Broadcom Inc (AVGO), the semiconductor maker, recently unveiled its robust financial results for fiscal Q3, showcasing stellar revenue figures and impressive free cash flow performance. This financial prowess has led to widespread speculation that AVGO stock may be considerably undervalued in the current market landscape.

Despite trading at $137.00 as of the recent market close, which reflects a decline of over 10% post-results, the stock remains above its six-month low of $120.45. Should this downward trajectory persist, AVGO could potentially revisit that low point.

However, the company’s exceptional free cash flow (FCF) results, along with healthy FCF margins in the latest fiscal quarter, suggest that AVGO stock is trading at a discount. Based on careful analysis, projections indicate that the stock could be valued significantly higher, with estimates ranging up to $191.80 per share, marking a potential increase of 40%, and a conservative minimum target of $165.22 per share.

Impressive Free Cash Flow (FCF) Achievements

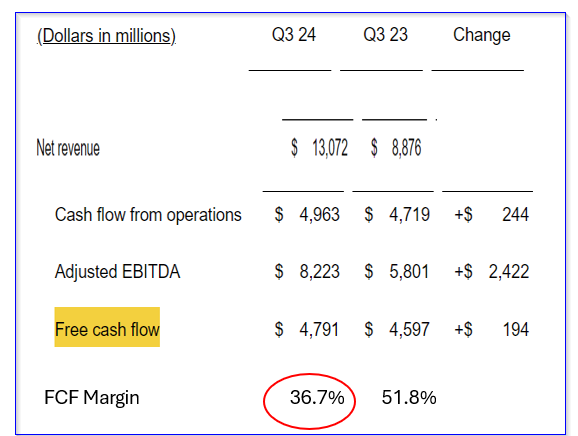

During the quarter ended on Aug. 4, Broadcom’s revenue soared to $13.07 billion, surpassing analyst predictions by approximately $108 million. The company reported a record FCF of $4.791 billion, representing a notable increase from the previous year’s Q3 FCF of $4.597 billion, a growth rate of +4.2%.

Additionally, Broadcom’s FCF margin stood strong at 36.65%, exceeding the FCF margin recorded in the prior quarter. Although slightly lower than the FCF margin from the previous year, the current figure remains impressive and sustainable, hinting at the potential for future growth and value appreciation.

Management’s optimistic revenue guidance for the fiscal year, along with analyst forecasts of increased revenue in the upcoming year, further bolster the narrative, signaling a potential FCF estimate of $22.3 billion in fiscal 2025.

Target Price Projection

Using an FCF yield metric, Broadcom’s FCF performance in the past year translates to a 2.92% FCF yield based on its market capitalization. As FCF continues to strengthen, this yield could rise to 2.50%, resulting in a projected market value of $892 billion in 2025.

This valuation suggests that AVGO stock could be undervalued by 40% in the current market scenario, with a potential target price of $191.80 per share. Even under a conservative 2.90% FCF yield assumption, the forecasted market capitalization of $769 billion indicates a minimum price target of $165.22 per share.

Analyst Perspectives on AVGO Stock

Market analysts echo the sentiment that AVGO stock is trading at a bargain. Various average price targets indicate significant upside potential, with projections ranging from $170.65 to $194.48. Recent adjustments to price targets by leading analysts further reinforce the notion of undervaluation.

Distinguished analysts have raised their price targets following the earnings release, underlining the growth potential of AVGO stock. Analysts such as Joseph Moore and Toshiya Hari, known for their accurate projections, have revised their targets upwards, aligning with the overall sentiment of undervaluation in the market.

In conclusion, Broadcom’s stock demonstrates substantial upside potential driven by its robust financial performance, strategic guidance, and analyst consensus on its undervaluation.

For more insightful Stock Market News analysis, stay tuned to relevant sources.