Ride-hailing juggernaut Uber could be riding the wave of the future as the autonomous vehicle landscape expands. Analysts anticipate a bright future for Uber as the autonomous vehicle (AV) industry burgeons. The company is poised to carve out a significant niche given its sprawling network and recent collaborations with AV giants like Waymo, Cruise, and WeRide. Bank of America is among those who see Uber reaping benefits amidst the fierce AV competition, where firms are scrambling to outpace each other in technological advancements, potentially leveraging Uber’s extensive platform.

Uber’s strategic partnerships with Waymo, Cruise, and WeRide underscore its sturdy position in the market and highlight the cutthroat nature of the industry, hinting at the heightened value of Uber’s network.

A massive opportunity beckons for Uber within the expansive AV market, where multiple victors can emerge. Analysts believe Uber’s collaborative approach with various AV players will set it on a path of competitiveness against Tesla in terms of both affordability and capability. The revelations from the Tesla event may suggest that full autonomy is still a distant dream, favoring a hybrid model in the immediate future.

The Lure of the Autonomous Ridesharing Market for Pioneers

Forecasts from Global Market Insights paint a rosy picture for the autonomous ridesharing sector, projecting a staggering 64% compound annual growth rate from 2023 to 2032, culminating in a market worth $66 billion. With the formidable technological hurdles and substantial capital required to navigate the AV landscape, this industry boasts lofty barriers to entry. Thus, early entrants like Tesla and Uber stand poised to gain substantial advantages once they establish a firm foothold, paving the way for sustained profitability over the long haul.

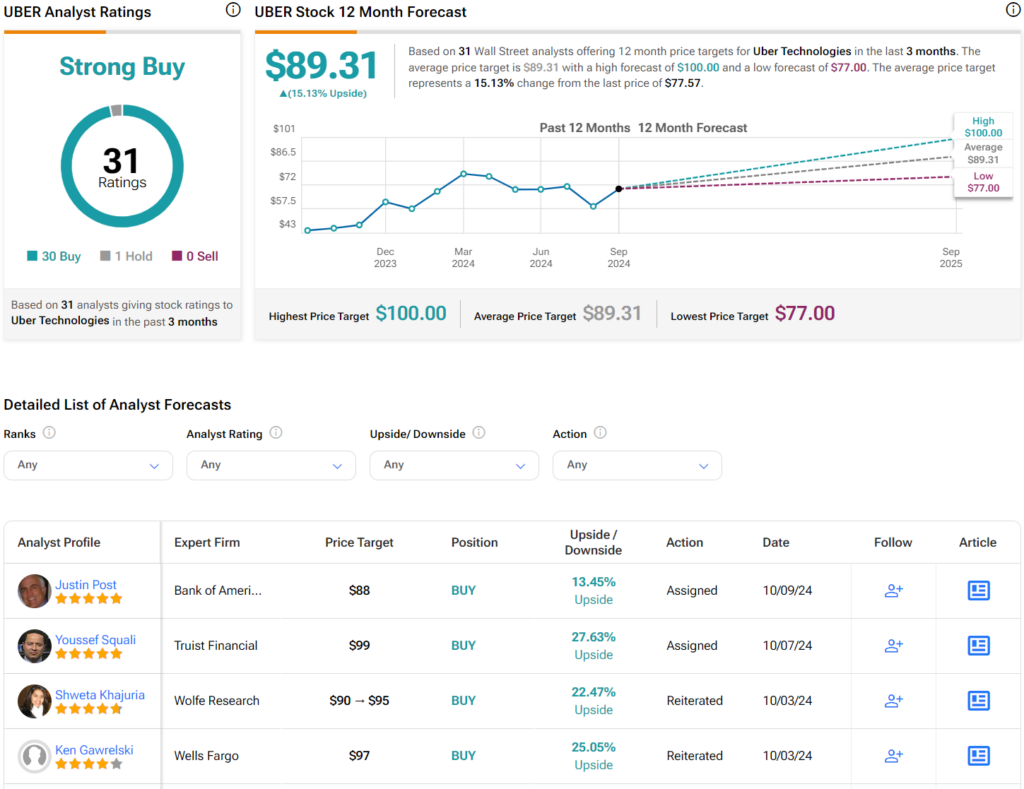

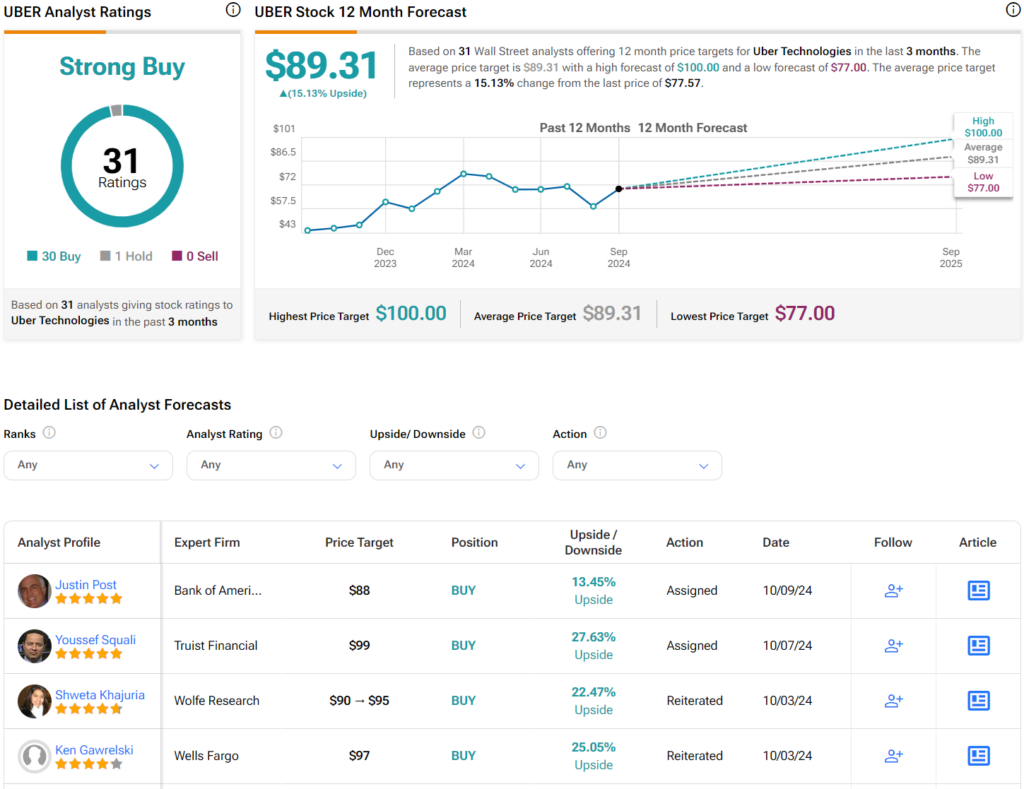

Should Investors Buy or Sell UBER Shares Now?

Shifting gears to Wall Street, market analysts pitch a solid case for Uber shares, with a Strong Buy consensus rating. This accolade stems from a tally of 30 Buy recommendations, one Hold rating, and zero Sells in the past quarter, illustrating a positive sentiment towards UBER stock. Following a remarkable 66% surge in its share price over the preceding year, the average UBER price target of $89.31 per share hints at a further 15.13% upside potential.