PayPal (PYPL) is a payment platform that acts as a modern-day alchemist, turning the mundane task of transferring money into a seamless digital experience. It dances through the complex world of financial transactions, connecting individuals and businesses with finesse, all while keeping their sensitive financial information under a virtual lock and key.

Venmo’s Rise: A Bullish Catalyst

Venmo, like a captivating melody, has enchanted the younger generation in the U.S. It serves not only as a digital wallet but also as a social hub where users can peek into each other’s digital diaries of spending, sprinkled with emoticons and comments.

Venmo’s stellar performance in the first quarter of 2024, showcasing an 8% surge in Total Payment Volume, is reminiscent of a phoenix rising from the ashes. In a tale of financial fortitude, the platform handled a staggering $250 billion in Total Payment Volume in 2022, marking a 6% year-over-year increase.

Visa and MasterCard Propel PayPal’s Growth

PayPal, like a strategic chess master, has deftly forged alliances with credit card giants Visa and Mastercard. These partnerships have acted as a warp drive, propelling PayPal’s expansion across borders and heralding millions of merchants and consumers into its ecosystem.

Furthermore, the entwining of paths with Google Pay and YouTube, akin to a harmonious symphony, has orchestrated seamless transactions across various platforms. And a pact with Alibaba, a behemoth in the Chinese e-commerce realm, has opened the gates to the vast Asian market.

PayPal’s Value Play

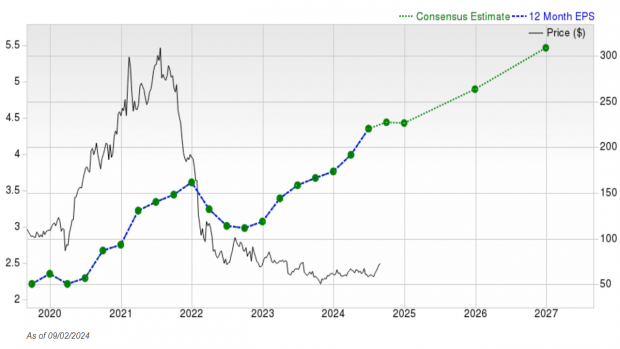

Once a shooting star during the pandemic, PayPal has descended from the dazzling heights of $300 to a more modest under $100. Yet, unlike other ephemeral darlings of the pandemic era, PayPal, akin to a sturdy oak, stands tall with solid fundamentals. Earnings now outstrip the days of yore when the stock commanded $300, with projections pointing steadfastly upwards into the realm of 2027.

Meanwhile, PayPal’s forward Price-to-Sales ratio has dipped to near 5-year lows at a lean 1.98x. In comparison, it loomed at a substantial 13.63x during its peaks. The valuation metrics render PayPal a compelling gem, glittering brighter than its counterparts in the sub-industry, sector, and even the illustrious S&P 500 Index.

PayPal Soars: Breakout Confirmed

With a thunderous clap, PayPal shares shattered the confines of a long consolidation phase at the brink of last month. The technical charts, akin to ancient seers, reveal two auspicious omens:

1) Golden Cross: The swift 50-day moving average has gracefully intersected above the lumbering 200-day moving average – a bullish augury.

2) Support/Resistance Flip: Prior price barriers for PayPal have metamorphosed into pillars of support, fortifying the stock amidst turbulent market conditions.

Conclusion: The flourishing growth of Venmo, sturdy partnerships, and an alluring valuation paint a vibrant tapestry of potential for PayPal shares over the impending 6-12 months.

The Brightest Beacon Shines

Out of a myriad of stars, 5 Zacks experts have each plucked their favorite, foretelling a luminous rise of +100% or more in the months ahead. Director of Research Sheraz Mian has selected a stellar standout, shining brighter than the rest.

This particular company caters to the millennial and Gen Z audience, orchestrating nearly $1 billion in revenue in the past quarter alone. A recent dip makes now a propitious moment to embark on this thrilling journey. While not all shining stars ascend, this one may outshine previous Zacks’ Stars that soared like Nano-X Imaging, ascending a remarkable +129.6% in just over 9 moons.

Free: See Our Top Stock And 4 Runners Up

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report