The race to dominate the artificial intelligence landscape has breathed fire into the stock market’s tech sector. The contenders? Two behemoths – semiconductor giant Nvidia and tech powerhouse Arm Holdings. In the epic saga of 2024, Nvidia gallops ahead with a 144% rise in its shares, closely trailed by Arm Holdings, scaling a remarkable 91% ascent.

The Rise of Nvidia

Nvidia, the reigning champion, reigns supreme in the realm of semiconductor giants. Its GPUs, the fiery engines fuelling AI revolution, have found a battleground in data centers, the ivory towers of cloud computing where AI imperiums thrive.

The dawn of accelerated computing, led by Nvidia, has unlocked unprecedented demand. CEO Jensen Huang’s visionary plunge into AI, epitomized by bequeathing the world’s first AI supercomputer to OpenAI in 2016, set the tone for a technological odyssey.

The spectacle of nations like the United Kingdom and Japan wielding Nvidia’s chips to craft AI supercomputers underscores the company’s meteoric rise. A surge in year-over-year revenue growth across pivotal quarters has been a testament to Nvidia’s irresistible allure.

| Quarter | Revenue | Change (YoY) |

|---|---|---|

| Q2 2024 | $30 billion | 122% |

| Q1 2024 | $26 billion | 262% |

| Q4 2023 | $22 billion | 265% |

| Q3 2023 | $18 billion | 206% |

Data source: Nvidia. YOY = Year over year.

Nvidia’s financial fortress stands tall – in the fiscal second quarter, total assets of $85.2 billion towered over liabilities of $27.1 billion. With net income soaring by 168% year over year to $16.6 billion, Nvidia’s charted waters seem favorable.

Huang’s vision of data centers metamorphosing into accelerated computing citadels heralds a seismic shift akin to the Industrial Revolution. An orchestrated gateway to ‘AI factories’ envisages a $600 billion cloud computing mecca, a crescendo in Nvidia’s symphony.

The Ascendancy of Arm Holdings

Arm Holdings, a linchpin in tech folklore, weaves its narrative through a tapestry of energy-efficient semiconductor designs. Its hegemony in the mobile realm is indisputable, yet the tides of AI royalty beckon.

A surge of 39% year-over-year in sales, culminating in a $939 million crescendo in fiscal 2025 Q1, bequeaths Arm Holdings with a laurel of triumph. The cadence of energy-thirsty AI applications propels Arm’s architectures into the anointed realms of demand.

Embracing a revenue model of licensing technology and reaping royalties from the tech-imbued devices marching forth, Arm Holdings leads its crusade through the terrains of AI demand. An apotheosis awaits in the forecasted crescendo of revenue to $3.8 billion in fiscal 2025.

In the luminous aura of fiscal success, Arm Holdings enshrines assets of $7.9 billion, shadowing liabilities of $2.2 billion. Witnessing net income amplify, from $105 million to $223 million, Arm’s posture is one of valor.

The Conundrum: Nvidia or Arm Holdings?

In the epic battle of semiconductor behemoths, Nvidia emerges as the knight in shining armor. Its scepter gleams with the allure of a lowly P/E ratio, a metric heralding valuations. Arm Holdings’ lofty P/E ratio of 360 casts a pall over Nvidia’s modest 55, an ode to Nvidia’s prudence.

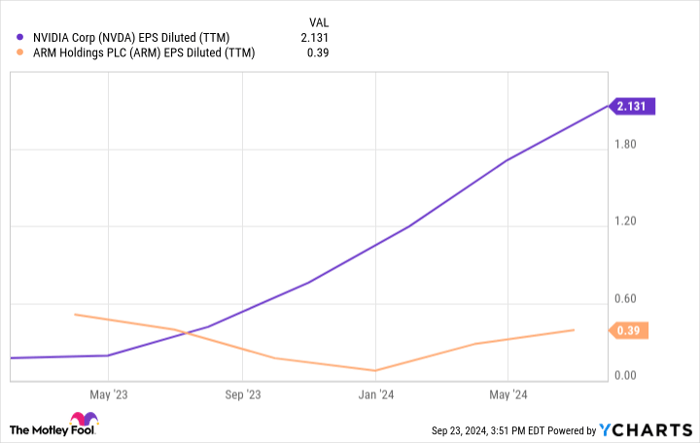

The saga of diluted earnings per share unfolds a divergent tale – Arm’s oscillations juxtaposed against Nvidia’s majestic ascent. The crescendo of Nvidia’s growth enshrines the data center domain, a trove of $26 billion amidst a record $30 billion revenue.

In the twilight of the mobile era, Arm Holdings resonates with the cries of the smartphone empire, where China’s shadows loom. A slowdown in Chinese smartphone symphonies amid market saturation presents a somber backdrop.

Nvidia’s dance in the cloud realm, coupled with financial mettle, weaves a tale of pedigree. The valiant rise in revenue and EPS, fortified by a robust valuation, anoints Nvidia as the phoenix of the long-term investment kingdom.

Should the Fortunes Favor Nvidia?

Before dispatching your loyal investment steed toward Nvidia’s domains, a solemn sage of advice beckons – the Motley Fool Stock Advisor analyst paragons flag a treasure trove, calling for a reverent gaze.

Unraveling the Mysteries of Stock Investing: Contrasting Nvidia’s Omission from the Elite 10

When the world of investing collides with the realms of hindsight, the results can sometimes be utterly jaw-dropping. Take Nvidia, for instance. A titan in the tech sector, a global behemoth, and a potential home run for savvy investors, yet it failed to secure a spot in the illustrious list of top 10 stocks advocated for investors’ immediate attention. To say investors were befuddled would be an understatement.

The Pinnacle of Investment Insight

Picture this – a serene April morning, the year is 2005. Nvidia lumbers into view, ready to make its indelible mark on the investing landscape, only to be met with a puzzling revelation – it wasn’t among the chosen ones. The 10 anointed stocks stood tall, promising myriad riches and unprecedented returns. Nvidia, unassuming yet powerful, overlooked in a critical moment that would set the course for what’s next.

The Pendulum of Investing Fortune Swings

Had you sifted through the annals of history to that fateful day in 2005 and wagered $1,000 on Nvidia, fast forward to the present, and you’d be staring at a staggering $756,882. A classic case of “what if” and “if only,” with Nvidia embodying the essence of missed opportunity and untapped treasure troves of potential growth.

The Beacon of Wisdom: Stock Advisor

Stock Advisor, a trusted oracle in the realm of investments, paves the way for aspiring investors seeking a roadmap to success. With a promise of reliability and foresight, Stock Advisor offers a blueprint for the future, with expert insights, portfolio building strategies, and the allure of two tantalizing stock picks each month.

The Impressive Track Record

Since its inception in 2002, the Stock Advisor service has not just outperformed but redefined the very essence of success, more than quadrupling the returns of the illustrious S&P 500. A testament to its vision, its acumen, and its knack for identifying the hidden gems amidst the clutter of the stock market.

As the investing world continues to evolve, as stocks wax and wane, one thing remains a constant – the pursuit of that elusive stock, the undervalued gem, the potential next big player in the market. While Nvidia may have missed the cut in this instance, who’s to say what the future holds for this tech powerhouse?

Deciphering the Tapestry of Stock Market Fortunes

As we navigate the intricate web of stock market fortunes, where every rise and fall tells a story, Nvidia’s omission from the elite 10 serves as a poignant reminder – in the world of investments, timing, insight, and a dash of luck all play pivotal roles. The stock market, akin to a tempestuous sea, requires a steady hand, a keen eye, and a willingness to brave the storms to reap the ultimate rewards.