The Economic Tidal Wave: China’s Stimulus Creates Market Buzz

China’s latest financial undertakings have sent ripples of excitement through global markets. The People’s Bank of China (PBoC) recently unleashed a flurry of measures, slashing the reserve requirement ratio (RRR) for banks and reducing key repo rates. Resulting from these bold moves is an influx of liquidity slated to infuse around $140 billion into the economy, fueling more lending and stimulating growth.

Surging Forward: Large-Cap Stocks with Analyst Buy Signals

Despite some market fluctuations post-announcement, select U.S.-listed Chinese stocks are holding steady as favorites among analysts. Let’s focus our lens on three large-cap stocks exhibiting strong upside potential and all carrying a coveted Buy rating.

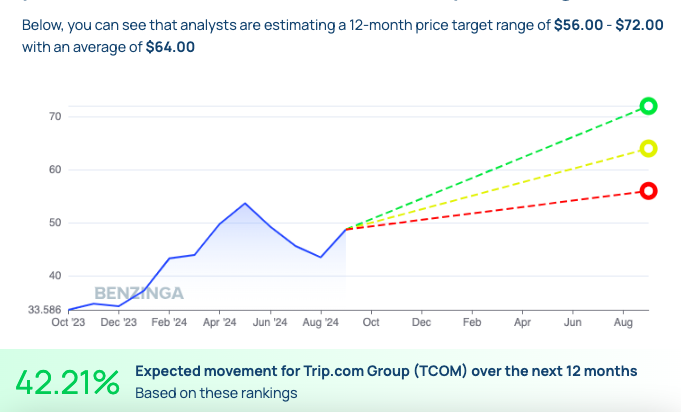

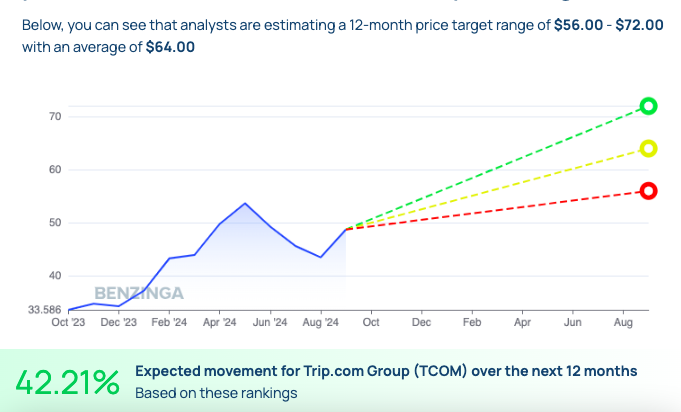

First on the spotlight is Trip.com Group (TCOM), China’s largest online travel agency. With a remarkable 44% year-to-date gain and a soaring 43% performance over the past year, Trip.com is riding high on analysts’ optimism. Forecasts predict a price surge from $56 to $72 over the next 12 months, with an average target of $64 — an outstanding 42.21% upside.

Next in line stands JD.com (JD), a prominent e-commerce player in China. Fueled by a robust logistics and fulfillment infrastructure, JD.com has already seen a 22% surge in value this year. Analysts are eyeing a potential price movement ranging from $28 to $47, with an average target of $37.50, translating to a promising 36.97% upward trajectory in the coming year.

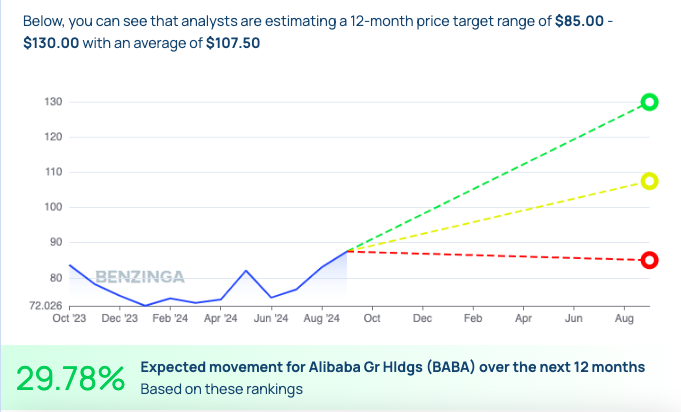

Completing the trio is Alibaba Group (BABA, BABAF), a powerhouse in the global e-commerce domain. Despite past hurdles, Alibaba’s diversified business ventures spanning online marketplaces to cloud computing continue to captivate analysts. With a 21% uptick thus far, forecasts hold a 12-month price target bracket of $85 to $130, averaging at $107.50. This prognostication hints at a 29.78% upside, positioning Alibaba as a solid long-term prospect.

Seizing the Momentum: A Promising Future for Chinese Market Players

As China’s economic engine roars into overdrive with the latest stimulus intervention, the trio of Trip.com, JD.com, and Alibaba stands poised to reap the rewards of the nation’s resurgence. Investors eyeing substantial returns amidst rejuvenated markets can look to these large-cap stalwarts as beacons of growth and opportunity.