Delta – Weathering the Storm

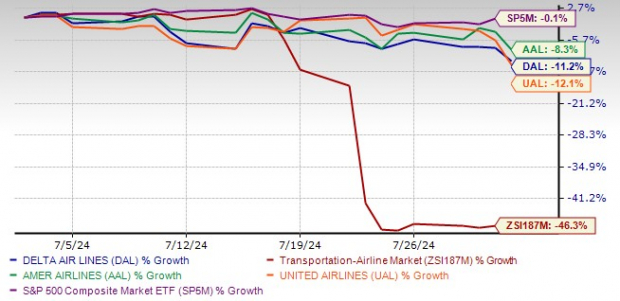

Delta Air Lines, based in Atlanta, GA, has faced turbulent times as its stock price plummeted by 11.2% in the last month. While the performance of Delta’s shares surpassed its industry peers, the airline lagged behind the S&P 500. Notably, Delta’s price performance was weaker compared to United Airlines but stronger than American Airlines in this period.

Revisiting Delta’s Recent Challenges

Delta recently grappled with a severe setback caused by a global IT outage on July 19. Unlike its industry counterparts, the airline struggled to swiftly recover from the disruption due to its heavy reliance on Microsoft systems for crucial operations. This reliance led to multiple flight cancellations, incurring losses of approximately $500 million over five days.

In a bid to manage the fallout, Delta had to issue refunds, arrange accommodation, and offer compensation to affected customers. The harrowing impact of the outage forced the airline to pursue damages related to the incident, underscoring the magnitude of the crisis it faced.

Financial Performance and Market Outlook

Delta’s second-quarter earnings for 2024 fell short of expectations, signaling a decline of 11.9% year-over-year. Facing relentless market pressures, Delta provided a pessimistic earnings forecast for the third quarter. The airline attributed this dismal performance to intensifying competition from low-cost carriers, undermining its pricing power and profitability.

Moreover, rising oil prices and escalating labor costs have added to Delta’s woes, posing significant challenges to its bottom line. The company’s earnings estimates have consequently witnessed a downward trajectory, reflecting the prevailing headwinds it confronts.

Finding Hope Amidst Turmoil

Despite these adversities, Delta has showcased resilience in certain aspects. The surge in passenger demand, particularly in leisure and business travel segments, has buoyed the airline’s revenue performance. Notably, Delta bolstered investor confidence by increasing its quarterly dividend by 50%, signaling robust financial health.

Additionally, from a valuation standpoint, Delta appears attractively priced compared to industry peers, with a promising Value Score of A. The airline’s adequate cash reserves have further instilled investor optimism regarding its financial stability.

Final Thoughts

While Delta’s current valuation and revenue prospects are promising, the prevailing challenges weigh heavily on its outlook. With a Zacks Rank #4 (Sell) designation, caution is advised when considering Delta’s stock amidst the ongoing turbulence. Investors are urged to closely monitor the company’s performance and await significant strides in its earnings before contemplating any substantial investment.

Analyzing Zacks’ Top Stock and Potential Winners

Exciting Potential

Investors are always on the lookout for the next big thing – a stock that could skyrocket and reward them handsomely for their foresight. Zacks, a respected name in financial analysis, has a track record of identifying such promising stocks. Nano-X Imaging, for instance, saw an astonishing increase of +129.6% in just over 9 months, a testament to the power of Zacks’ insights.

Past Success

Reflecting on historical winners like Nano-X Imaging can provide valuable lessons for today’s investors. Understanding how certain stocks managed to achieve exponential growth in relatively short periods can guide current strategies and choices.

Potential Gains Ahead

When considering the top stock recommended by Zacks, there is a palpable sense of anticipation. The recent successes indicate the possibility of significant gains for those who follow Zacks’ advice closely. With the right information and analysis, investors may position themselves to capitalize on future growth trends.

Key Insights

Zacks Investment Research offers a treasure trove of information for investors seeking an edge in the market. By tapping into their expertise and understanding the rationale behind their top stock picks, individuals can make informed decisions that align with their financial goals.