Deutsche Bank analyst Edison Yu has initiated coverage of Tesla (TSLA) stock with a Buy rating, dubbing it his “Top Pick” among autos. Yu’s assigned price target of $295 hints at a potential 29.3% upside from current levels. The analyst perceives Tesla not solely as an electric vehicle (EV) manufacturer, but as a trailblazing technology platform invading various tech domains, thus molding a distinctive valuation structure.

Analyst’s Rosy Outlook on Tesla

Yu extolled Tesla’s strong hold on the battery electric vehicle (BEV) market concerning scale and cost. He commended the brand’s dedicated following and anticipates an escalation in margins due to the introduction of new models and enhancements.

On a distant horizon, Yu prophesied Tesla to emerge as a pioneer in self-driving technology, emphasizing robotaxis and the humanoid universe with its Optimus robot. These applications epitomize the apex of artificial intelligence (AI). Furthermore, Tesla’s energy storage branch is predicted to flourish, with projected sales exceeding $13 billion by 2025.

In conclusion, Yu lauds Tesla as a class apart, poised for imminent expansion.

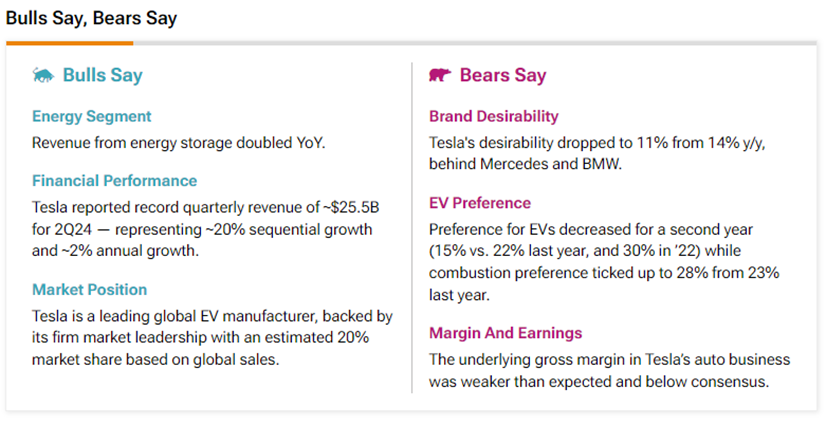

Insights from TipRanks’ Analysis: Bulls vs. Bears

The dichotomy among Wall Street analysts regarding TSLA stock is evident, tangled in the web of challenges and prospects surrounding the company. According to TipRanks’ Bulls Say, Bears Say tool, some market seers applaud Tesla’s escalating revenues from the energy storage division and celebrated Q2 figures coupled with the company’s unchallenged market domination.

In contrast, Bears fret over dwindling brand allure, sluggish electric vehicle demand, and margin squeezes.

Is Tesla a Buy, Sell, or Hold?

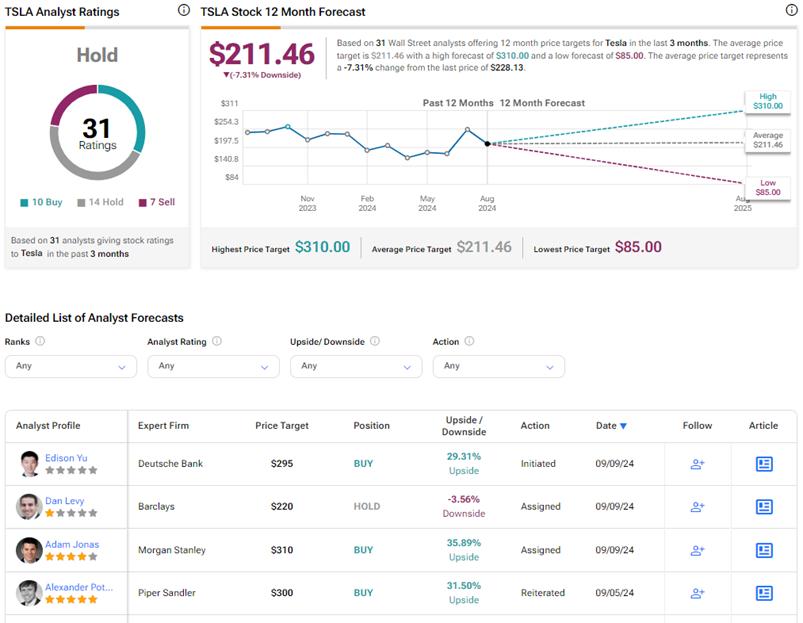

Given the divergence in insights, TSLA stock is currently tagged with a Hold consensus rating. This valuation hinges on ten Buys, 14 Holds, and seven Sells recorded on TipRanks. The average Tesla price target sits at $211.46, indicating a potential 7.3% descent from the current scope. Since the year’s inception, TSLA shares have relinquished 8.2% of their worth.

Peruse more TSLA analyst evaluations