Market Expectations and Recent Trends

As the market eagerly awaits the quarterly results of the renowned ‘the Magnificent 7,’ hopes are high for a potential reversal of recent stock market dips. The turbulent market conditions have been triggered by uncertainties surrounding regulatory and trade policies, post the November elections. Export restrictions on semiconductor players have added to this apprehension, but seasoned investors advise against reading too deeply into the recent underperformance of the Mag 7 stocks, given their past remarkable growth.

Comparative Performance and Expectations

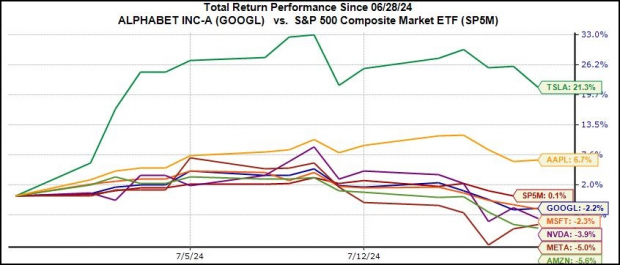

Examining the performance since the inception of July, Tesla has outshined its counterparts, with a soaring surge of +21.3%. Meanwhile, Microsoft and Alphabet have closely mirrored each other with marginal declines. However, altering the starting point to the beginning of 2024 steers the ranking entirely, positioning Tesla and Alphabet at the top. This shift in dynamics underscores the transformative power of time and contexts in the volatile tech realm.

Upcoming Earnings Report and Estimates

With Alphabet and Tesla set to unveil their Q2 results imminently, all eyes are on these tech giants. Current Q2 EPS estimates for Alphabet stand at $1.85, signaling a robust +13.7% year-over-year growth in earnings. Similarly, Tesla anticipates a Q2 EPS of $0.62, slightly below the previous year’s figures. However, the market’s reaction post-earnings release is not solely tethered to EPS surprises, as evidenced by the divergent market movements of Alphabet and Tesla following their last quarterly reports.

Future Projections and Sector Overview

While the rest of the Mag 7 gear up to disclose their earnings in the following weeks, the tech sector as a whole brims with optimism. Forecasts predict a remarkable +25.6% earnings surge compared to the same period last year on +13.3% higher revenues. This anticipated growth trajectory, after a phase of adjusted demand from previous years, underscores the cyclical yet resilient nature of the tech industry.

Analysing Tech Sector Performance

The tech sector, including the influential Mag 7, has exhibited a promising trend with a substantial earnings growth of +17.2%. This positive shift in estimates, coupled with a favorable revisions trend over recent quarters, sets a buoyant tone for the sector’s future prospects.

Unboxing Earnings Season & Notable Reports

As the Q2 reporting cycle gains momentum, a diverse array of companies, from Verizon and AT&T to UPS and Spotify, are poised to reveal their financial results. The historical comparisons reflect varying degrees of earnings and revenue surprises, with the prevalent highlight being the unexpected low in revenue beats percentage, setting a new benchmark over the past 5 years.

Embracing the Earnings Landscape

Plunging into the quarterly earnings landscape, the tech sector braces for a riveting period. With the Mag 7 and other industry stalwarts gearing up to unveil their results, the market anticipates a blend of surprises and challenges, underscoring the dynamic nature of the ever-evolving tech landscape.

The Brightening Horizon for S&P 500 Earnings

Encouraging Growth Trends

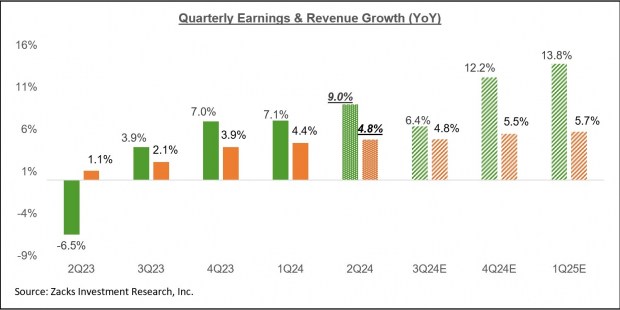

Combining the actual results and future estimates for the S&P 500 companies, analysts project a 9% increase in earnings compared to the same period last year, with revenues expected to rise by 4.8%. This anticipatory growth pattern signifies the most substantial quarterly surge since the +10% earnings upswing of the first quarter in 2022.

Picturing Q2 2024 Performance

The accompanying graphic delineates the year-over-year earnings and revenue progression for the second quarter of 2024 in light of the preceding and subsequent periods. The visual representation underscores the positive trajectory painted by the data.

Image Source: Zacks Investment Research

Leading up to the Q2 earnings season, a distinct trend of favorable revisions in estimates emerged, positioning Q2 estimates for the S&P 500 index as relatively resilient compared to prior quarters. During the three months preceding June 30th, Q2 estimates demonstrated remarkable stability, hinting at a robust earnings season trajectory.

This upcoming Q2 earnings growth presents not only the most robust performance since early 2022 but also propels aggregate earnings for the period to potentially reach an all-time quarterly zenith.

Burgeoning Earnings Potential

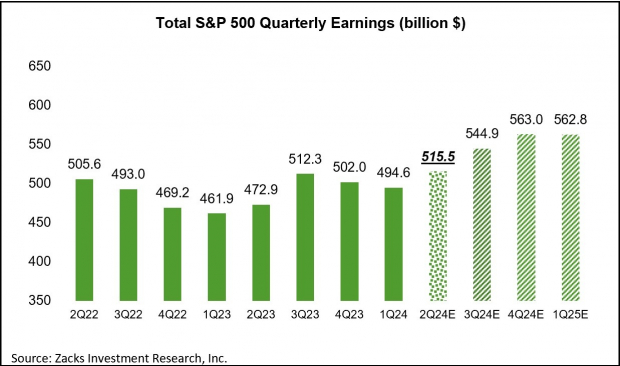

Illustrated in the chart below, the cumulative S&P 500 earnings for Q2 are poised to surpass the earnings recorded in the third quarter of 2023. This statistical comparison paints a vivid picture of the ascending earnings trajectory the index is currently on.

Image Source: Zacks Investment Research

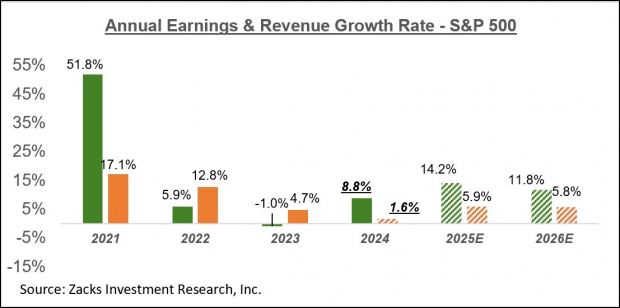

Looking at the broader annual outlook, estimates foresee a prolific 8.8% earnings uptick for the full year 2024, accompanied by a 1.6% growth in revenues. Excluding the Finance sector from the equation, the revenue growth projection escalates to 3.9%, retaining an impressive 8.7% earnings growth for the index on an ex-Finance basis.

Image Source: Zacks Investment Research

These figures not only suggest a promising trajectory for earnings but also hint at a fiscally ambitious landscape for the S&P 500.