Charter Communications‘ CHTR division, Spectrum Enterprise, is aggressively broadening its technology solutions. Spectrum Enterprise’s arsenal encapsulates networking and managed services solutions inclusive of Internet access, Ethernet access, and network, voice and TV solutions.

The company recently disclosed that its all-in-one solution, Managed Network Edge, has been selected by Heritage Grocers Group to supply network monitoring, cybersecurity protections, connectivity, and managed IT services. These are vital to ensuring critical network uptime and security for various operations such as credit card transactions, AI-driven inventory tools, environmental monitoring IoT sensors, online ordering, and delivery services.

The Spectrum Enterprise team remains steadfast in its commitment to working hand-in-hand with clients to elevate their business outcomes with tailored solutions that evolve along with their needs.

Clientele Expansion Supports Growth

The Spectrum Enterprise division of Charter Communications is leveraging its growing clientele and robust enterprise customer base to propel near-term revenue growth. Currently serving approximately 30.6 million residential and small and medium business (SMB) Internet customers, Spectrum’s Zacks Consensus Estimate for fiscal 2023 forecasts revenues of $54.62 billion, reflecting a 1.10% year-over-year upturn.

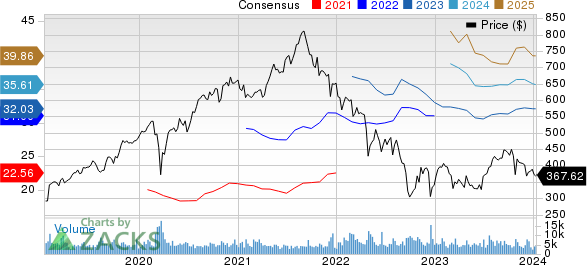

The consensus estimate for earnings has decreased by 8 cents over the past 30 days, standing at $8.93 per share. Notably, Spectrum has a diverse portfolio of clients including Red Studios Hollywood, Redman Realty Group, among others.

Recently, Red Studios Hollywood engaged Spectrum Enterprise to advance its digital network by installing a high-speed, low-latency Fiber Internet Access (FIA) circuit with a second backup circuit. Similarly, Redman Realty Group has opted for Spectrum Enterprise’s technology solutions to upgrade its phone systems and elevate sales using the company’s modern network.

Spectrum has also forged partnerships with major industry players like Cisco Systems, RingCentral , AOC Connect, and more. It recently introduced Secure Access with Cisco Duo and Cloud Security with Cisco+ Secure Connect, aimed at fortifying cybersecurity solutions for businesses. Spectrum has also allied with RingCentral to offer SMBs and other enterprise customers high-speed internet and network solutions, coupled with a reliable, secure, and user-friendly communications platform.

However, over the past six months, Charter Communications’ shares have witnessed a 4.1% decline vis-à-vis the Zacks Consumer Discretionary sector’s 1.2% rise. The decrease is attributed to persistent video-subscriber attrition primarily caused by cord-cutting and tough competition from streaming services such as Netflix and Disney+.

Assessment of Zacks Rank & Alternative Stock

At present, Charter Communications has a Zacks Rank #4 (Sell). A better-ranked stock in the broader Consumer Discretionary sector is Netflix, carrying a Zacks Rank #2 (Buy). Netflix shares have yielded a 44.9% return in the past year. The long-term earnings growth rate for Netflix is pegged at 21.3%.

(We are reissuing this article to correct a mistake. The original article, issued on January 11, 2024, should no longer be relied upon.)

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

Top Stock Analysis: Is This Company the Next Big Contender?

This company has been making waves in the stock market, with the potential to rival or even surpass recent Zacks’ Stocks Set to Double like Boston Beer Company, which experienced a staggering +143.0% surge in little more than 9 months, and NVIDIA, which boomed by an impressive +175.9% in just one year.

Explosive Growth Potential

Shares in this company have been catching the eye of investors for the immense growth potential they offer. Its meteoric rise projects it as the dark horse in the stock market race, defying expectations and charting a course for the top spot.

Strategic Expansion Ventures

The company’s clientele is on an upward trajectory with strategic deals, much like a grocery chain agreement, propelling its expansion. It is evident that this entity means business and is not holding back in its pursuit of market domination.

Notable Industry Players

Bolstering its position even further, the company has been establishing notable collaborations, strengthening its foothold akin to industry giants such as Netflix, Inc. (NFLX), Cisco Systems, Inc. (CSCO), Charter Communications, Inc. (CHTR), and Ringcentral, Inc. (RNG).