Shares of Butterfly Network‘s stock soared 26.9% on Sept. 4 following the announcement of the commercial launch of its innovative Butterfly iQ3 device in Europe. Investors have been uplifted by the strong reception of Butterfly iQ3 in the U.S. market since its launch in February.

The EU MDR certified Butterfly iQ3, compliant with the Restriction of Hazardous Substances Directive, is now available across all European countries and the UK after its successful rollout in Canada during the second quarter. The remarkable capabilities of the Butterfly iQ3, powered by the advanced P4.3 chip, promise top-quality imaging, enhanced 3D tools, and a compact, user-friendly design.

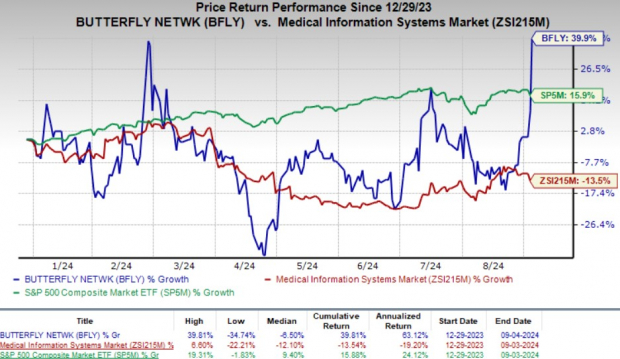

Year-to-date, BFLY’s stock has surged 39.9%, outshining the industry’s 13.5% decline, driven by the rapid adoption of Butterfly iQ3 in the U.S. market, while the S&P 500 Index has gained 15.9% during the same period.

Image Source: Zacks Investment Research

U.S. Success of Butterfly Network’s iQ3

In the second quarter, Butterfly Network witnessed a 16% revenue uptick mainly propelled by the robust adoption of Butterfly iQ3 in the United States and expanding sales post-launch in Canada. Notably, iQ3 dominated online orders, comprising 74% of the total during the quarter and a striking 89% share across all sales channels in Canada. The company’s strategic device upgrade initiative, facilitating the conversion of older probes into new iQ3 units, opened up fresh growth avenues, with over a thousand probes upgraded during the quarter.

During the same quarter, iQ3 sales represented half of total unit sales, with a significant 75% of units sold in the United States.

Enhancing Patient Care with Butterfly Network’s iQ3

Butterfly iQ3’s groundbreaking features such as iQ Slice and iQ Fan streamline image capture processes. iQ Slice allows for capturing up to 46 ultrasound slices simultaneously across a wide angle, simplifying image acquisition without intricate handling. Conversely, iQ Fan, tailored as a dedicated lung tool, minimizes necessary movements for data capture, aiding quick clinical decisions.

Backed by a rich toolkit encompassing over 20 anatomical presets, six imaging modes, AI-driven enhancements, and calculation tools, Butterfly iQ3 stands out. Its compact, ergonomic build has resonated well with healthcare professionals in the U.S. and Canada, promising similar traction in the European market. The device’s design, featuring a 17% smaller probe face, compact size, and enhanced battery life, ensures extended scanning capabilities and swifter charging.

These functionalities have significantly bolstered echo image quality and biplane mode for cannulation, proving invaluable in managing patients requiring challenging IV access.

Butterfly Network’s Zacks Rank & Promising Stocks

Butterfly Network is currently rated Zacks Rank #2 (Buy).

Other standout stocks in the broader medical sector include Boston Scientific, Apyx Medical, and Universal Health Services, all holding a Zacks Rank #2 at present.

Boston Scientific boasts a long-term estimated growth rate of 12.6% and has consistently surpassed earnings estimates over the past four quarters, with an average beat of 7.2%.

Apyx Medical, with a projected growth rate of 20% for 2025, has room for improvement after missing earnings estimates in the trailing four quarters, albeit with a negative surprise of 25.98% on average.

Universal Health Services is anticipated to grow at a rate of 19% long-term and has exceeded earnings projections in each of the past four quarters, posting an average positive surprise of 14.58%.

While these stocks offer varying investment opportunities, Butterfly Network’s recent strides with iQ3 position it as a key player in the rapidly evolving healthcare technology landscape.