Dell Technologies DELL shares have declined 8.1% in the past 6 months. A contracting gross margin and weakness in consumer PC shipments have been headwinds.

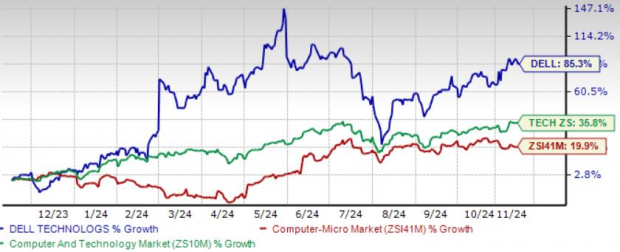

However, we believe that the dip offers a buying opportunity for investors, given the company’s expanding AI portfolio. In the past 12 months, DELL shares have skyrocketed 85.3%, outperforming the broader Zacks Computer & Technology sector’s return of 35.8%.

Strong demand for AI servers, driven by ongoing digital transformation and heightened interest in generative AI (GenAI) applications, has been a key catalyst.

The Dell AI Factory launch has been a game changer. It combines Dell Technologies’ solutions and services optimized for AI workloads and supports an open ecosystem of partners comprising NVIDIA NVDA, Meta Platforms META, Microsoft MSFT and Hugging Face.

YTD Performance

Image Source: Zacks Investment Research

DELL’s partnership with NVIDIA has played a pivotal role in developing the Dell AI Factory. The collaboration integrates Dell Technologies’ portfolio with NVIDIA’s AI Enterprise software platform and Tensor Core GPUs, enhancing compute power, and simplifying AI application development and deployment for faster time to value.

Dell Stock Rides on Strong Portfolio, Partner Base

DELL’s leading-edge air and liquid-cooled AI servers, networking and storage tuned and optimized for maximum performance at the node and rack level are driving top-line growth.

In second-quarter fiscal 2025, orders were $3.2 billion, primarily driven by Tier-2 cloud service providers. Dell shipped $3.1 billion of AI servers in the fiscal second quarter and the AI server backlog was $3.8 billion exiting the reported quarter.

AI server pipeline is expanding across Tier-2 cloud service providers (CSPs) and enterprise customers. Dell Technologies expects strong top-line growth for the second half of fiscal 2025, driven by robust AI demand.

DELL’s expanding AI opportunity with Tier-2 CSPs, enterprise and emerging federal customers is significant. An expanding partner base that includes the likes of AMD, NVDA, META, MSFT and Intel is helping it gain customers.

Dell PowerEdge XE9712 is an NVIDIA GB200 NVL72-based platform targeted toward the largest AI GPU clusters for large language model training and real-time inference. Dell PowerEdge M7725 is a direct-to-chip liquid-cooled 5th generation AMD EPYC-based system for high-performance, dense computing.

As part of the Dell AI Factory, Dell GenAI Solutions with Intel offers jointly engineered, tested and validated platforms for seamless AI deployment. It features the Dell PowerEdge XE9680 and Intel Gaudi 3 AI accelerators with Dell storage, networking, services and an open-source software stack. These solutions support a range of GenAI use cases, including content creation, digital assistants, design and data creation, and code generation.

DELL and NVIDIA are working to enable AI deployments at the telecom network’s edge through the PowerEdge XR8000 server, which is equipped with NVIDIA L4 Tensor Core GPUs. This combination enhances computing power and simplifies AI application development and deployment for faster time to value.

DELL Offers Positive View for 2H25

Dell Technologies believes that the AI hardware and services market will be worth $174 billion by 2027, witnessing a CAGR of more than 22% between 2023 and 2027. The company is strengthening engineering capabilities, including data center networking and design, to support its AI-related initiatives.

For fiscal 2025, DELL expects revenues between $95.5 billion and $98.5 billion, indicating year-over-year growth of 10% at the mid-point of $97 billion. It expects the Infrastructure Solutions Group to grow 30%, fueled by AI.

Earnings are expected to be $7.80 per share (+/- 25 cents) for fiscal 2025, up 9% year over year at the mid-point.

Earnings Estimate Revisions Trend Higher for DELL

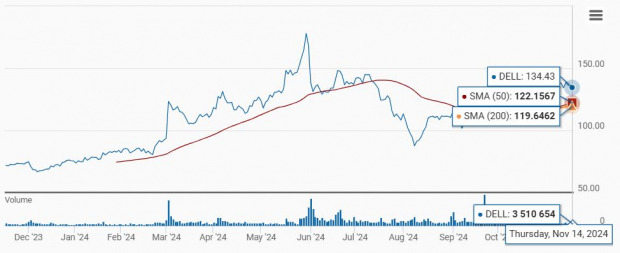

The Zacks Consensus Estimate for Dell’s fiscal 2025 earnings is pegged at $7.85 per share, up by a penny over the past 60 days and indicating 10.1% year-over-year growth.

The consensus mark for Dell’s revenues is pegged at $97.27 billion, indicating year-over-year growth of 10%.

Dell Technologies Inc. Price and Consensus

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

DELL’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 16.32%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

DELL Shares Appear Cheap

Dell Technologies shares are cheap, as suggested by a Value Score of A.

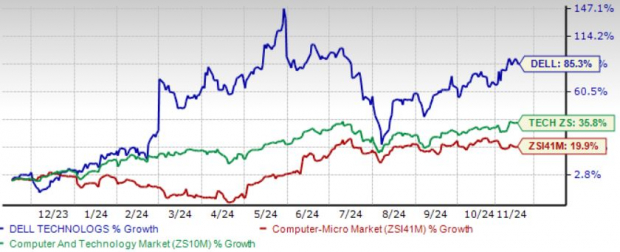

The DELL stock is trading at a significant discount with a forward 12-month P/E of 14.57X compared with the sector’s 26.98X.

DELL’s P/E Ratio (F12M)

Image Source: Zacks Investment Research

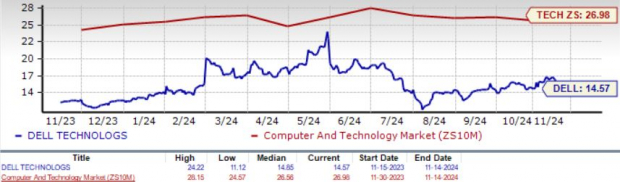

DELL shares are also trading above the 50-day moving average, indicating a bullish trend.

DELL Shares Trade Above 50-Day & 200-Day SMA

Image Source: Zacks Investment Research

Conclusion

Dell’s robust AI portfolio and an expanding partner base are key drivers that make the stock attractive for investors.

DELL currently has a Zacks Rank #2 (Buy), suggesting that investors should start accumulating the stock right now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Must-See: Solar Stocks Poised to Skyrocket

The solar industry stands to bounce back as tech companies and the economy transition away from fossil fuels to power the AI boom.

Trillions of dollars will be invested in clean energy over the coming years – and analysts predict solar will account for 80% of the renewable energy expansion. This creates an outsized opportunity to profit in the near-term and for years to come. But you have to pick the right stocks to get into.

Discover Zacks’ hottest solar stock recommendation FREE.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report