SoundHound AI’s Rising Symphony

As of late, SoundHound AI has been playing a sweet melody for investors, with May proving to be a crescendo of success.

The first quarter of 2024 showcased an impressive performance, with a 73% surge in revenue to $11.6 million, lifting investor spirits once again. The company’s adjusted net loss narrows slightly, instilling confidence as it boosts revenue guidance for the year ahead. The crescendo is set to continue, aiming to exceed $100 million in revenue by 2025.

SoundHound AI’s confidence in its future stems from solidifying revenue streams and strategic partnerships with heavyweights like Nvidia and Stellantis. With the integration of their generative AI voice assistant into Nvidia’s Drive platform and vehicles from Stellantis, the company is making inroads across industries such as automotive and food services, totaling a whopping $140 billion market for voice-recognition AI.

The Resilience of Nvidia

Nvidia stands tall, commanding a 98% market share in data center GPUs, providing investors a robust gateway to profit from the AI infrastructure boom. Its cutting-edge chips power large language models and technologies pivotal for companies like SoundHound AI to thrive, solidifying its technological supremacy.

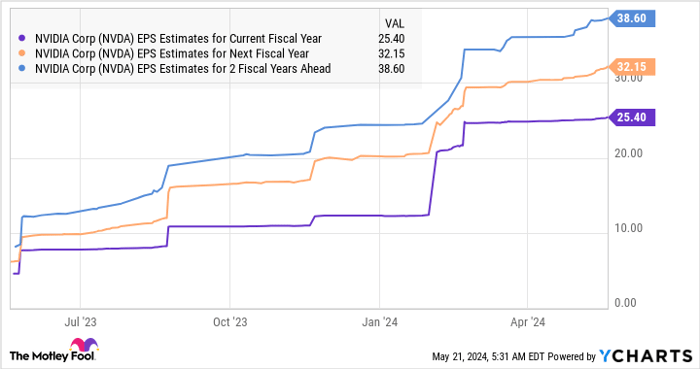

The fiscal year 2024 saw Nvidia soar with revenue escalating by 126% to $60.9 billion, outpacing its counterparts. Adjusted earnings surged by an impressive 288% to $12.96 per share, painting a picture of continued financial health in the foreseeable future.

With a promising landscape ahead, characterized by the anticipated expansion of the AI chip market growing at a 38% annual rate through 2032, and generating a massive $372 billion in annual revenue, Nvidia’s dominance seems unshakable. On the flip side, SoundHound AI may face formidable competition from industry giants and rising players like OpenAI.

The Superior AI Investment: Nvidia vs. SoundHound

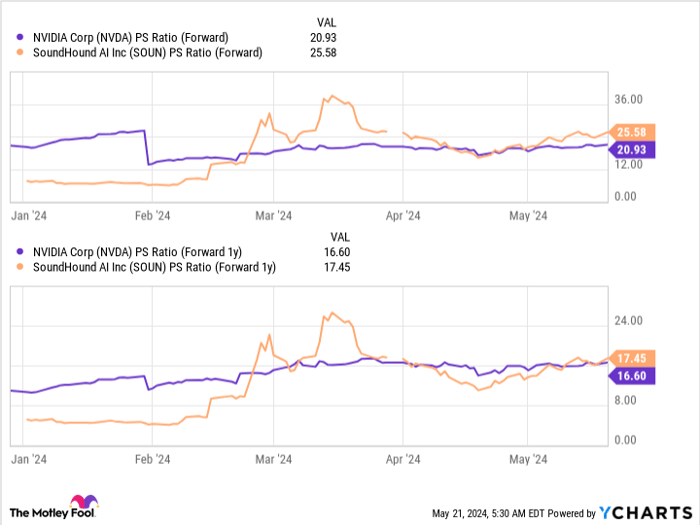

Comparing Nvidia and SoundHound in the realm of artificial intelligence (AI) investments sheds light on why Nvidia emerges as the prime choice. With Nvidia holding a price-to-sales (P/S) ratio of 39, surpassing SoundHound’s 27 times sales valuation, one might wonder about the safer bet. However, Nvidia’s elevated valuation is legitimized by its rapid growth, improving profitability, and near-monopoly status in AI chip production. Therefore, when examining their forward sales multiples, it becomes evident that Nvidia, with its higher P/S ratio, is the wiser investment.

Analyzed & Justified: Nvidia’s Valuation

It’s crucial to understand the nuances of Nvidia’s P/S ratio, which, despite being higher than SoundHound’s, is supported by the company’s accelerated expansion, enhanced bottom line, and dominant position in the AI chip sector. These factors collectively position Nvidia as the more sound and fruitful investment vehicle when considering the two companies in the AI market.

NVDA PS ratio (forward); data by YCharts.

Investor’s Dilemma

For the discerning investor aiming for optimal returns in the AI sector, the choice is evident. Nvidia’s supremacy, underscored by its inflated P/S ratio, reflects its competitive edge and promising future. Hence, weighing the growth potential, market standing, and financial performance of both entities, Nvidia stands tall as the superior AI investment option.

Before delving into Nvidia’s stocks, investors should ponder this fact:

The Motley Fool Stock Advisor team recently highlighted the 10 best stocks for prospective investors, with Nvidia not making the list. However, historical context reveals a compelling narrative. Imagine if you had invested $1,000 in Nvidia back on April 15, 2005 – that investment would have burgeoned to a staggering $652,342!*

Stock Advisor offers a roadmap to financial success through expert guidance on portfolio construction, regular analyst updates, and bimonthly stock recommendations. Boasting a track record that has vastly outperformed the S&P 500 since 2002, the service is synonymous with stellar returns.*

*Stock Advisor returns as of May 13, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.