Financial giants have made a conspicuous bullish move on Blackstone. Our analysis of options history for Blackstone BX revealed 35 unusual trades.

Delving into the details, we found 57% of traders were bullish, while 34% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $348,049, and 27 were calls, valued at $1,349,735.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $130.0 to $230.0 for Blackstone over the last 3 months.

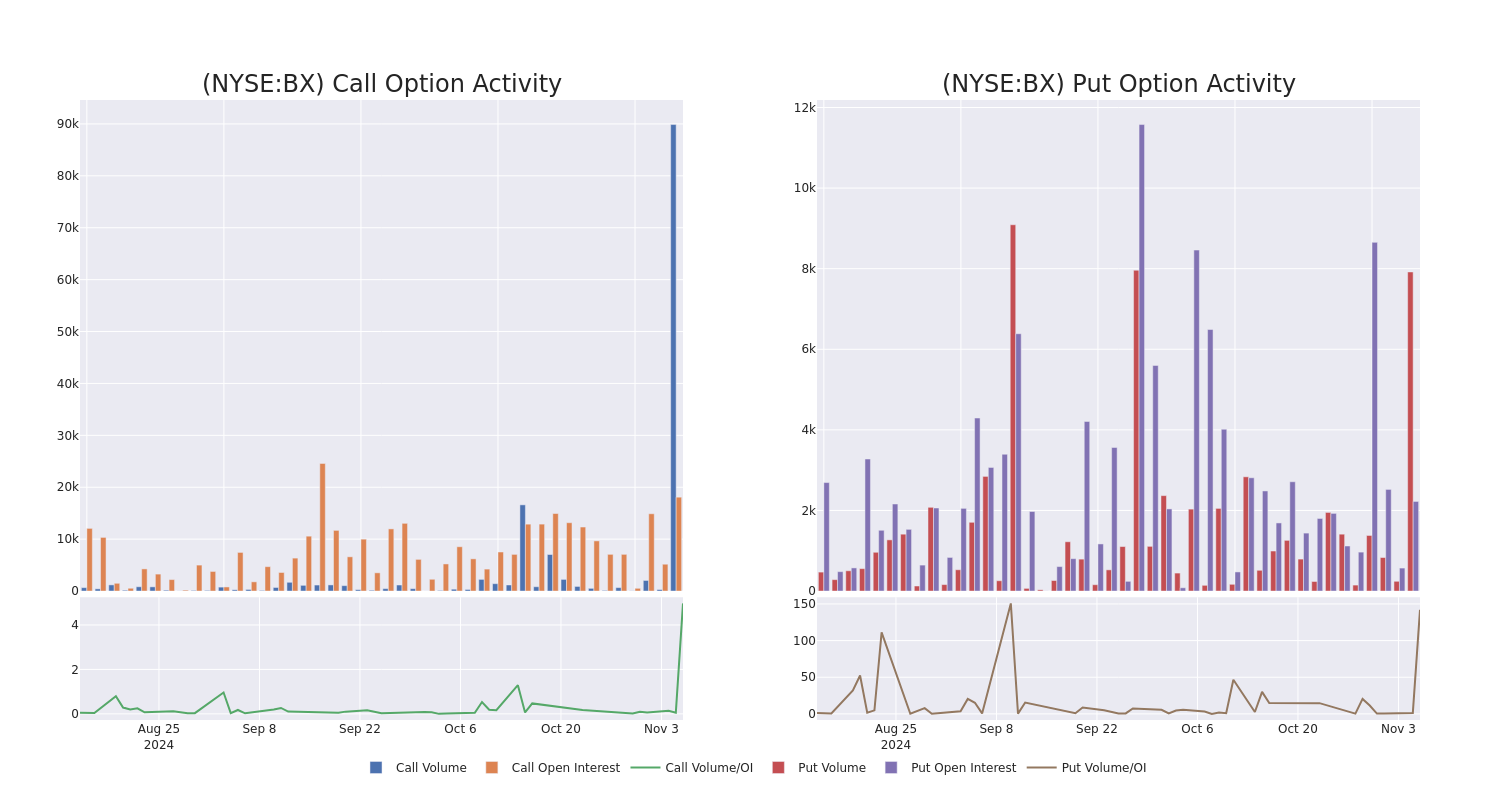

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Blackstone’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Blackstone’s whale trades within a strike price range from $130.0 to $230.0 in the last 30 days.

Blackstone 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BX | PUT | SWEEP | BULLISH | 01/17/25 | $4.9 | $4.65 | $4.65 | $175.00 | $93.0K | 308 | 225 |

| BX | CALL | SWEEP | BEARISH | 01/17/25 | $6.3 | $6.1 | $6.1 | $190.00 | $91.5K | 1.1K | 219 |

| BX | CALL | SWEEP | BULLISH | 05/16/25 | $2.74 | $2.01 | $2.74 | $230.00 | $87.4K | 10 | 319 |

| BX | CALL | TRADE | NEUTRAL | 01/17/25 | $54.8 | $53.7 | $54.25 | $130.00 | $86.8K | 3.3K | 34 |

| BX | CALL | TRADE | BULLISH | 07/18/25 | $57.8 | $55.95 | $57.23 | $130.00 | $85.8K | 26 | 25 |

About Blackstone

Blackstone is the world’s largest alternative-asset manager with $1.076 trillion in total asset under management, including $808.7 billion in fee-earning assets under management, at the end of June 2024. The company has four core business segments: private equity (25% of fee-earning AUM and 28% of base management fees), real estate (37% and 42%), credit and insurance (29% and 23%), and multi-asset investing (9% and 7%). While the firm primarily serves institutional investors (87% of AUM), it also caters to clients in the high-net-worth channel (13%). Blackstone operates through 25 offices in the Americas (8), Europe and the Middle East (9), and the Asia-Pacific region (8).

Where Is Blackstone Standing Right Now?

- With a trading volume of 1,286,347, the price of BX is up by 2.97%, reaching $182.74.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 73 days from now.

What The Experts Say On Blackstone

In the last month, 5 experts released ratings on this stock with an average target price of $169.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from UBS persists with their Neutral rating on Blackstone, maintaining a target price of $160.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Blackstone with a target price of $155.

* An analyst from B of A Securities persists with their Buy rating on Blackstone, maintaining a target price of $192.

* An analyst from Goldman Sachs has decided to maintain their Neutral rating on Blackstone, which currently sits at a price target of $150.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Blackstone, targeting a price of $188.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Blackstone options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs