In the ever-evolving landscape of artificial intelligence stocks, C3.ai has emerged as a frontrunner, buoyed by the resounding demand for its C3 Generative AI solutions and bolstered by partnerships with tech giants like Amazon, Alphabet, and Microsoft.

C3.ai has been strategically enhancing its ties with these tech behemoths, most notably clinching the AWS Generative AI competency milestone, a testament to its growing rapport with Amazon.

The achievement of the Amazon Web Services (“AWS”) Competency Program underscores C3.ai’s adeptness in leveraging AWS technologies for generative AI (Gen AI) applications, fostering a deeper integration within the AI domain.

Recently, C3.ai unveiled the C3 Generative AI for Government Programs, an innovative AI tool operating on Alphabet’s Google Cloud. This revolutionary application aims to streamline the dissemination of accurate information about government programs to citizens.

This latest breakthrough is poised to fortify C3.ai’s presence in the federal sector, with Federal revenues doubling in fiscal 2024 and a remarkable surge in the closure of Federal agreements.

Steady Expansion and Market Performance

The burgeoning collaborations with leading cloud service providers signal a promising trajectory for C3.ai’s long-term growth. Notably, in fiscal 2024, the company experienced a significant uptick in agreements closed through its network, an encouraging 62% increase year over year.

Challenges in Stock Performance

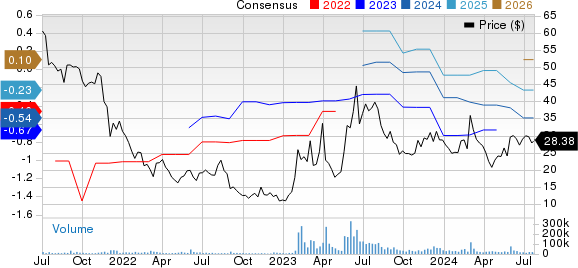

Despite recent positive momentum, C3.ai shares have encountered a slump in year-to-date performance, trailing behind industry benchmarks with a decline of 1.2%. This underperformance raises questions about the stock’s resilience in the dynamic AI market.

Analysis of Financial Indicators

Concerns loom over C3.ai’s near-term outlook due to high investment requirements for driving growth. Furthermore, valuation metrics point to a premium price tag on AI stock when compared to industry standards, indicating potential overvaluation in the market.

Forecasted Trends and Expectations

The company’s revised estimates for fiscal 2025 paint a mixed picture, with anticipated revenue growth and widened loss projections. Analyst consensus reveals a positive revenue outlook but a concerning increase in loss per share estimates.

C3.ai’s Strategic Portfolio and Future Landscape

Amidst market fluctuations, C3.ai’s robust portfolio and expanding clientele remain pivotal strengths. The wide adoption of its Enterprise AI software across various sectors bodes well for its future growth.

The applications of C3 Generative AI in manufacturing, industrial, and military domains illustrate its prowess in enhancing operational efficiency, safety standards, and data analysis across industries, reflecting a broader impact on the AI ecosystem.

Noteworthy success stories include significant operational savings and efficiency gains at companies like Cargill, Baker Hughes, and Petronas, showcasing the tangible benefits reaped from C3.ai’s AI solutions.

The Verdict on C3.ai’s Market Standing

C3.ai’s ambitious investment plans might exert short-term pressure on margins, potentially impacting the stock’s performance. While the demand for its AI solutions remains robust, caution is advised due to potential short-term challenges.

With a Zacks Rank #4 (Sell), the current market sentiment leans towards a cautious stance on C3.ai’s stock. Investors are advised to tread carefully in light of the evolving dynamics of the AI market.