Investors frequently heed the advice of Wall Street analysts in making critical investment decisions. The evaluation of a stock’s rating by brokerage firms can significantly influence its market trajectory. The question remains – how reliable are these recommendations?

Before delving into the reliability of brokerage recommendations and how to leverage them, let’s analyze the sentiments of Wall Street experts regarding Progressive (PGR).

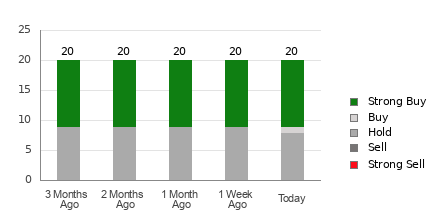

As of now, Progressive holds an average brokerage recommendation (ABR) of 1.85, falling between Strong Buy and Buy on a scale from 1 to 5. This rating is an aggregated assessment from 20 different brokerage firms, with 55% of recommendations classed as Strong Buy and 5% as Buy.

Diving Deeper into Brokerage Recommendations for PGR

While these ratings advocate for purchasing Progressive, it’s imprudent to base investment decisions solely on this information. Numerous studies demonstrate the limited success rate of brokerage recommendations in identifying stocks with substantial price appreciation potential.

Why the skepticism, you ask? Analysts at brokerage firms often exhibit a positive bias towards stocks they cover due to vested interests, resulting in a disproportionate number of favorable recommendations. For each “Strong Sell” suggestion, there are typically five “Strong Buy” endorsements, revealing a misalignment of interests between institutions and individual investors.

To mitigate this bias, prudent investors should corroborate brokerage recommendations with reliable tools such as the Zacks Rank, a reputable stock rating mechanism with a strong track record of forecasting near-term price movements.

Comparing ABR with Zacks Rank

While both ABR and Zacks Rank are represented on a 1-5 scale, they serve distinct purposes. ABR relies solely on brokerage suggestions, often denoted with decimals, while Zacks Rank employs a quantitative model based on earnings estimate revisions, presented as whole numbers from 1 to 5.

Brokerage analysts tend to be overly optimistic in their recommendations due to institutional interests, potentially misleading investors. Conversely, the Zacks Rank relies on earnings estimates, showing a tangible correlation between estimate trends and stock price movements.

The Zacks Rank maintains a balanced distribution of ranks across all stocks with current-year earnings estimates provided by brokerage analysts, ensuring fairness in evaluations. Moreover, the Zacks Rank excels in timeliness, swiftly reflecting earnings estimate revisions and effectively predicting future stock prices.

Is Progressive (PGR) a Viable Investment?

Progressive has witnessed a 4.6% surge in the Zacks Consensus Estimate for the current year, now standing at $11.85. With analysts displaying growing optimism towards the company’s earnings potential through upward EPS revisions, the stock might experience a notable upswing in the near future.

Based on the recent consensus estimate change and other related factors, Progressive currently holds a Zacks Rank #2 (Buy). This positive outlook stems from analysts’ collective confidence in the company’s future performance.

Therefore, the Buy-equivalent ABR for Progressive may guide investors effectively in their decision-making process.

Zacks Investment Research