The recent revelation that Alphabet’s YouTube garnered the largest share of TV viewership in May appears counterintuitive. While traditional TV has been on a gradual decline, one might assume that a streaming heavyweight like Netflix would reign supreme.

This victory, however, leaves investors pondering the better choice in the realm of streaming service stocks. Should they stick with the longtime dominator, Netflix, or venture into YouTube’s diverse content pool under the nurturing wings of Google’s parent company?

The Strategic Stance

Technically speaking, Netflix stands as the pure “streaming stock” pick, heavily reliant on this medium. It has maintained an edge as a pioneer in the industry, consistently expanding its content library and features amidst growing competition.

However, maintaining this lead comes at a steep price, including hefty investments in original content creation and a recent shift towards ad-supported models. Despite these challenges, Netflix’s Q1 2024 revenue surged by 15% to $9.4 billion, primarily fueled by a rise in memberships and pricing.

In stark contrast, Alphabet operates as a conglomerate, drawing revenue from advertising, cloud services, and various other ventures. Apart from a short-lived foray into proprietary content creation, YouTube traditionally thrived as a hub for user-generated content. With proven expertise in digital advertising, the bulk of its earnings stemmed from this avenue.

Yet, the $8 billion earned from YouTube in Q1 2024 pales against the staggering $46 billion raked in from Google search ads during the same period.

Comparing the Financial Landscapes

Alphabet’s sheer magnitude translates into a higher free cash flow compared to Netflix. Generating approximately $17 billion in free cash flow during Q1, Alphabet’s free cash flow represented about 21% of its revenue. While numerically eclipsing Netflix’s $2.1 billion, Netflix’s free cash flow accounted for about 22% of its revenue.

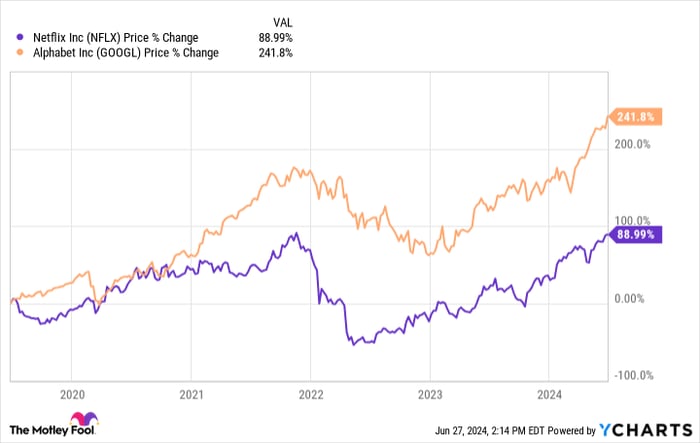

A notable upturn in Netflix’s performance likely catalyzed its stock, soaring by 65% over the past year against Alphabet’s modest 55% increase.

Over the past five years, Alphabet significantly outshone Netflix, even amid aggressive strides made by Netflix’s competitors. A rejuvenation seems underway for Netflix, especially with the introduction of an ad-supported option, leading to double-digit revenue growth in recent times.

However, Netflix’s recent uptick comes at a premium, evident in its current 48 P/E ratio, significantly higher than Alphabet’s 28. Despite Netflix’s slightly superior performance in the near term, it comes at a considerably steeper price.

Deciding Between the Giants

Given the current landscape, investors may find Alphabet a more appealing choice. Despite YouTube forming a smaller segment of the conglomerate, labeling Google’s parent solely as a “streaming stock” appears misleading.

Alphabet’s prowess in attracting advertising revenue strategically situates the company amidst a streaming sector increasingly reliant on ad-backed content. Moreover, YouTube sources its content at minimal costs, indicating that its streaming segment operates at a relatively lower expense level compared to Netflix.

Finally, Alphabet’s ability to generate free cash flow on par with Netflix as a percentage of revenue, coupled with a diversified business portfolio and a more attractive valuation, positions it as the long-term preferred choice for investors.

Is Alphabet the Right Investment?

Prior to diving into Alphabet’s stock, it’s crucial to consider the insights below:

The Motley Fool Stock Advisor team recently unveiled their top 10 stock picks for potential high returns, with Alphabet notably absent from the list. These selected stocks are poised to yield significant gains in the foreseeable future.

Reflecting on Nvidia‘s inclusion on a similar list in 2005, investing $1,000 at the recommendation date would have burgeoned to a mind-boggling $757,001!

Stock Advisor offers an actionable game plan for investors, complete with portfolio-building strategies, regular analyst updates, and two fresh stock recommendations monthly. This service has remarkably outperformed the S&P 500 by more than fourfold since 2002.

*Stock Advisor returns as of June 24, 2024