In the dynamic world of Wall Street, where fortunes rise and collapse like a game of Jenga, some individuals possess an almost mythical allure – the billionaires. These titans of finance, with their colossal portfolios, are under constant scrutiny as they navigate the intricate web of the stock market. Beholden to transparency regulations, these billionaire moguls must share their quarterly 13F filings, providing a peephole for us common folk into their financial machinations.

While it’s prudent to make investment decisions based on personal circumstances, there’s a certain intrigue when these financial behemoths start amassing a particular stock. The recent 13F filings unveiled a consistent pattern – billionaires flocking to a stock that has already ushered in financial prosperity for many investors. Even amidst their complex strategies, the uber-rich often opt for simplicity.

So, what’s the hot stock that has captured the attention of Wall Street’s elite, and why does it continue to hold significant promise for both billionaires and average investors alike?

The Amazon Frenzy Among Billionaires

The tech juggernaut, Amazon (NASDAQ: AMZN), may not be the flashy, new kid on the block in the stock market arena. However, it hasn’t deterred billionaires from acquiring shares. Per the 13F filings, several high-profile investors made significant purchases of Amazon shares in the quarter ending June 30, 2024:

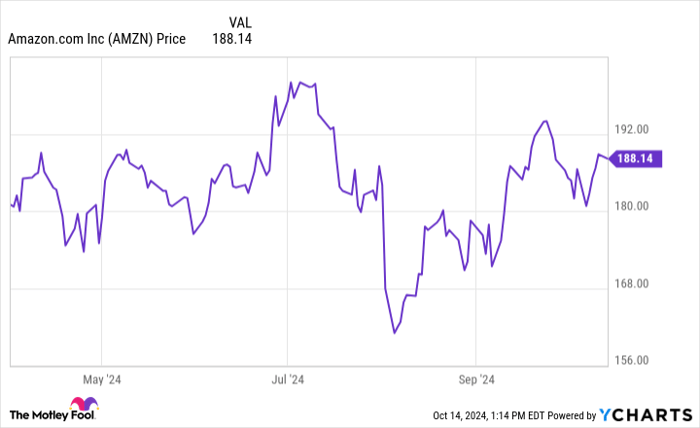

As we dissect these filings, it’s essential to acknowledge that they reflect past activities, potentially outdated. Amazon’s stock witnessed fluctuations in recent months, leaving uncertainties about the billionaires’ current positions – bought, sold, or held. Yet, the consistency in Amazon’s valuation since April beckons contemplation on the underlying allure that captivated these financial giants towards the e-commerce titan.

Unwavering Growth Trajectory for Amazon

Amazon, a household name in global commerce, might not set pulses racing due to its familiarity. However, its track record speaks volumes. Through sustained growth in e-commerce and cloud computing services, Amazon has facilitated the transformation of modest investments into substantial wealth over the years.

At present, Amazon stands as a dominant force in both its core sectors. With an estimated 40% market share in U.S. e-commerce and a 31% slice of the worldwide cloud services market, Amazon competes with tech giants like Microsoft and Alphabet. The steadfast expansion trends in e-commerce and cloud migration, further propelled by the advancement of artificial intelligence, signal ample growth opportunities on the horizon. Industry projections foresee the cloud computing market ballooning to $2 trillion by 2030, excluding burgeoning segments like Amazon’s advertising arm, set to generate around $50 billion in revenue this year.

A Golden Opportunity with Amazon’s Valuation

Valuing a stock entails various methodologies, but for Amazon’s reinvestment-heavy approach, focusing on its operational cash flow appears insightful. Currently, Amazon’s price-to-operating-cash-flow ratio hovers around a decade-low mark of 18.5. This suggests an opportune moment, comparably favorable over the past ten years, to consider Amazon shares. A profound history of astute capital re-investment, with an average return on invested capital of 10.9% over the last decade, underscores Amazon’s robust fundamentals.

In essence, Amazon epitomizes an exceptional business proposition at a compelling valuation snapshot. The convergence of robust business fundamentals and attractive pricing renders Amazon a tantalizing prospect for investors, irrespective of their financial stature.

Seize the Moment with Amazon’s Potential Upswing

For those plagued with hindsight regret on missing out on lucrative stock investments, a second chance emerges. Our expert analysts, in rare instances, release “Double Down” stock recommendations, predicting imminent surges in certain companies. This opportune juncture beckons aspiring investors to seize the moment before it slips away. Consider the staggering returns from past “Double Down” recommendations:

- Amazon: A $1,000 investment in 2010 yielded $21,139!

- Apple: A $1,000 investment in 2008 grew to $44,239!

- Netflix: A $1,000 investment in 2004 surged to $380,729!

The current flurry of “Double Down” alerts for three exceptional companies heralds an exceptional financial prospect you wouldn’t want to miss. Seize this unique opportunity before it evaporates into the ethers of the stock market universe.

*Stock Advisor returns as of October 14, 2024