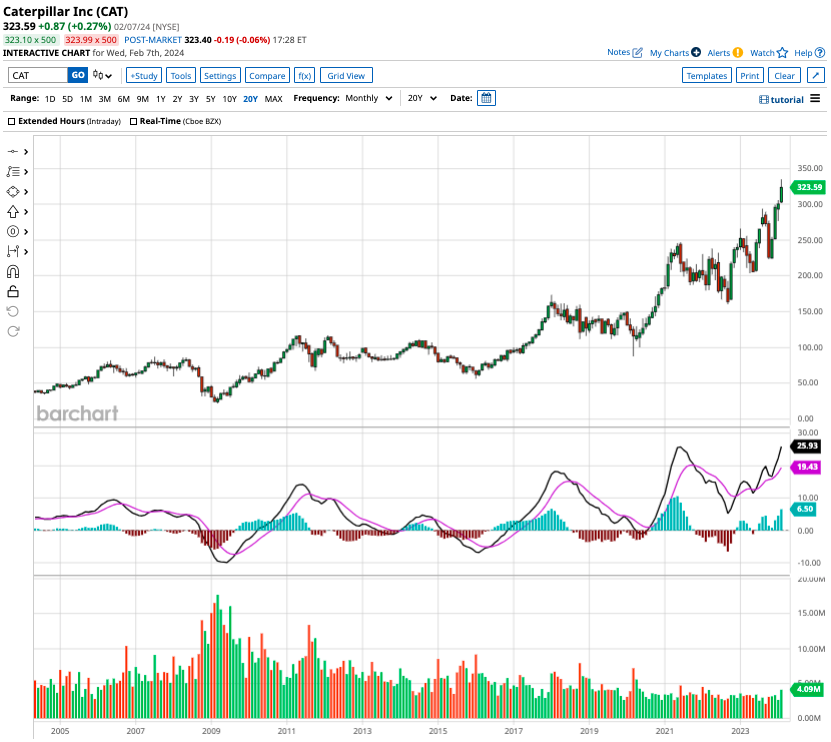

Farm and construction equipment companies, such as Caterpillar (CAT) and Deere & Company (DE), have delivered impressive returns to investors over the past two decades. With Caterpillar shares surging over 1,200% and Deere stock returning 1,740% to investors since February 2004, the two giants have outperformed the broader markets, creating substantial wealth for long-term shareholders.

However, past performance is not the sole consideration for current and future investors. It is vital to evaluate which of these large-cap giants presents a stronger investment opportunity in the present market environment.

Caterpillar: Digging into the Pros

With a market cap of $164.7 billion, Caterpillar is a leading manufacturer and seller of construction and mining equipment, along with off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. The company’s robust financial performance in Q4 of 2023 showcased its resilience, reporting a 13% year-over-year increase in revenue, while its adjusted earnings per share exceeded estimates at $5.23.

Caterpillar’s expanding earnings led to an operating cash flow of $12.9 billion in 2023, enabling the company to return $7.5 billion to shareholders through dividends and buybacks in the last 12 months. Furthermore, the company ended Q4 with an order backlog of $27.5 billion, and analysts are anticipating a marginal sales increase to $67.6 billion in the current year, supported by robust demand across most end markets amid an uncertain macro backdrop.

While Caterpillar’s top-line growth is projected to remain limited in 2024, the company raised its profitability guidance for the year, expecting to generate free cash flow within the range of $5 billion to $10 billion, higher than its prior guidance. At 15.4 times forward earnings and an annual dividend of $5.20 per share, Caterpillar presents a compelling investment prospect, especially given the forecasted 12.6% annual earnings growth in the next five years.

Deere: Plowing through the Pros

With a market cap of $108.1 billion, Deere is a stalwart in the manufacturing and distribution of equipment for agriculture, construction, forestry, and turf care. As one of the oldest companies globally, founded in 1837, Deere holds a resilient position, weathering various economic downturns over the last two centuries and demonstrating robust cash flows.

In fiscal Q4 of 2023, Deere surpassed estimates with adjusted earnings of $8.26 per share. However, the company’s cautious guidance for fiscal 2024 led to a decline in its stock value, with management expecting sales volume to transition from a cyclical peak to mid-cycle levels in the next 12 months. Despite this cyclical nature, Deere remains a strong contender, paying shareholders a quarterly dividend of $1.47 per share, with an annual growth rate of 12.5% since 2004.

Analyst Expectations: Insight into the Future

Of the 20 analysts covering Caterpillar stock, a mixed sentiment prevails, with 7 recommending “strong buy,” 1 recommending “moderate buy,” 10 recommending “hold,” and 2 recommending “strong sell.” The average target price for Caterpillar stands at $271.42, indicating a slight downtrend from its current trading price.

In the case of Deere, out of the 20 analysts covering the stock, 11 recommend “strong buy,” 1 recommends “moderate buy,” and 8 recommend “hold.” The average target price for Deere is $428.33, indicating a potential upside of 13.8% from its current trading price.