We are off to a positive enough start in the Q4 earnings season, albeit muddled by the seemingly ‘noisy’ big bank results. The big banks’ performances, while not particularly stellar, are not lackluster either. Most struggled to surpass consensus revenue estimates, casting a shadow over an otherwise cautiously optimistic start.

Bank Performance Analysis

Bank of America battled a -17.3% decline in Q4 earnings from the previous year amid a -10.5% drop in revenues. Despite this, the bank’s Q4 earnings surpassed estimates, debunking any surprise in the year-over-year dip, primarily due to the FDIC fee. Significantly, the four major banks together shelled out $9 billion in FDIC fees – a considerable impediment to financial growth.

However, amidst this challenging landscape, Bank of America continued to exhibit robust net interest earnings in the quarter, slightly trailing the year-earlier period. This parallels the performance of JPMorgan, Wells Fargo, and even Citigroup, with the latter adopting a comprehensive strategy in its Q4 earnings release.

Looking ahead to 2024, JPMorgan anticipates flat net interest earnings, Wells Fargo forecasts a high single-digit decline, and Citi foresees a ‘modest’ drop – all in sync with the anticipated rate decline and macro-driven slowdown in credit demand.

Financial Sector Earnings Overview

On the broader financial front, 22.8% of the S&P 500 index’s total market capitalization has reported Q4 results for the financial sector. Notably, total earnings have risen by +6.3%, accompanied by a +2.3% uptick in revenues. Impressively, all banks beat EPS estimates (100%), but only 50% managed to exceed revenue estimates, aligning with the prevalent trend across sectors.

Examination of Earnings and Revenue Trends

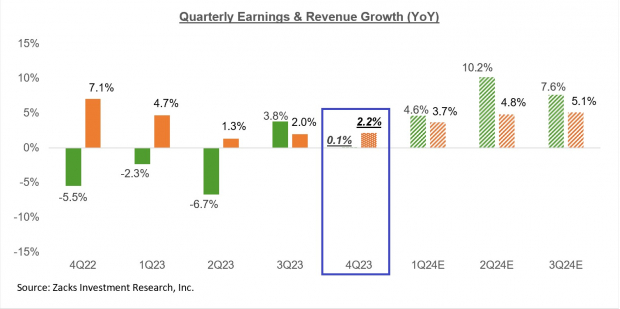

Delving into the depicted chart, 2022 Q4 earnings are projected to rise by +0.1% with a +2.2% surge in revenues. This comes on the heels of a +3.8% earnings growth in the preceding quarter (2023 Q3) and a sequence of three consecutive quarters of dwindling earnings. Contrarily, the chart indicates a promising upward trajectory in revenue growth over this period.

Extending the scope to an annual basis, the chart illustrates the absence of an impending earnings recession over the next two years, contradicting the narrative propagated by earnings recession proponents for more than a year.

Revisions and Sectoral Updates

During the formidable period commencing April 2022, estimates saw substantial negative revisions, plummeting by about -15% from peak to trough and exerting acute pressure on numerous sectors, including Construction, Consumer Discretionary, Technology, and Retail. Interestingly, from April 2023 to October 2023, estimates rallied across major sectors like Technology, signaling a stabilizing trend.

Ominously, the current outlook signifies yet another easing in estimates. However, the Tech sector has witnessed a pronounced turnaround, significantly influencing the aggregate earnings landscape.

Upcoming Reports and Comparative Analysis

The existing Q4 results from 29 S&P 500 members have unveiled a +7.6% surge in total earnings from the corresponding period last year, accompanied by +6% higher revenues. Notably, 93.1% managed to outperform EPS estimates, yet only 55.2% surpassed revenue estimates. With approximately 50 companies scheduled to release results during this week, the limelight will notably fall on the major regional banks and brokerage firms such as Goldman Sachs and Morgan Stanley.

Albeit restricted, historical comparison charts duly place the Q4 earnings and revenue growth rates into perspective.

The Electric Jolt: The Booming Lithium Battery Market

In the midst of a technological revolution, the electric vehicle industry is propelling its investors to dazzling heights. The breathtaking rise is fueled, quite literally, by millions of lithium batteries that are being churned out every day. The demand for these power cells is predicted to surge by an eye-popping 889%. While the earnings and revenue growth rates for a consortium of 29 index members are neatly aligning with prior periods, companies are now amply surpassing EPS estimates but struggling to outpace revenue projections.

The Golden Era of Electric Vehicles

As the world races toward a cleaner, greener future, the automobile industry’s transformation is akin to a reverberating thunderstorm, electrifying the entire landscape. The quest to reduce carbon emissions and embrace sustainability has ushered in a new dawn, one that spotlights the promising lithium battery market.

Mining for Opportunity

Just as the gold rush captivated America in the 1800s, the surge of lithium batteries has the potential to make millionaires out of savvy investors. The exponential demand for lithium batteries mirrors the frenzy surrounding this precious metal during its most tumultuous era. The current fervor surrounding electric vehicles holds the same promise of newfound wealth and fortune for those who can discern the golden opportunity amidst the chaos.

The potential for astronomical gains in the lithium battery market beckons astute investors who dare to venture into the ever-promising electric vehicle sector.