Cognizant Technology Solutions is a formidable $33 billion behemoth in the professional services realm, catering to a spectrum of industries like financial services, health sciences, communications, media, and technology. From offering consulting services to technology solutions and outsourcing, Cognizant is deeply entrenched in customer service, analytics, fraud detection, and more.

The company’s journey as a public entity dates back to the heady days of the Dot-com bubble, with its IPO launched in 1998. Remarkably, even during the subsequent market crash, Cognizant’s stock price never dipped below its IPO level, making it a rare success story amidst the internet frenzy. Over the years, the stock price surged from a minuscule 21 cents per share to a whopping $93.47 by 2022, painting a portrait of wealth creation.

In contrast, recent times have been a saga of disillusionment. Currently hovering around $66 per share, the stock has been stagnant at 2015 levels, with a pronounced 30% slump from its 2022 pinnacle. Despite this, the revenue stream is exhibiting a steady, albeit gradual, uptrend, with robust free cash flow and a negative net debt balance – a far cry from a moribund state.

However, is the present downtrend a potential window for bargain hunting? Insights from Elliott Wave analysis suggest otherwise.

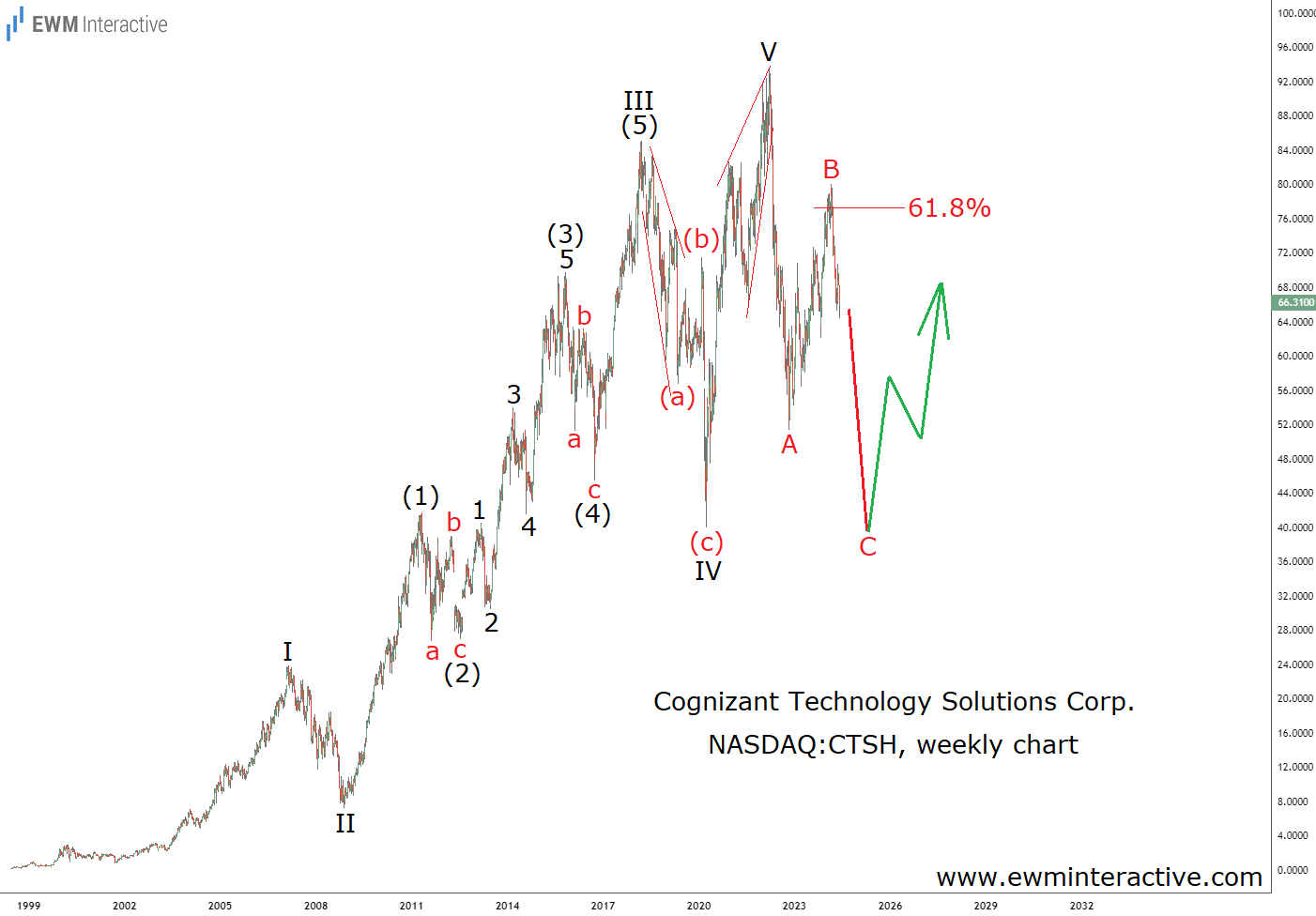

The Elliott Wave analysis unveils a compelling narrative on the stock’s trajectory. A textbook five-wave impulse pattern unfolded from 1998 to 2022, structured as I-II-III-IV-V, with wave III and V indicating lower degrees of trends. As per the Elliott Wave theory, every impulse paves the way for a subsequent three-wave correction. Post the culmination of wave V, the bears seized control, dragging the stock to $51.33 in Q4 of 2022.

The choppy recovery in 2023 ushered the stock to $80.09 by February 2024, halting near the 61.8% Fibonacci resistance level following the preceding downturn. This pattern suggests that we’ve witnessed merely waves A and B of a three-wave retracement cycle, with wave C underway, eyeing downside targets harmonizing with wave IV’s support in the low $40s.

If this wave count materializes, a full 5-3 wave cycle would conclude, signaling the resumption of the broader uptrend in due course. Presently, the outlook remains shrouded in skepticism, with Cognizant potentially bracing for another severe correction, possibly shedding another third of its valuation before discovering a robust support threshold.