This Canadian uranium explorer is treading carefully but determinedly along the shifting sands of opportunity in the Athabasca Basin. They have identified a dozen targets across their Falcon project and diligently honed in on three for potential future drilling, stirring the anticipatory winds of the market.

Unveiling Promising Prospects

President and Chief Executive Officer Brooke Clements spoke with a glint of optimism, seeing a gleaming horizon in the eastern margins of the Athabasca Basin. The company’s sighting of targets, a meticulous work of amalgamated data from aerial surveys, historical programs, and structural interpretation, has sent ripples of excitement through the sector.

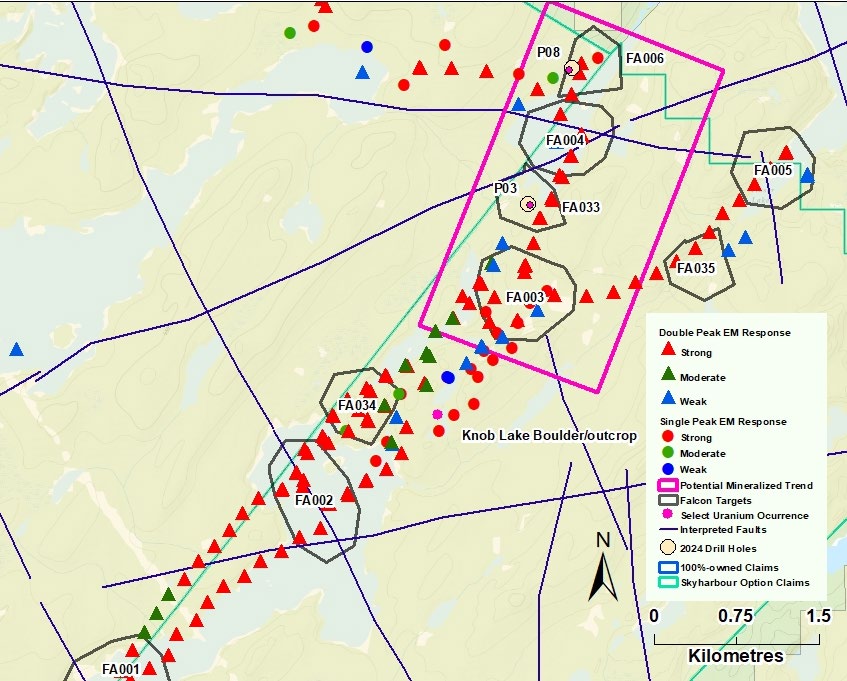

The company’s gaze is steadfastly fixed on Zone 1 within Falcon, where they unearthed near-surface uranium mineralization earlier this year. The evocatively named targets FA006, FA003, and FA002 beckon with magnetic allure, promising untold treasures waiting to be unearthed.

Across Zones 1, 2, and 3, North Shore’s map of opportunities expands, a cartographic testament to their unyielding resolve to chart new territories in the quest for uranium riches.

Strategic Navigation of Exploration

Not content with merely one promising horizon, North Shore casts its eyes towards West Bear, another plot of land ripe with potential. With an exploration strategy as finely tuned as a master craftsman’s instrument, the company dances between discoveries, tantalizingly close to realizing their ambitions.

The market watchers, no strangers to the ebb and flow of stocks, whisper of a potential renaissance in the company’s fortunes. As the soil is tilled, and the possibilities laid bare, the stock’s potential seems primed for resurgence, a phoenix awaiting its moment to soar.

The Quench for Demand

Amidst the whispers of progress, a drumbeat grows louder – the need for more uranium to fuel the world’s hunger for energy. The pendulum of demand swings ever higher, reaching for the skies as projections soar like a mighty eagle circling its prey.

The looming shadow of necessity falls across the industry, compelling companies to delve deeper into the earth’s embrace to meet the surging requirements. The cards are laid on the table, a game of supply and demand where the stakes could not be higher.

A Spark of Hope

As the company marches onward, chasing the hidden veins of prosperity, there is a glimmer of optimism on the horizon. The imminent recovery in uranium prices, a beacon in the maelstrom of market fluctuations, promises a brighter dawn for those who dare to delve deep.

Guided by data, driven by ambition, North Shore’s tale unfolds like a well-worn treasure map, each target a hidden gem waiting to be uncovered, each drill a step closer to unravelling the mystery of the earth’s bounty.

The Bright Prospects Ahead for North Shore Uranium

North Shore Uranium is setting the stage for a promising path forward as it gears up to enhance its exploration efforts in the upcoming drill program. By directing attention towards follow-up drilling along the 3 km trend and exploring new targets in Zone 1 and other potential areas, the company is positioning itself for possible discovery success.

A Glimpse into Ownership and Share Structure

Insiders and founding investors collectively hold around 45% of the issued and outstanding shares of North Shore Uranium. Notable stakeholders include Clements, who owns 3.56% or 1.31M shares, Director Doris Meyer with 2.11% or 0.78M shares, and Director James Arthur holding 1.58% or 0.58M shares. Moreover, a significant portion of the shares, amounting to 40.5%, are under a voluntary pooling agreement until October 19, 2026, ensuring stability and commitment.

The majority of the remaining shares are held by retail investors, with institutional ownership being minimal. Currently, North Shore has 36.84M outstanding shares, with a market capitalization of CA$2.52 million, reflecting the recent price per share of CA$0.065. Over the past 52 weeks, the share price has ranged between CA$0.06 and CA$0.30, indicating a fluctuating yet resilient market performance.

As North Shore Uranium continues to advance its exploration endeavors, the company is poised for growth and potential breakthroughs in the realm of uranium mining and production. Stay tuned for further updates on the progress and developments in the exciting journey ahead.