear frontrunner in the AI stock race this July, offering more significant potential than AMD.

Data by YCharts

Additionally, the historical success of companies like Nvidia, listed in the Motley Fool Stock Advisor, underscores the potential gains from visionary investments. Intel’s current positioning echoes Nvidia’s growth trajectory in its early stages, hinting at substantial returns for astute investors.

Join the Intel Bandwagon: A Sound Investment Move

Considering Intel’s strategic initiatives and undervaluation relative to its peers, it stands out as a compelling choice for investors eying the AI landscape. As Intel advances further into chip manufacturing and cements its position in AI innovation, the stock presents a strong case for potential growth and long-term value appreciation.

For investors seeking to capitalize on transformative trends in the tech sector, Intel emerges as a prudent pick this July, promising rewards akin to those realized by early backers of now-legendary stocks like Nvidia.