Can PVH Stock Rise 13% To Its Pre-Inflation Shock Highs?

A Roller-Coaster Ride for PVH Stock

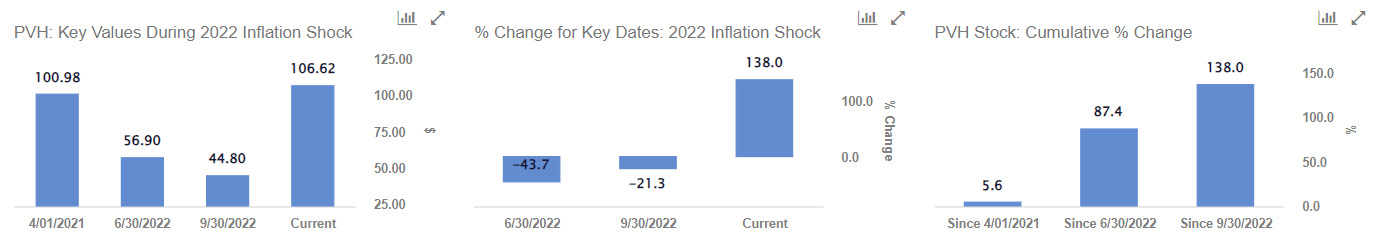

PVH Corp’s stock, trading at $107 per share, is still 13% below its pre-inflation shock high of $123 seen in November 2021. Despite a 10% decline in revenue in Q1 of FY’23 and internal restructuring, the company’s adjusted earnings increased by 14% year-over-year to $2.45 per share.

Looking ahead, PVH management forecasts further revenue decline and challenges in Europe and wholesale segments for the rest of the year. However, hopes are pinned on improvements in the Spring 2025 collection to turn the tides around.

Navigating Turbulent Waters

PVH stock has seen a tumultuous journey, with returns fluctuating significantly year-on-year. While it outperformed the S&P 500 in 2023, it lagged behind in 2021 and 2022. The current uncertain macroeconomic environment, with high oil prices and interest rates, raises questions about PVH’s future relative to the broader market.

Valuation Analysis and Market Comparisons

To return to its pre-inflation shock highs, PVH stock would need to climb about 13%. Analysts estimate the company’s valuation to be around $110 per share, hinting at a potential 3% upside from the current market price.

Comparing PVH’s performance during the recent inflation shock and the 2007-08 crisis provides insight into its resilience and growth potential amidst challenging market conditions.

Examining Fundamentals and Risk Factors

PVH’s revenue growth has been inconsistent, with earnings per share fluctuating significantly. Rising inflation has impacted consumer spending, posing challenges for the company’s stability in a tough operating environment.

The company’s high leverage and pending refinancing mention in the Q1 earnings call present risks that could hinder its ability to realize potential gains in the future.

The Road Ahead

With the Federal Reserve’s efforts to stabilize inflation rates, PVH stock could see strong gains when recession fears subside. However, caution is advised due to the company’s balance sheet pressures and debt levels.

Comparing PVH’s performance against its peers can provide further insights for investors looking to navigate the apparel industry.

Key Performance Metrics

| Returns | Jul 2024 MTD | 2024 YTD | 2017-24 Total |

| PVH Return | 1% | -13% | 18% |

| S&P 500 Return | 3% | 18% | 152% |

| Trefis Reinforced Value Portfolio | 1% | 8% | 665% |

[1] Returns as of 7/11/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios