DBS remains steadfast in its positive outlook on the Hong Kong-listed shares of Alibaba Group Holding Limited (HK:9988), foreseeing a substantial 44% upside potential. Post the company’s latest June quarter results, analyst Sachin Mittal from DBS reaffirmed a Buy rating on the stock. Mittal’s confidence stems from Alibaba’s commanding presence in the e-commerce sector and its diverse business lines. Overall, the stock holds a Moderate Buy rating on TipRanks.

Alibaba, a Chinese tech giant, is renowned for its online marketplace.

DBS Optimistic about Alibaba’s Diversified Portfolio

DBS expresses optimism regarding Alibaba’s diverse portfolio, encompassing cloud computing, digital media, and entertainment, which underpins its robust revenue base and Buy rating.

Mittal also highlighted the growth potential in Alibaba’s international commerce platforms, such as AliExpress, Lazada, and Trendyol. In the June quarter, Alibaba’s International e-commerce division excelled, with a 32% year-over-year sales surge. Mittal envisions a 23% compound annual growth rate (CAGR) for this segment from FY24 to FY27. Moreover, DBS trusts in the company’s Cloud Computing arm, forecasting a 9% CAGR over the same period.

Commencing September 2024, Alibaba plans to levy a 0.6% service fee on GMV (gross merchandise value) per merchant transaction on Taobao and Tmall. Mittal believes this move will drive customer management revenue (CMR) and earnings. DBS projects a 7% growth in the company’s CMR in FY25.

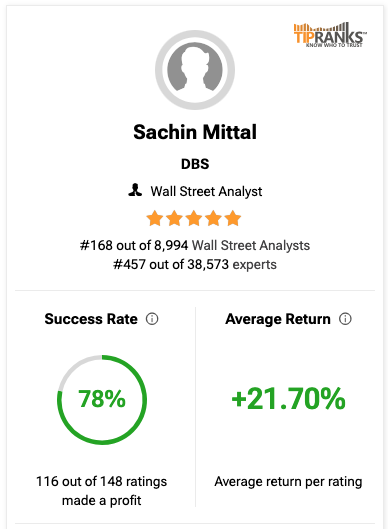

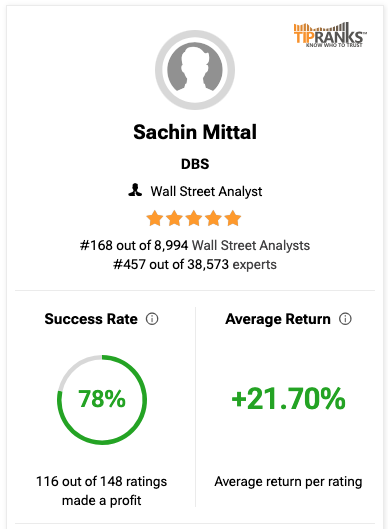

Mittal’s Top Rank on TipRanks

Per TipRanks’ ranking system, Mittal is a five-star analyst, positioned 168 out of over 8,900 analysts on the platform. With a 78% success rate, Mittal boasts an average return of 21.7% per rating.

TipRanks assesses financial experts based on success rate, average return, and statistical significance, aiding users in tracking and evaluating top financial minds for potential investment opportunities.

Key Insights from Alibaba’s Recent Results

Alibaba revealed a mixed bag of results in the June quarter. While the Cloud business demonstrated robust performance, registering a 6% year-over-year revenue ascent to ¥26.5 billion driven by AI product uptake and solid public cloud growth, revenue from Alibaba’s e-commerce segment, the Taobao and Tmall Group, dipped 1% year-over-year to ¥113.37 billion.

The company’s overall revenue surged by 4% year-over-year to ¥243.2 billion, alongside a 27% decline in net income to ¥24.02 billion.

Should Investors Consider Alibaba Shares?

Year-to-date, Alibaba stock has appreciated by 7.6%.

On TipRanks, 9988 stock has garnered three Buy and two Hold recommendations. The Alibaba share price target is HK$99.10, indicating a potential 22% upswing from the current trading price.