As automakers worldwide gear up their investment in hybrid technologies, shifting focus from fully electric vehicles to hybrid cars due to greater consumer acceptance, the landscape of the automotive industry is rapidly evolving. This shift has been accentuated by the competitive threat posed by Chinese electric vehicle manufacturers, prompting companies to prioritize hybrids with their attractive double-digit profit margins over often unprofitable fully electric vehicles.

An excellent case in point is Toyota Motor (TM), a stalwart in championing hybrid technology. The company’s impressive first-quarter operating profit of $7 billion, representing a 78% year-on-year increase, underscores the changing dynamics in the global automotive market. Toyota’s recent launch of a new generation of internal combustion engine (ICE) vehicles reflects its anticipation of a prolonged transition to EVs on a global scale.

Hybrid vehicles, which held a modest 7% market share in the U.S. in 2023, are now experiencing a remarkable resurgence. U.S. hybrid sales have surged by 35% year-on-year in 2024, mirroring a similar trend in Europe where hybrid vehicle sales have soared by 21% to 1.3 million units, outpacing the 2% growth in EVs, according to BNP Paribas (BNPQY). With S&P Global Mobility data predicting a tripling in hybrid sales over the next five years, hybrids are projected to constitute 24% of U.S. new car sales by 2028.

Forward-looking projections are even more optimistic, with Ford (F) CEO Jim Farley envisaging a quadrupling of hybrid sales for the company over the same period.

The Precious Metal Poised for Growth Amidst the Hybrid Boom

Amidst the resurgence of interest in hybrid vehicle technology and the enduring demand for traditional combustion engine cars, investors in commodities are now eyeing platinum as a strategic avenue to capitalize on the thriving hybrid vehicle market. Funds investing in platinum (PLV24) are witnessing a surge in investor interest, foreseeing sustained demand for platinum required in both hybrid and conventional engine vehicles to reduce emissions.

The rationale is simple: as hybrids gain prominence, the requirement for catalytic converters and platinum is set to increase. Catalytic converters in hybrid vehicles necessitate higher volumes of platinum compared to gasoline and diesel engines to effectively control emissions, typically demanding 10% to 15% more platinum per vehicle due to greater temperature variability in hybrids.

Platinum’s largest demand driver is the automotive sector, accounting for around 40% of annual platinum demand. In 2023, automotive demand for platinum saw a robust 16% year-on-year growth, reaching 3,211 koz. Projections indicate a more modest 2% growth to 3,269 koz this year.

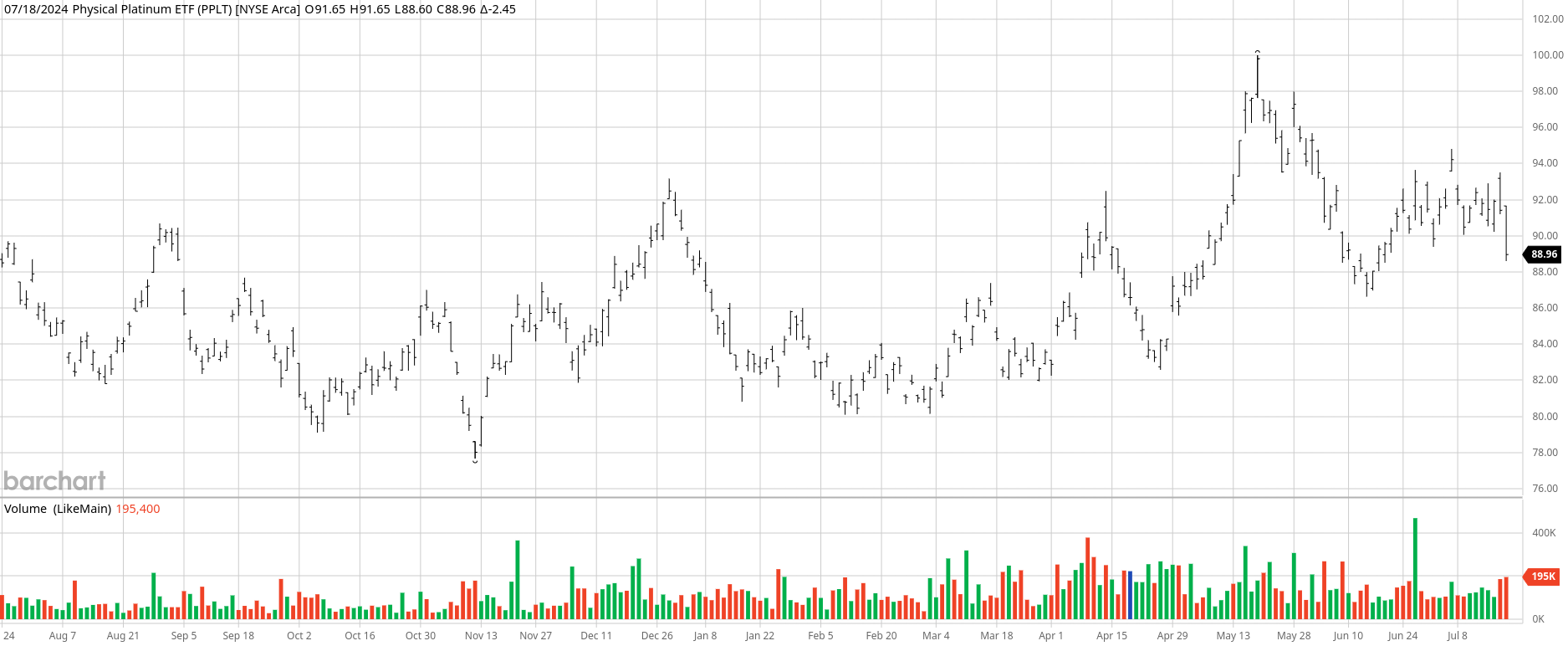

Exchange-traded funds (ETFs) backed by physical platinum witnessed a substantial surge of about 444,000 ounces in the second quarter of 2024, equivalent to nearly 6% of annual demand, marking the most significant quarterly growth since 2020. This influx of ETF inflows propelled the platinum price to soar by 20% within a month until mid-May, after consistently trading below $1,000 per ounce. However, platinum prices have retraced some gains since then, with the most active futures contract trading around $975 per ounce, significantly lower than its 2008 all-time high of $2,240.

Potential Avenues for Platinum: Beyond Hybrid Vehicles

Platinum’s demand extends beyond automotive applications, with a notable uptick in demand driven by artificial intelligence (AI) and data storage sectors. The usage of platinum in hard disk drives (HDDs), which utilize magnetic platters coated with a platinum alloy to enhance thermal and magnetic stability, is gaining traction due to the surge in AI-powered data storage needs.

With the introduction of heat-assisted magnetic recording (HAMR) technology, the HDD market is witnessing resurgence after nearly two years of decline. The growth in AI technology necessitates expanded data storage requirements, propelling total HDD unit shipments to increase by just under 1% in the last quarter of 2023, marking a significant turnaround in HDD demand following a decline since early 2022.

The implementation of HAMR technology holds promise for data center firms seeking solutions to enhance energy efficiency and storage capacity, thereby further driving demand for HDDs coated with platinum alloys.

Potentially, platinum could play a pivotal role in fuel cell vehicles if they gain widespread acceptance. Notably, platinum serves as the primary catalyst in fuel cells due to its ability to facilitate reactions selectively without obstruction, coupled with exceptional stability under fuel cell operating conditions.

Investing in PPLT Shares

Against the backdrop of robust demand for platinum catalyzed by the hybrid vehicle revolution, one strategic approach for investors is to consider purchasing shares in the abrdn Physical Platinum Shares ETF (PPLT). This ETF is backed by physical platinum bars securely stored in London, with holdings amounting to 1,017,379,123 ounces as of June 30. Featuring a reasonable expense ratio of 0.60%, the fund provides investors with a direct exposure to the physical platinum market.

Despite concerns plaguing the catalytic converter market and platinum demand, the PPLT shares have remained relatively stagnant, experiencing a mild decline of around 1-2% over the past year and a 3% dip year-to-date. This presents a compelling opportunity for investors to consider acquiring PPLT shares in the mid- to upper $80s range.