A Bright Spot Amidst Darkness

Amidst an economic environment fraught with challenges, a glimmer of hope has shone upon the China and Hong Kong stock markets. The recent surge in positive sentiments, sparked by aggressive interest rate cuts by the People’s Bank of China (PBoC) and forthcoming expansionary fiscal measures targeting consumer spending, has acted as a beacon of light in the otherwise gloomy financial landscape.

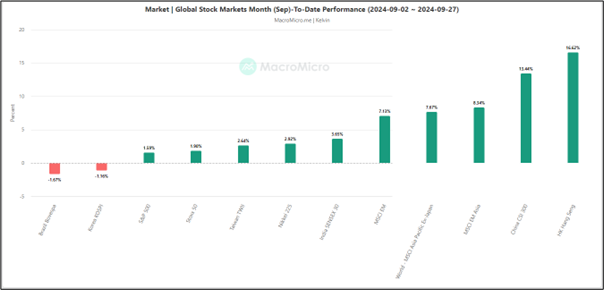

CSI 300 and Hang Seng Index Lead the Charge

The recent performance of global benchmark stock indices paints a clear picture – the CSI 300 and Hang Seng Index have emerged as frontrunners. As of September 27, these indices have outperformed their regional and global counterparts, showcasing remarkable gains of 13.44% and 16.62% respectively.

A Bold Move in Uncertain Times

Signaling a departure from conventional monetary policies, the PBoC has taken decisive steps to combat economic challenges. With substantial interest rate cuts, liquidity support for stocks, and capital injections into major state banks, China is navigating uncharted waters with a sense of urgency and determination.

Navigating Choppy Waters with Fiscal Buoyancy

Recognizing the limitations of monetary stimulus alone, China is gearing up to deploy expansionary fiscal policies to bolster economic growth. The anticipated issuance of special sovereign bonds and cash handouts to boost consumer spending mark a strategic shift towards a more proactive economic strategy.

Market Resilience and Recovery

The market breadth indicators for the CSI 300 and Hang Seng Index reflect a positive trend, with a significant increase in the percentage of stocks trading above their respective 200-day moving averages. This uptick in market breadth signifies a broader-based recovery in these indices, setting the stage for sustained growth.

Charting a New Course: Hang Seng Index Analysis

A closer look at the Hang Seng Index reveals a potential shift in trends, with technical indicators pointing towards a bullish trajectory. Key support levels and resistance zones provide valuable insights for investors, guiding them through the turbulent waters of financial markets.