As investors consistently turn to Wall Street analysts’ insights for guidance on their stock selections, the question arises – do these brokerage recommendations truly hold weight in garnering profitable investments?

Before delving into the credibility of brokerage suggestions and how investors can leverage them effectively, let’s explore the sentiments of major players on PepsiCo (PEP).

The Brokerage Verdict on PEP

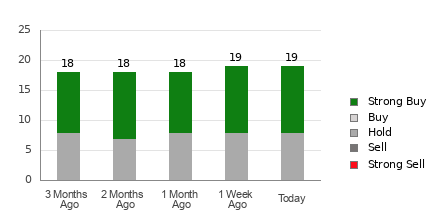

PepsiCo currently stands at an Average Brokerage Recommendation (ABR) of 1.84, a rating derived from assessments made by 19 brokerage firms. With an ABR between Strong Buy and Buy, the consensus visualization showcases 11 Strong Buy recommendations out of the 19 total, marking a substantial 57.9% endorsement.

Decoding the Brokerage Trend for PEP

The ABR hints towards a bullish stance on PepsiCo, yet making investment decisions solely based on this metric might prove imprudent. Studies reveal that brokerage recommendations fall short in steering investors towards stocks with genuine growth potential.

The analysts at these firms, driven by vested interests, often exhibit a skewed positive inclination towards the stock they cover, leading to an inequitable ratio of “Strong Buy” to “Strong Sell” recommendations.

The Power of Zacks Rank Unveiled

Contrary to ABR, the Zacks Rank offers a more reliable outlook, categorizing stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) based on earnings estimate revisions. This model, grounded in quantifiable data, significantly impacts near-term price performances of stocks.

Recognizing the fundamental contrast, while the ABR predominantly examines brokerage recommendations, the Zacks Rank shines a spotlight on earnings estimate revisions, reflecting a stronger predictive accuracy for stock movements.

PEP – A Lucrative Investment?

The Zacks Consensus Estimate for PepsiCo reveals a positive trajectory, with a 0.1% escalation to $8.16 for the current year. Analysts exhibit a growing optimism towards the company’s earning potential, elevating the stock to a Zacks Rank #2 (Buy), supported by a robust consensus estimate and favourable earning trends.

Therefore, the ABR equivalent endorsing PepsiCo may offer invaluable insights to investors seeking a foothold in the market.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which surged over +800% post-recommendation. This new top chip player, with burgeoning earnings and an expanding clientele, stands poised to cater to the surging demands for Artificial Intelligence, Machine Learning, and Internet of Things. The global semiconductor industry is slated for an explosive journey from $452 billion in 2021 to $803 billion by 2028.