Billionaire Chase Coleman, renowned for astute investments in tech giants like Meta Platforms and Microsoft’s LinkedIn, has recently made a daring move that has caught the eye of the investment community. Coleman, the driving force behind Tiger Global Management, made a considerable bet on Southeast Asian conglomerate Sea Limited (NYSE: SE), a move that has raised eyebrows and sparked speculation about the company’s future prospects.

The Evolution of Sea Limited

Reflecting on the trajectory of Sea Limited over the years, Coleman’s initial interest in the company back in 2018 stemmed from the promising opportunities in mobile gaming and online commerce within the burgeoning Southeast Asian markets. The company experienced a meteoric rise in its stock price, fueled in part by the surge in demand for its offerings during the pandemic-induced lockdowns.

However, by 2022, Sea Limited faced challenges, including the Indian government’s ban on its popular game “Free Fire” and setbacks in its e-commerce division, notably in European and Latin American markets. These hurdles prompted Tiger Management to significantly reduce its holdings in Sea Limited.

Notably, Sea Limited has since refocused its efforts on strengthening its e-commerce foothold in Southeast Asia by investing in logistical infrastructure to enhance its competitive edge, a strategy that has proven successful for industry leaders like Amazon and MercadoLibre and which likely influenced Coleman’s decision to reinvest in Sea Limited.

Sea Limited in Figures

The positive shift in Sea Limited’s fortunes is evident in its financial performance. The company reported a robust revenue of $3.7 billion in the first quarter of 2024, showing a 27% increase from the same period last year. Key segments like Shopee and SeaMoney experienced impressive revenue growth, with Shopee soaring by 33% and SeaMoney by 21%. Furthermore, Garena managed to curtail its revenue decline to 15%, a notable improvement compared to the sharp drop in revenue the division experienced in 2023.

Despite a 34% surge in the cost of revenue leading to a net loss attributable to shareholders of $24 million, Sea Limited remains optimistic about sustaining double-digit revenue growth throughout 2024. Additionally, the potential relaunch of “Free Fire” in India could further bolster Garena’s prospects, signaling a positive outlook for the company.

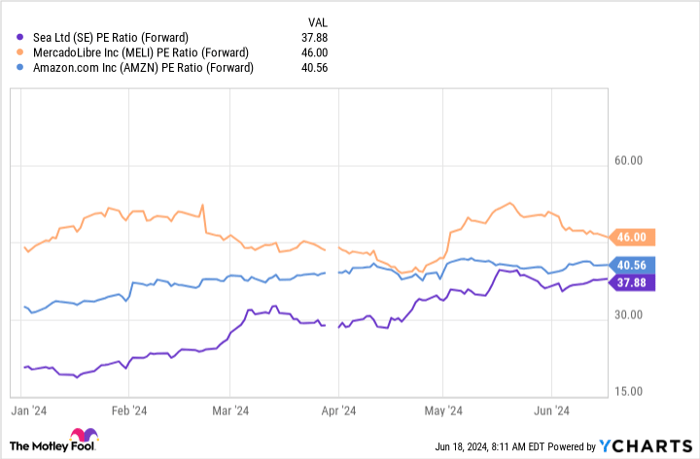

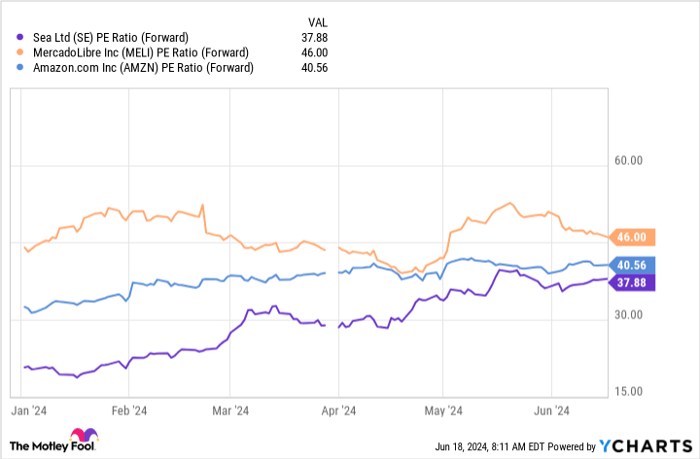

Sea Limited’s stock has surged by 85% since the start of 2024, with a forward P/E ratio lower than that of Amazon and MercadoLibre, indicating a favorable valuation and growth potential. These improvements likely contributed to Coleman’s renewed interest and confidence in the company.

SE PE Ratio (Forward) data by YCharts

Assessing Tiger Management’s Strategy

Both internal operational improvements and external market trends indicate Sea Limited’s potential to emerge as a dominant player in the e-commerce space on a global scale. Despite concerns surrounding e-commerce focus and decreased gaming revenues, Sea Limited has made strategic shifts to enhance its competitive edge and revitalize its gaming offerings, positioning itself for substantial growth in the Southeast Asian market and beyond.

Tiger Management’s decision to increase its stake in Sea Limited following these developments underscores the confidence in the company’s trajectory. Given the current valuation of Sea Limited’s stock, there may still be ample opportunity for investors to follow Coleman’s lead and capitalize on the company’s growth potential.

Exploring Investment Opportunities

For investors contemplating an investment in Sea Limited, it is essential to weigh the potential risks and rewards carefully. While Sea Limited did not make it to the recent list of the ten best stocks identified by the Motley Fool Stock Advisor team, the company’s resilience and growth prospects make it a compelling candidate for long-term investment strategies.

Considering the remarkable returns companies like Nvidia have generated over time, identifying promising opportunities like Sea Limited early on can lead to significant wealth creation in the future. The guidance and insights provided by the Motley Fool Stock Advisor service can offer investors a roadmap to navigate the complexities of the market and identify lucrative investment avenues that align with their financial goals.

*Stock Advisor returns as of June 10, 2024