Alibaba (NYSE: BABA) stock has caught the attention of top-tier billionaire investors recently. David Tepper of Appaloosa Management and Michael Burry of Scion Asset Management significantly bolstered their positions in the Chinese e-commerce giant during the first quarter, signaling a positive outlook on the company’s future.

Tepper, with an estimated net worth of $20 billion, solidified Alibaba as his largest holding after more than doubling his stake in Q1. Meanwhile, Burry raised his investment in Alibaba to 125,000 shares, making it his second-largest holding behind JD.com.

The Resurgence of a Bargain Bet

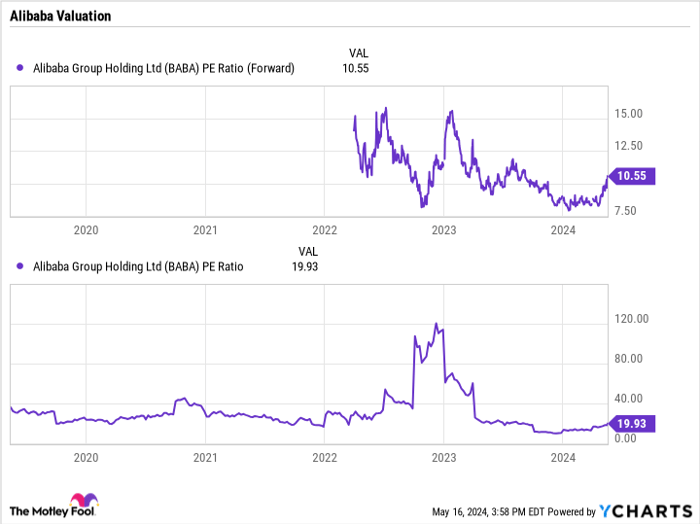

Alibaba’s stock, despite a 12% rise year-to-date, has weathered a tumultuous few years marked by a decline of over 50% in the past five years and a steep 70% drop from its late 2020 peak. However, the company’s revenue has continued to rise despite the stock’s downward trend, leading to an enticing forward P/E ratio of only 10.5, indicating significant undervaluation.

Moreover, Alibaba boasts a substantial cash reserve of $85.5 billion, representing a treasure trove of opportunities. With a sound financial position and a low valuation, Alibaba’s management has initiated sizeable stock buybacks, repurchasing $4.8 billion in Q1 and authorizing a fresh $25 billion repurchase program earlier this year.

The company’s strategic reinvestment efforts are evident in its Q1 performance, with a focus on business unit autonomy leading to early signs of revival in key segments like e-commerce, cloud computing, and international retail and logistics.

A Wager on China’s Economic Rejuvenation

Tepper and Burry’s increasing stakes in Alibaba reflect a broader bet on China’s economic rebound. As the Chinese government rolls out stimulus measures such as issuing 1 trillion yuan in bonds for modernization initiatives and easing mortgage restrictions to bolster the housing market, investor confidence in Alibaba’s future outlook is reinforced.

Enhanced economic conditions in China, coupled with Alibaba’s dominant presence in the e-commerce landscape with platforms like Tmall and Taobao, position the company for growth once consumer sentiment improves.

Image source: Getty Images

Timing Your Entrance into Alibaba Stock

Alibaba presents an attractive investment opportunity with its undervaluation and robust cash holdings. While the company’s growth rate has moderated, ongoing investments in future expansion make it a compelling addition to retail investors’ portfolios.

However, the inherent risks associated with a Chinese company subject to governmental influence suggest cautious optimism rather than aggressive buying. Despite this caveat, Alibaba stands out as a stock with considerable potential.