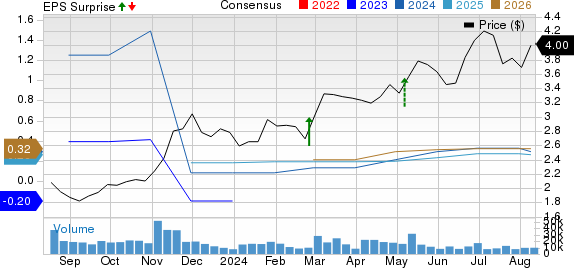

BRF S.A. BRFS is gearing up to showcase impressive bottom-line growth during its second-quarter 2024 earnings announcement on August 14. Analysts estimate quarterly earnings to hit 7 cents per share, marking a significant improvement from the 10-cent loss in the same quarter last year.

While a positive trajectory is expected in earnings, the company might face a slight dip in its top-line performance. Analysts predict a 2.6% decline in quarterly revenues, with estimates pegged at $2.6 billion. Despite this, BRF, a global food industry giant, managed to surprise investors in the previous quarter with a 50% earnings beat.

Key Factors to Bear in Mind

BRF continues to ride the waves of the successful BRF+ program, which prioritizes enhanced commercial strategies, cost effectiveness, and operational excellence. The company’s dedication to innovative, high-value products sustains competitive pricing and fortifies market resilience. Stable feed costs in the short run will aid the company in efficient cost control and improved profitability. These factors are anticipated to steer BRF’s performance in the imminent quarter.

Insights from Zacks Model

Based on our rigorous analysis, we aren’t favoring an earnings beat projection for BRF this time around. The typically reliable combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) isn’t aligning in support of this potential outcome.

Currently holding a Zacks Rank #3 and an Earnings ESP of 0.00%, BRF appears to be lacking the necessary oomph for an earnings surprise this quarter.

Favorable Stock Options

Among the array of stocks under scrutiny, Ollie’s Bargain shows promise with an Earnings ESP of +2.38% and a Zacks Rank of 3. Projections indicate a bottom-line upswing in its upcoming quarterly reports. The expected earnings of 78 cents per share signify an impressive 16.4% spike from the prior year.

Costco Wholesale Corporation, with an Earnings ESP of +0.67% and a Zacks Rank of 3, is poised for growth in both revenue and earnings in its next quarterly release. Forecasts project a 1.4% revenue increase to $80.1 billion, with earnings at $5.02 per share reflecting a 3.3% uptick from the prior year.

Coty COTY is another contender to watch out for, boasting an Earnings ESP of +22.73% and a Zacks Rank of 3. Forecasts foresee a remarkable 400% surge in quarterly earnings to 5 cents per share, alongside a revenue rise of 1.8% to $1.38 billion. Despite a history of negative earnings surprises, Coty seems poised for redemption this quarter.