Shifting Perspectives on Cannabis Company Leverage

When it comes to evaluating the leverage of Cannabis companies, the debate often centers around the Debt/EBITDA metric. However, a fresh approach proposed by Viridian suggests that Total Liabilities / Market Cap is a more accurate valuation measure. This metric cuts through accounting intricacies, providing a real-time reflection of the market’s estimation of asset value above liabilities.

Redefining Debt: Incorporating Leases and Tax Liabilities

One critical aspect highlighted by Viridian is the treatment of leases as part of a company’s capital structure. The significant presence of leases, representing a substantial portion of debt for many cannabis companies, indicates a vital necessity to consider them alongside traditional debt metrics. Furthermore, accrued tax liabilities exceeding a quarter of tax expense are viewed as debt by Viridian, irrespective of the company’s classification.

Calculating Adjusted Net Debt

Viridian modifies the calculation of net debt by supplementing traditional debt figures with lease and tax liabilities before deducting cash holdings. This adjusted net debt approach aims to present a clearer picture of a company’s financial obligations.

Accounting for Financial Realities

With a focus on operational lease payments impacting EBITDA, Viridian adjusts its valuation metrics accordingly. By integrating lease expenses into EBITDA to derive EBITDAR, the company strives to offer a more nuanced analysis of leverage and valuation.

Evolution of Valuation Metrics

While traditional EV/EBITDA ratios remain a standard measure, Viridian advocates for a more sophisticated evaluation technique. By combining adjusted net debt with market cap to ascertain enterprise value, utilizing EBITDA in the EV/EBITDAR ratio enhances the accuracy of the valuation.

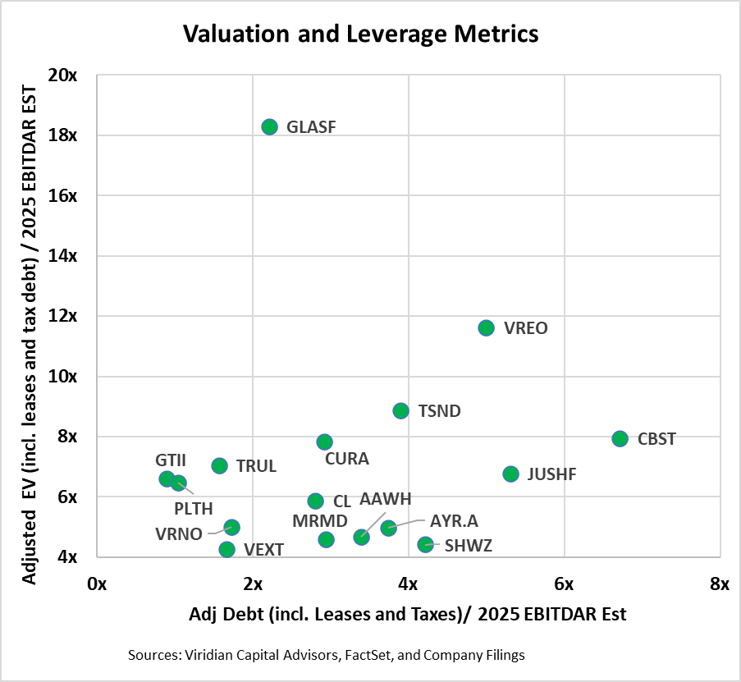

Chart of the Week: Insights and Trends

The depicted graph showcases the baseline values for the new leverage and valuation metrics, emphasizing the impact of including leases and taxes. This week’s tracker by Viridian will delve deeper into the relative effects on leverage and valuation metrics, providing a comprehensive view of financial realities in the cannabis sector.

Unveiling Investment Trends

The Viridian Capital Chart of the Week captures essential investment, valuation, and M&A trends sourced from the Viridian Cannabis Deal Tracker. This tracker serves as a valuable tool for cannabis industry players, investors, and acquirers seeking insights for strategic decision-making regarding capital allocation and M&A strategies.