Apple (NASDAQ: AAPL) endured a sluggish start in the early part of the year, with its shares tapering off by 12% in May. Amidst diminishing product sales, adverse market conditions, and an uncertain foothold in the burgeoning artificial intelligence (AI) sector, investor confidence waned.

However, the tech behemoth has orchestrated a remarkable turnaround since then, with its stock surging by 34% since May 1. Apple reclaimed Wall Street’s favor by surpassing expectations in its third quarter of 2024 and teasing a promising AI future. In Q3 of 2024 (ending on June 29), the company witnessed a 5% year-over-year revenue surge, surpassing analysts’ projections by $1.4 billion. The quarter reaped the benefits of a 24% uptick in iPad sales and a 14% rise in services revenue.

Apple’s Foray into AI:

Apple is primed to make a substantial foray into the AI domain with the imminent release of its iPhone 16 in September and the introduction of Apple Intelligence — a transformative overhaul of its operating systems.

The stock of Apple has ascended over a staggering 177,000% since its IPO in 1980, riding on the success of groundbreaking products like the inaugural iPhone. The company’s astronomical ascent might leave some analysts pondering the extent of its potential stock growth. Yet, Apple stands at the threshold of a new epoch with AI and could reap significant rewards as its technology matures.

Here’s why Apple could be the ticket to a millionaire’s retirement with astute investment.

Potential Shift in Apple’s Product Lineup:

Apple recently announced the date for its much-awaited iPhone keynote, slated for September 9, publicized with the tagline “It’s Glowtime,” likely a nod to its AI-centric theme.

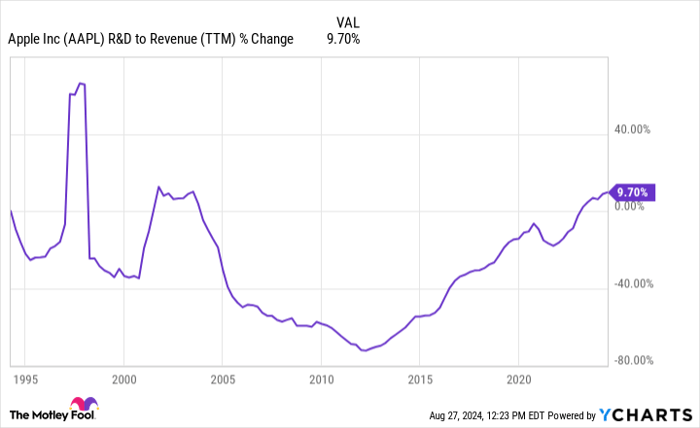

The company has escalated its AI venture this year, unveiling Apple Intelligence in June and now gearing up for the iPhone 16 launch. The upcoming smartphone will mark Apple’s maiden venture tailored with AI at its core, with the company pouring billions into the initiative. Apple’s research and development (R&D) spend hit $8 billion in 2024, reflecting a 10% surge from the previous year.

While the hefty investment in AI might raise eyebrows among investors, it also beckons the question: What innovative marvel does Apple hold in reserve? Apple is not typically the pioneer in an industry but is renowned for its gradual market entry strategy, followed by a swift ascent to dominance.

Apple’s free cash flow soared to $104 billion in 2024, indicating its capacity to sustain AI investments and bridge the gap to its competitors. Hence, the present moment could offer an opportune time for investment before Apple’s stock takes flight over the ensuing decades.

Diversified Monetization Avenues for its AI Initiatives:

While companies like Microsoft, Amazon, and Alphabet predominantly focus on the business realm of AI, channeling massive investments into their respective cloud platforms, Apple stands poised to seize the consumer sector. Driven by the popularity of its range of products and the potential to incorporate paid AI services into its portfolio of digital subscription platforms, Apple could carve out a profitable niche in the domain.

Over the past five years, services revenue growth at Apple has markedly outstripped all other segments, as evidenced in the chart above. Services are set to outpace iPhone sales in total revenue, becoming the company’s top-earning sector; an AI makeover of its offerings could fuel a surge in product upgrades, while innovative services could drive sustained revenue generation for Apple.

Apple’s earnings are forecasted to breach $8 per share by fiscal 2026. Multiplying this figure by its forward price-to-earnings (P/E) ratio of 34 yields a share price of $285, projecting a 25% stock growth in the subsequent two fiscal years. Consequently, retaining shares over a decade or two could propel a substantial investment portfolio past the million-dollar milestone by retirement.

Apple harbors immense potential and stands as an enticing prospect for investors with a long-term outlook.

Contemplating a $1,000 Investment in Apple:

Prior to delving into Apple’s stock, deliberate on this:

The Motley Fool Stock Advisor analyst team recently spotlighted what they deem the 10 best stocks for investors to consider now… with Apple absent from the list. The 10 selected stocks hold the promise of substantial returns in the impending years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449*!

Stock Advisor furnishes investors with a clear blueprint for success, encompassing portfolio construction guidance, regular analyst updates, and two fresh stock picks every month. The Stock Advisor service has exceeded the returns of the S&P 500 by more than fourfold since 2002*.

*Stock Advisor returns as of August 26, 2024