Exploring the World of Roku

Amidst the tumultuous landscape of the tech market, Roku, the streaming platform and device provider, has stood its ground despite a staggering 88% dip from its all-time highs. The company, currently valued at $8.2 billion, has weathered the storms of the bear market in 2022. While expectations of a swift return to previous peaks may seem unrealistic this year, Roku presents itself as a compelling investment opportunity in a burgeoning macro environment. My optimism stems from factors such as the global surge in online streaming consumption, Roku’s improving profit margins, and its attractive valuation.

Roku and the Expansive Market Landscape

The seismic shift towards cord-cutting and online streaming has painted a new horizon, with Roku at the forefront of this digital revolution. As nearly half of U.S. households bid farewell to traditional cable subscriptions and embrace streaming services, Roku finds itself in a prime position to capitalize on this behavioral shift. The disparity between viewership trends and advertising budgets signals an untapped opportunity, one that Roku is poised to exploit in the coming years.

Roku’s distinctive blend of platform services and advertising tools positions it favorably in the accelerating realm of video streaming and digital ads. By offering a seamless aggregation of multiple streaming services and empowering marketers with targeted advertising capabilities, Roku is paving the way for sustained growth.

Roku’s Financial Fortitude

In the realm of financial performance, Roku exhibited a commendable sales growth of 19% in Q1 of 2024, reaching $881.5 million. Nonetheless, a slight dip in gross profits, pointing to a margin contraction from the previous year, warrants scrutiny. The challenges primarily stem from the Devices segment, where margins turned negative, hinting at potential cost discrepancies in hardware production.

Despite the evolving financial landscape, Roku managed to curb operating expenses, showcasing commendable fiscal discipline. This newfound prudence bore fruit, with the company reporting a positive free cash flow of $426.8 million as opposed to an outflow of $448 million recorded a year ago. Such buoyant cash flows not only underscore operational efficiency but also bode well for Roku’s strategic growth initiatives.

Unlocking Value in Roku Stock

The current slump in Roku’s share prices beckons contrarian investors, offering a window of opportunity to capitalize on the company’s future prospects. Traditional valuation metrics may fall short in gauging Roku’s potential due to its prevailing net loss scenario. However, at 19.2 times trailing cash flows, Roku’s valuation appears modest, especially in light of its robust growth trajectory. In a comparative landscape where tech giants like Netflix command a 40x multiple on cash flows, Roku presents an enticing proposition for discerning investors.

Analysts’ Sentiment on ROKU Stock

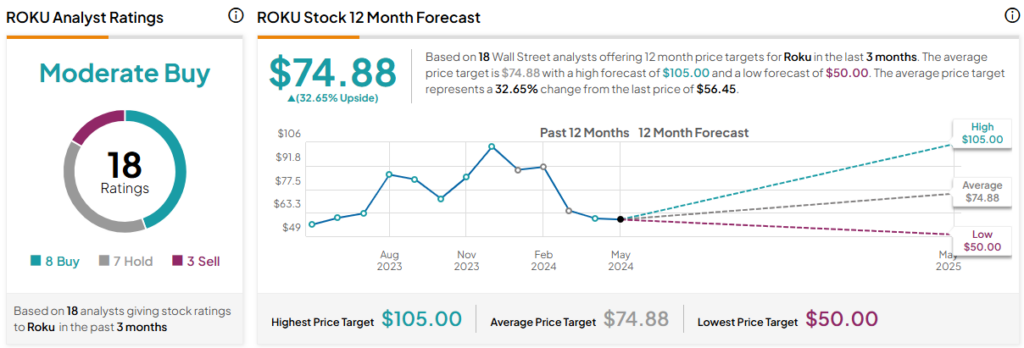

Among the analyst community, opinions on Roku stock are varied, with a blend of Buy, Hold, and Sell ratings. The overall consensus seems to lean towards a Moderate Buy stance, with an average price target of $74.88 suggesting a potential upside of 32.65% from current levels. This diverse outlook hints at the nuanced opportunities and risks associated with Roku’s stock performance.

The Way Forward for Roku

While scaling the peaks of its previous glory may be a lofty ambition for Roku in the near term, the company’s trajectory points towards a promising future. As Roku continues to optimize its free cash flow and alleviate losses, shareholders stand to reap substantial rewards in the foreseeable future. In essence, Roku epitomizes resilience and adaptability in navigating the ever-evolving streaming landscape, presenting a beacon of hope for investors seeking long-term growth and stability.