Amidst the financial tumult, PDD Holdings stands at a crossroads, poised to either ascend or descend. For contrarian investors, there’s a glimmer of hope when pessimism looms large. As challenges are openly acknowledged and factored into stock prices, savvy traders may find an opportune moment to make their move. My bullish sentiment towards PDD stock stems from the company’s underlying growth trajectory – a fact underscored by tangible financial results and strategic management foresight in navigating an uncertain terrain.

The Phenomenal Top-Line and Bottom-Line Growth

As PDD Holdings weathered a 29% stock plunge following robust second-quarter financial disclosures, contradictions abound. Revenue soaring by an impressive 86% year-over-year to $13.36 billion evoked mixed reactions; while commendable, it failed to meet analysts’ lofty expectations of $14.03 billion. Not to be outdone, the company’s operating expenses and cost of revenue surged, signaling financial prudence challenges. However, against this backdrop, PDD reported an exceptional 125% spike in adjusted net income and a remarkable $3.20 per share in adjusted earnings – a testament to operational resilience in the face of mounting headwinds.

Navigating the Storm: PDD’s Management Levels with Investors

When candid dialogues between a company’s management and investors occur, accolades are warranted. Yet, in PDD Holdings’ case, a dose of reality left a bitter aftertaste in the market’s mouth. VP of Finance Jun Liu’s cautionary words on intensified competition and evolving consumer behaviors cast shadows of doubt, precipitating a stock sell-off. However, beneath the surface, PDD’s growth trajectory and long-term prospects still shine brightly, eclipsing immediate concerns and spotlighting tenacious resilience amidst uncertainty.

Analysts’ Take: Is PDD Stock a Buy?

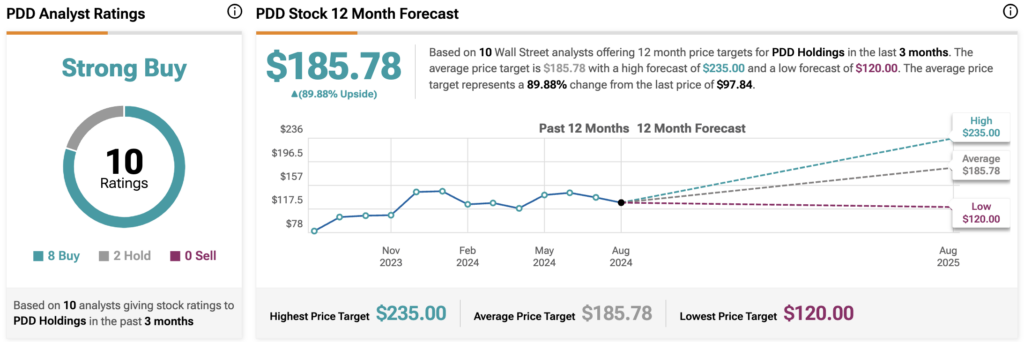

Analysts aboard the TipRanks’ train have bestowed PDD with a Strong Buy rating, backed by eight Buys and two Holds in the past quarter. The average price target of $185.78 posits an enticing 89.9% upside potential, fanning the flames of investor optimism. Notably, the stock dancefloor is dominated by Elinor Leung of CLSA, boasting a stellar track record with an average return of 91.69% per rating and an 80% success rate – a beacon for prospective traders seeking financial guidance.

Explore more PDD analyst ratings

Concluding Thoughts on PDD Stock

In the aftermath of Liu’s stark revelations, market upheavals unfolded, laying bare PDD Holdings’ short-term battles. Yet, paradoxically, these trials may have already been baked into the stock’s valuation, a common phenomenon in volatile markets. As the dust settles, the company’s victorious trounce of Wall Street estimates and the prevailing mood of cautious anticipation for upcoming challenges present an intriguing buy opportunity for daring contrarians.