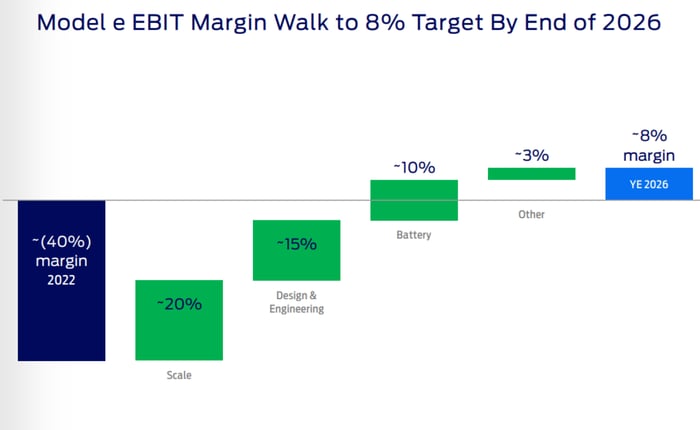

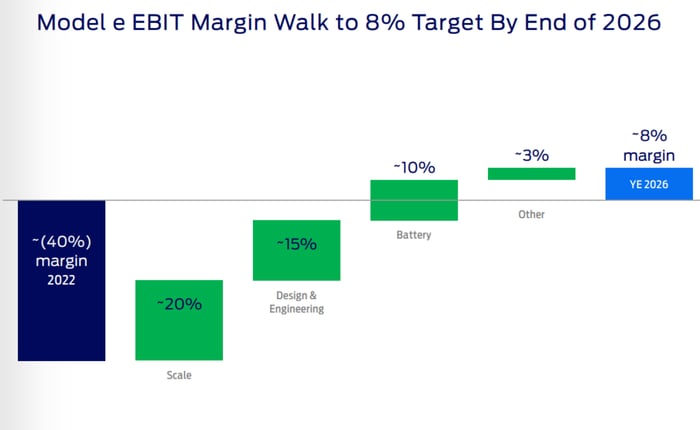

When investing in Ford Motor Company (NYSE: F), the prospect of turning around its $4.5 billion annual electric vehicle (EV) losses generates optimism for long-term investors. However, Ford’s recent decision has cast doubts on whether it can achieve this goal by 2026.

A Glimpse of Success

The F-150 Lightning witnessed a remarkable surge in sales, with a 55% increase in 2023, amounting to over 24,000 vehicles. It emerged as America’s best-selling EV pickup, crucial for Ford’s EV aspirations. The conventional F-Series trucks yield substantial profits for Ford, making the shift to Lightning EV trucks imperative.

However, the recent capacity cuts in the production of F-150 Lightning raise concerns regarding the realization of Ford’s ambition to turn a profit from EVs by 2026.

Image source: Ford Motor Company

Enhanced scale is crucial for attaining profitability, but the reduced F-150 Lightning production will slow down this achievement. Ford revealed plans to cut two-thirds of jobs at the Michigan plant, transitioning to a single daily production shift from the previous two-shift, three-crew operation.

The Other Side of the Coin

Despite the deceleration in EV scale due to F-150 Lightning production cuts, displaced workers will potentially join a third crew to ramp up the production of the more profitable Bronco SUV and Ranger pickup. CEO Jim Farley highlighted, “We are taking advantage of our manufacturing flexibility to offer customers choices while balancing our growth and profitability.”

Admittedly, Ford’s slower approach to attaining the required EV scale is influenced by the decelerated growth of the U.S. EV market, hindering the company’s swift progression.

In the short term, this move is poised to temporarily alleviate Ford’s EV losses as it shifts focus to manufacturing more lucrative vehicles, considering the significant losses incurred per EV produced and sold by Ford.

Navigating Choppy Waters

In essence, Ford’s move signifies adaptation and equilibrium in response to market dynamics. Although EV sales have been soaring and recorded a peak volume in the fourth quarter, the growth rate has diminished year-over-year. This shift in Ford’s route to achieving Model e goals by 2026 mirrors the challenges prevalent in the capricious automotive industry. Ford’s ultimate success remains on the horizon, albeit with a slightly altered path in the near term.

Should you invest $1,000 in Ford Motor Company right now?

Before investing in Ford Motor Company, it’s worth noting that the Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy now. Interestingly, Ford Motor Company did not make the cut among these potential high-return stocks.

The Stock Advisor service provides investors with a comprehensive investment guide, offering insights on portfolio construction, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has exceeded the return of S&P 500 by more than threefold*

*Stock Advisor returns as of January 22, 2024

Daniel Miller has positions in Ford Motor Company. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.