Investors often lean on analyst recommendations when making decisions about stocks. The updates from brokerage-firm-associated analysts, also known as sell-side analysts, have a considerable impact on stock prices. But do these recommendations hold true? Let’s delve into the world of brokerage opinions and see how they relate to Vistra Corp. (VST).

The Brokerage Landscape on Vistra

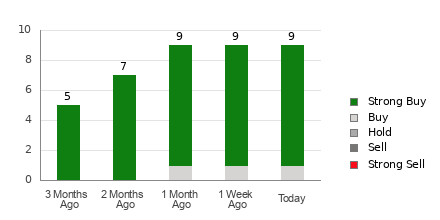

Vistra currently boasts an average brokerage recommendation (ABR) of 1.11, exemplifying a rating between Strong Buy and Buy on a scale ranging from 1 to 5. This calculation aligns with the actual recommendations (Buy, Hold, Sell) offered by nine brokerage firms. Of these nine, eight suggest a Strong Buy, while one advises a Buy. These recommendations are respectively divided into 88.9% and 11.1% of all suggestions.

Brokerage Recommendations Analysis

While the ABR signals a positive stance on Vistra, basing investment decisions solely on this metric might not be prudent. Studies have demonstrated the limited success of brokerage recommendations in guiding investors towards stocks with significant price appreciation potential.

Why is this so? Brokerage firms, driven by vested interests in the stocks they cover, tend to lean towards positive ratings. Research shows an alarming ratio of five “Strong Buy” recommendations for every “Strong Sell” recommendation. This bias can mislead retail investors, rather than providing a clear direction on a stock’s trajectory.

Validation through Zacks Rank

The Zacks Rank, a proprietary stock rating tool with a robust audited track record, categorizes stocks across five classifications, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool gauges a stock’s price performance outlook in the near term. Therefore, cross-referencing the ABR with the Zacks Rank offers a potentially profitable investment rationale.

Important Note: The ABR and Zacks Rank, despite sharing a 1-5 scale, serve distinct purposes. The ABR derives solely from brokerage recommendations, often in decimal format (e.g., 1.28). Conversely, the Zacks Rank hinges on a quantitative model emphasizing earnings estimate revisions, represented by whole numbers (1 to 5).

Continued below…

Moving from Bias to Data-Driven Predictions

Brokerage analysts, historically known for their optimism in recommendations, may inadvertently mislead investors due to their firms’ vested interests in stocks. In contrast, the Zacks Rank leverages earnings estimate revisions, unveiling a strong correlation between near-term stock prices and these revisions.

Notably, whereas the ABR may lack timeliness, Zacks Rank promptly reflects brokerage analysts’ updated earnings estimates, ensuring a more accurate prediction of future stock values.

Insights into Vistra Corp.

Vistra’s earnings estimate revision portrays an optimistic trend, evidenced by a 1% enhancement in the Zacks Consensus Estimate for the current fiscal year, reaching $4.99. The unanimous analyst sentiment towards higher EPS estimates for Vistra suggests a potential upsurge in the stock’s value ahead.

This significant revision, coupled with other useful factors related to earnings estimates, aligns Vistra with a Zacks Rank #1 (Strong Buy). Investors seeking such opportunities can explore a curated list of Zacks Rank #1 stocks for further insights.

The Infrastructural Revolution Looming

A massive wave of infrastructural revamp in the U.S., a bipartisan priority on the horizon, is set to unleash a flurry of investments. The impending trillions to be dispensed come with an air of inevitability, promising fortunes for savvy investors.

The key query remains – are you positioned early in the right stocks, poised to capitalize on their growth potential? Zacks has unveiled a Special Report to navigate this realm, encompassing five select companies primed to benefit immensely from the forthcoming construction boom.

Don’t miss out – grab your free copy today and crack the code to profiting from this monumental overhaul.

Click here for your FREE guide on tapping into the infrastructure spending surge!