Importance of broker recommendations in stock trading is akin to a compass guiding a ship through turbulent waters. But are these suggestions truly a beacon of light, or just a flickering flame in the wind?

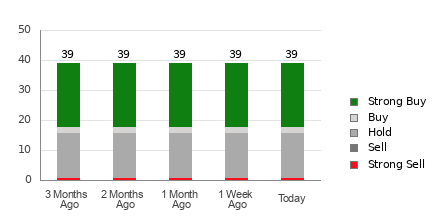

Netflix, the revered entertainment giant, sits at the forefront of many investors’ minds. With a notable average brokerage recommendation (ABR) of 1.91, it resides in a realm between Strong Buy and Buy, as synopsized from the insights of 39 brokerage firms.

Examining the landscape of Netflix recommendations further unveils an intriguing narrative. Among the fortuitous 39 evaluations, 21 herald a Strong Buy status while a measly two sing the tune of Buy. The swaying tides of commerce seem to favor Netflix in full sail. Anchors aweigh!

Unraveling the Trends of Brokerage Recommendations for NFLX

Analyzing visual data is like peering through a kaleidoscope of financial conjecture. Yet, heed not these images alone, for a deeper dive is imperative before pledging your allegiance to the Netflix creed.

Brokers tend to tilt the scales in favor of optimism, a bias that often paints the market in hues brighter than reality allows. For every echo of “Strong Sell,” five cries of “Strong Buy” reverberate, reflecting a paradigm where self-interest mingles with financial curation.

Amidst this labyrinth of brokerage dictums, a shining star emerged – the Zacks Rank, an audit-vetted guardian of investor interests. By amalgamating the wisdom of the masses with the foresight of algorithms, Zacks offers a lifeline to those adrift in the sea of market speculations.

Educating the Masses: Zacks Rank vs. ABR

Within the stratum of financial acronyms lies a tale of two indices – the ABR and the Zacks Rank. While both share a numeric guise, their souls couldn’t be more divergent.

Brokerage affirmations dance in decimal realms, assessing stocks in fragmented hues. Yet, the Zacks Rank shuns half-measures, quantifying riches with whole numbers, featuring the symphony of earnings revisions as its opus.

As winds of change sweep through the earnings landscape, analysts’ projections undulate like a field of wheat in the breeze. Herein, the Zacks Rank stands immutable, a bedrock of stability in a tempest-tossed sea of financial conjecture.

Is NFLX a Gem in the Rough?

Perched on the precipice of financial fortune, Netflix’s earnings contemplate a valley of numinous possibilities. With a steadfast Zacks Consensus Estimate at $19.08, analysts murmur of a future bathed in the golden hues of prosperity.

Marked by a Zacks Rank #3 (Hold), Netflix stands as a stalwart vessel amidst the choppy waters of market volatility. Before casting your lot with Netflix, remember – the storm clouds of uncertainty often herald the brightest of dawns.

Handpicked Stocks: A Treasure Trove for Investors

Unveiled to the discerning eye stands a pantheon of 7 elite stocks, handpicked from the celestial list of Zacks Rank #1 Strong Buys. Whispered to be “Most Likely for Early Price Pops,” these stocks gleam like gems in a murky mine.

Since antiquity, the stars have aligned in favor of these chosen few, outshining the market with a brilliance that echoes through the ages. Attend to them with great care, for within their depths lie the essence of financial alchemy.

May your sails be ever billowed with the winds of prosperity, and your pockets brim with the treasures of discerning investment. Navigate the ever-changing currents of commerce with wisdom, for in the realm of stocks, the tides wait for no one.