Unprecedented Rally in Chinese Stocks

Recently, the financial world has been abuzz with the remarkable surge in Chinese stocks. It’s as if a Chinese ADR dartboard could land you right at the peak of the Empire State Building. Take for instance the iShares China Large Cap ETF (FXI), soaring by approximately 30% in just two short months. Yet, it’s the smaller players like Futu Holdings (FUTU) and UP Fintech Holding (TIGR) that are truly grabbing attention with astronomic gains of 63% and 89%, respectively!

Image Source: Zacks Investment Research

The Significance of Analyzing Trading Activities

Legendary trader Jesse Livermore once sagely commented, “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills.” Whether you rode the wave of the Chinese stock rally or not, understanding this phenomenon is a learning opportunity. Studying this move will equip you to seize similar opportunities in the future.

Historically Low Valuations in China Stocks

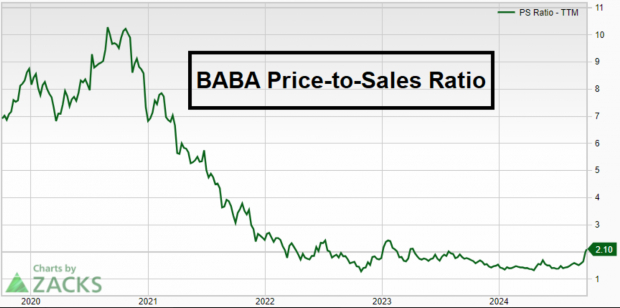

Before the uptrend, valuations of top Chinese stocks hit rock bottom. For instance, Alibaba (BABA), the e-commerce behemoth, saw its price-to-sales ratio plummet from 10x in 2021 to a bargain basement level below 2x.

Image Source: Zacks Investment Research

Insights into Smart Money Moves in Chinese Stocks

Observing 13F disclosures can offer a peek into the moves made by astute investors. These disclosures require institutional managers with assets over $100 million to unveil their stock holdings. Before the surge in Chinese equities, noteworthy investors like Michael Burry and David Tepper were seen picking up shares of JD.com (JD). In particular, David Tepper’s investment strategies are worth noting, as he often takes leveraged, high-conviction positions that pay off.

Catalyst: Central Bank Liquidity Injection

Amidst prevailing pessimism, soaring short interest, and rock-bottom valuations, the Chinese government unleashed an unexpected, extensive stimulus package, far surpassing Wall Street’s anticipations. And the rest, as they say, is history.

Even if you didn’t ride the Chinese stock wave, understanding the dynamics at play, such as low valuations, smart money activity, and liquidity boosts, will serve as valuable lessons for future investment opportunities.

7 Best Stocks for the Next 30 Days

Fresh off the press: Expert analysts have distilled a list of 7 top-tier stocks from the current Zacks Rank #1 Strong Buys. These are deemed as the “Most Likely for Early Price Pops.” Since 1988, this list has outperformed the market by over 2 times, yielding an average annual gain of +23.7%. So, these hand-picked 7 stocks deserve your prompt attention.

iShares China Large-Cap ETF (FXI): ETF Research Reports

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Futu Holdings Limited Sponsored ADR (FUTU) : Free Stock Analysis Report