Meta Platforms Inc. META is the world’s largest social media platform. The company’s portfolio offering evolved from a single Facebook app to multiple apps like photo and video sharing app Instagram and WhatsApp messaging app owing to acquisitions. Along with in-house developed Messenger, these apps now form Meta’s family of products.

The tech giant is set to release its third-quarter 2024 earnings results on Oct. 30, after the closing bell. The stock currently carries a Zacks Rank #2 (Buy) and has a positive Earnings ESP of 2.83%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better (Rank #1 or 2) and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Meta Platforms is investing heavily in generative artificial intelligence (AI). A section of financial experts raised questions about the timing of the monetization of these massive investments.

A possible earnings and revenue beat will ensure META’s ability to a great extent about AI spending monetization. This along with a favorable Zacks Rank should drive its stock price significantly in the near future.

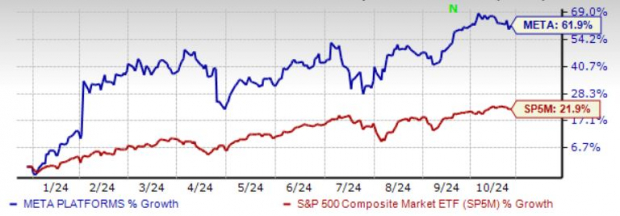

The chart below shows the price performance of META year to date.

Image Source: Zacks Investment Research

Factors to be Considered for Third Quarter

Meta Platforms is benefiting from steady user growth across all regions, particularly Asia Pacific. META has been leveraging AI to improve the potency of its platform offerings. These services currently reach more than 3.3 billion people daily. User growth remained solid in the United States, with WhatsApp reaching more than 100 million monthly users and Thread approaching the 200 million user milestone.

META is riding on strong advertising revenue growth prospects. In the second quarter of 2024, advertising revenues increased 21.7% year over year to $38.33 billion, accounting for 97.9% of revenues. Meta Platforms’ advertising revenues are expected to benefit from strong spending from advertisers as they leverage its growing AI prowess.

META has been leveraging AI and machine learning to boost the potency of its social-media offerings, including WhatsApp, Instagram, Facebook and Threads. META’s significant investment in AI is expected to help it gain market share in the digital advertising space.

Key metrics like Family daily active people, ad impressions and average price per advertisement are likely to remain solid on a year-over-year basis in the third quarter, reflecting the dominant position of the company in the digital advertising market.

However, the Meta Platforms Reality Labs division (which includes virtual reality, augmented reality and metaverse initiatives) has been a significant drag on profits. It remains to be seen how the company is approaching profitability for this segment and if massive investment in AI has aided this initiative.

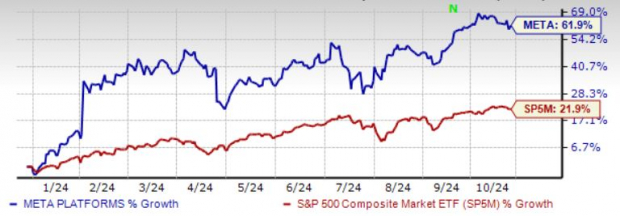

Solid Earnings Estimate Revisions for META Shares

For third-quarter 2024, the Zacks Consensus Estimate currently shows revenues of $40.16 billion, suggesting an improvement of 17.6% year over year and earnings per share (EPS) of $5.17, indicating an appreciation of 17.8% year over year. The company delivered positive earnings surprises in the last four reported quarters with the average beat being 12.6%.

Moreover, META has witnessed positive earnings estimate revisions for 2024 and 2025 in the last seven days. At present, the Zacks Consensus Estimate indicates a year-over-year increase of 20% and 44.2%, respectively, for revenues and EPS in 2024.

The current Zacks Consensus Estimate for 2025 revenues and EPS reflects an upside of 14% and 13.3%, respectively. In addition, META has a long-term (3-5 years) EPS growth rate of 19.1%, significantly higher-than the S&P 500 index’s growth rate of 13.1%.

Image Source: Zacks Investment Research

More Catalysts for META Stock

Meta Platforms is set to receive initial shipments of NVIDIA Corp.’s NVDA new flagship AI chip later this year. NVIDIA’s next-generation AI chip, called Blackwell, is the upcoming driver. META is set to get B200 Blackwell chips.

META’s AI-driven platform is enhancing ad delivery efficiency and increasing return on ad spend for advertisers. Solid performance in spaces like e-commerce, gaming, entertainment, and media is benefiting Meta Platforms.

Management said that the company will invest $37-$40 billion as capital expenditure in AI initiatives in 2024. Moreover, capital spending is likely to reach more than $50 billion in 2025.

On July 24, META unveiled its Llama 3 AI model. Using NVIDIA’s latest HDX H200 chip that supports Meta Platforms’ Llama 3 AI model, an investment of $1 by an API provider can generate $7 in revenues over the next four years. This mostly free Llama 3 model and its advanced version to be released next year aim to compete with incumbent like Open AI.

On Oct. 24, Meta Platforms entered into a multi-year deal with Thomson Reuters Corp. TRI to allow its AI chatbot access to news content for responses to current events and news questions. This constitutes a significant AI partnership between a tech behemoth and a news publishing giant.

Strong Upside Left for META Shares

Year to date, the stock price of Meta Platforms soared nearly 62%, well above the Zacks defined Internet Software Industry’s gain of 23.1%. Despite this, META is currently trading at an attractive valuation compared to its peers. The stock has a forward price/earnings (P/E) of 26.5X, below the industry’s P/E of 32.9X. META has a robust return on equity of 34.2%.

The average short-term price target of brokerage firms represents an increase of 9.1% from the last closing price of $573.25. The brokerage target price is currently in the range of $425-$811. This indicates a maximum upside of 41.5% and a maximum downside of 25.9%.

Image Source: Zacks Investment Research

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Thomson Reuters Corp (TRI) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report